Disclosure: This post may contain affiliate links. If you click on a link I may make a small commission at no extra cost to you. You can read the full disclosure here.

Last Updated on February 5, 2023 by Chris Panteli

Ways To Drastically Cut Expenses

Are you ready to trim your budget? Find out how to drastically cut expenses with these simple tips. Cutting the budget isn’t something that has to be hard, but it will take a bit of discipline on your part.

If you’ve noticed that your household expenses are outpacing your earnings each month, it’s time to focus on saving money quickly. And if your goal is to be debt-free, learning how to drastically cut household expenses should be at the top of your list.

Keep in mind that cutting personal expenses might feel hard at first, but once you see how rewarding it can be to save money and cut expenses, you just might find that you love living the ‘tight budget’ lifestyle. And you can begin to put this extra cash towards an emergency fund – look at you now, hey!

- Ways To Drastically Cut Expenses

- How To Drastically Cut Expenses

- Cutting Expenses Adds Up

- 33 Ways To Drastically Cut Expenses

- 1. Use Cashback

- 2. Honey Browser Extension

- 3. Negotiate Bills (Internet, TV, Wireless Phone)

- 4. Cancel Unused Subscriptions

- 5. Cell Phone

- 6. Ditch Cable TV

- 7. Sell Stuff You Don’t Use

- 8. Use A Programmable Thermostat

- 9. Use LED Light Bulbs

- 10. Unplug Electrical Items

- 11. Use An Electric Blanket

- 12. Seal The Windows

- 13. Sell Your Car

- 14. Rent Your Car Out

- 15. Rideshare To Work

- 16. Rent Out A Room

- 17. Walk Everywhere

- 18. Buy Generic

- 19. Buy Second Hand

- 20. Meal Plan

- 21. Store Your Meals and Freeze

- 22. Don’t Eat Out – Make Date Nights At Home

- 23. Take A Packed Lunch To Work

- 24. Budget Properly

- 25. Use The 30-day Rule Before Big Purchases

- 26. Save Coins

- 27. Get Free Starbucks Coffee’s

- 28. No-Spend Day

- 29. Make Your Own Cleaning Products

- 30. Quit The Gym

- 31. Pay Cash Only

- 32. Use Amazon Prime

- 33. Get An Electric Toothbrush

- Final Thoughts On Drastically Cutting Expenses

- FAQs

- How To Drastically Cut Expenses

How To Drastically Cut Expenses

Before learning how to trim your budget, there are a few simple tips to keep in mind. You need to have a solid grasp of your take-home pay (actual net earnings per month) before you figure out where you need to cut expenses.

Your monthly expenses cannot outpace the amount of money you earn. This is a one way street to financial ruin and a mistake so many of us often make! Sorting your expenditure into different budget categories will also help you get a more holistic view of your financial situation.

If you’ve never actually taken a good look at your spending, it’s time to peel back the layers now. It can feel hard to cut the cost of living at first because spending money can actually be quite fun. But when you’re starting to feel as though your everyday expenses are making you feel anxious, the fun needs to be dialed down a notch (at least for a bit).

Learning how to cut household costs is one of the first steps to take. You’ll be amazed at how much money per year you can save once you actually start to budget monthly.

Recommended: 21 Awesome Online Jobs For Moms Without Investment

Cutting Expenses Adds Up

If you need to scale back on your spending, you’re not alone. Millions of people are starting to tighten their spending and are looking for ways to trim their budget to ultimately grow their savings. In a short amount of time, your bank account can and will grow quickly.

Following some of the free tips below on how to cut costs can be one of the quickest ways to achieve this. The great thing about cutting expenses is that you’ll be able to see results each and every month.

And every small expense you manage to reduce really does add up. It takes time and patience to really feel the effects, but once it kicks in, you’ll wish you’d started sooner.

Recommended: 5 Finance Experts Bust The Biggest Savings Myths

33 Ways To Drastically Cut Expenses

While there can be other ways to save money, this is an awesome list to help you get started. Out of these 33 ways to cut expenses, there are certain to be a few that are applicable to you and your spending habits. So have fun taking a chainsaw to those pesky direct debits and unnecessary costs! The expense saw massacre starts now!

1. Use Cashback

Quit leaving free money on the table! (I’m not the type of person to type in all caps because I feel like it’s intrusive but if I did, this would be one time that it’s warranted.) If you shop online, there are so many ways that you can easily earn money back on each and every one of your purchases.

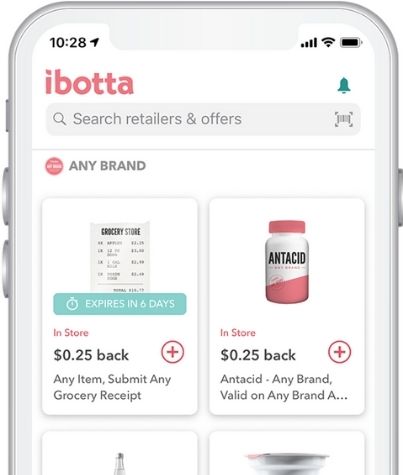

Some of the biggest and best online options include Ibotta, TopCashback, and Swagbucks. They all tend to work very similarly to one another in terms of payment and redeeming, so I recommend either of these, if not all!

Ibotta

Get cashback on everyday purchases, up to $20 in welcome bonuses, payment as soon as your order is confirmed, and all 100% FREE.

If you are going to buy something online, you can go through their sites and earn a percentage back on every purchase you make. Not only are you getting the items that you need but you’re also getting back a good portion of the money, too. In my mind, that’s the perfect way to cut expenses easily by getting items that you’re going to buy any way at a cheaper price.

Recommended:

- 11 Best Cashback Apps to Save Money

- Is Ibotta Legit? | Definitive Review

- Ibotta Cheat List | Ultimate Guide

2. Honey Browser Extension

The Honey extension is a lifesaver (or a money saver, at least) Once you download and install, just keep it on and active when you’re shopping online. This extension basically saves you money and consequently cuts your expenses, by ensuring you get the possible price for any given product.

Honey searches its database of thousands of coupons and discount codes and automatically applies to your cart when applicable. I have personally managed to cut a business expense in half using this browser extension. When shopping online for loyalty cards for my restaurant business, I was delighted to find a 50% coupon automatically added – saving me a ton of cash.

3. Negotiate Bills (Internet, TV, Wireless Phone)

Do you like to negotiate? If so, why aren’t you using it to your advantage? You can use this skill to negotiate your cell phone plan and your cell phone bill and possibly even lower the cost of your TV or Internet monthly payments as well.

And if you’re not a fan of negotiating, Bill Shark does it for you. There’s a little bit of information that you’ll have to give them access to in order to negotiate, but they’ll take over and do the “dirty work” for you. This means you can cut expenses on autopilot and be safe in the knowledge you’ll never pay more for your bills than you need to.

4. Cancel Unused Subscriptions

Do you even know what you’re currently subscribed to?

If not, that’s a big deal and potentially a big cost as well. And if you’re anything like the other millions of people who just “subscribe and forget”, you might be paying for something that you don’t even know that you have. And there is nothing worst than a monthly expense you don’t actually need!

Luckily, Bill Shark can help again and dig through your statements and alert you to when this is happening. Plus, once those subscriptions are found, they’ll cancel and take care of it for you.

5. Cell Phone

Getting rid of your cell phone altogether would drastically cut expenses, but for most of us, not really an option.

If you’re wondering why your cell phone bill is so expensive, who says that it has to be? This is something that you might be able to get lowered so why not give it a try? Truebill can easily take over and do the negotiations on your behalf for your cell phone bill, too.

All you have to do is provide the necessary information and they’ll take over and see if they can save you a huge chunk of change every single month.

6. Ditch Cable TV

The need for paying a huge cable bill or being stuck in a contract is long gone. With the use of all the streaming channels that we can have every month, this should be a super simple place to cut monthly expenses.

Signing up for Prime video is one set price and gives you access to thousands of movies and shows. Forget the monthly bill and commitments and try a streaming service instead.

Get a 30 Day Free Trial on Amazon Prime Video Now (and watch ‘The Boys’, it’s wicked!)

7. Sell Stuff You Don’t Use

Ok, so this may not appear like an expense, but if you have stuff lying around that you don’t use, you could be leaving cash on the table. And in my mind, that is an opportunity expense that needs to rectified!

Take a look around your room. Is it full of things that you really don’t even use? If so, the time to make some super easy money is right now. With places like eBay and Craigslist, you can list your items online and score some quick cash fast.

Just be certain to be safe when you’re dealing with transactions and other people and you shouldn’t have any issues at all.

A good rule of thumb when it comes to selling personal items is that if you haven’t used it in 6 months, you’re more than likely not going to be using it, or missing it, anytime soon. The only exception I would add to that is luggage – and let’s be honest, 2020 has been the worst year ever for holidays! Hopefully, the summer fun can resume as normal in the future!

8. Use A Programmable Thermostat

Utility bills can vary and really cost an arm and a leg. Finding that perfect temperature and keeping it there without someone in your family putting it higher can be a real cause for concern.

The good news is that using a programmable thermostat can be a simple solution that can help you set a cost-efficient temperature. Google Nest can help do this so that you can plan ahead and cut out any surprise utility bills in the future.

Heating is one of those necessary expenses, but cutting it down is a great way to save money. Unless you’re like my mom who is always cold no matter the weather – for them, I suggest a big warm coat and a hot water bottle.

9. Use LED Light Bulbs

Take a quick walk around your house and count up your lightbulbs. Did you know that just by switching to LED lights, you can easily be saving anywhere from $50-$75 per month? Talk about ways to drastically cut expenses!

Not only are you reducing your costs but it’s also far better for the environment. Educate yourself with this simple money-saving trick and watch the savings really add up. Pretty “bright” idea, right?

10. Unplug Electrical Items

My mom used to do this back in the day and I always found it to be an odd practice.

But now that I’m adulting, I totally get it and find myself doing it as well. Even when your appliances aren’t turned on (aka lamps,etc.) they’ll still be pulling in a slow and steady stream of electrical current the entire time. Will it add up to be a huge saving? No, probably not.

But even if you can cut your bill by $20 monthly, that’s over $200 savings per year! Which in combination with all the other drastic cuts in expenses is pretty significant!

11. Use An Electric Blanket

Are you someone who is always cold?

Leave the furnace alone and find a way to give yourself an easy option to get warmth instead. Using an electric blanket on your bed at night will keep your toes toasty warm and make it so you don’t have to mess with the thermostat, either.

When I was a poor student my electric blank was literally my best friend! We couldn’t afford to keep the heating on, so it was the only cost-effective way to stay warm. Ah, the good old days!

Did you know you could run an electric blanket every night for around $20 per year! This will obviously vary slightly depending on the wattage and energy costs – but if you can use it instead of the heating, it’s a money-saving winner!

12. Seal The Windows

Houses tend to move or shift over time which can ultimately cause gaps or areas of your window to not be as tightly sealed as they once were. And when this happens, you’ll need to find a simple and affordable way to seal your windows. Otherwise, you’re just letting money pour out of your house and out of your wallet!

Because if you don’t, what is going to happen is that your furnace is going to be working overtime to try and combat the chilly air that is sneaking in through the cracks. And even though it’s just a hairline crack, that can let in a ton of cold air that can keep your furnace working a lot harder than it needs to be.

A simple sealing project to fix air leaks could save between $83 and $166 per year on heating and cooling costs according to Energy.gov

13. Sell Your Car

If you can, going down to one car might not be a bad idea. If you’re in an area that has good public transport then ditching the wheels is an incredible way to drastically reduce expenses. Not only could it be quick cash from a sale, but it also means that you’ll be saving more money on your monthly car insurance, too.

And if you live close to work, then switching from 4 wheels to 2 is a great idea for your health and wellbeing as well. Cycling is better for the environment, basically costs next to nothing and is a free way to stay fit and healthy!

My brother has been riding into work on his bike for a couple of years now, and loves it!

14. Rent Your Car Out

If you’re not quite ready to sell your car, I get it. It’s a big decision. Buy yourself a bit more time and consider renting out your car instead. Turo is a great resource that can make the car rental process a super easy solution.

The car rental business is a million-dollar industry so why not cash in on that and put a little bit of green in your pocket, too?

Recommended: How to Make Money Renting Your Car on Turo

15. Rideshare To Work

We all know that gas is expensive and it’s one of those monthly costs that just feels like it continues to go up. If you’re able to stop driving to work every day on your own and start ridesharing with someone, this can be a great way to stop fueling up so much and cut down your commuting costs as well.

Not only will you save on gas, but you’ll find out that you’ll also pay less for your car maintenance down the road also. Less driving means less wear and tear on your tires, fewer oil changes, and more which ultimately means that you’ll have more money to save or do other things with that you want.

16. Rent Out A Room

Have an extra room in your house? Spruce it up and rent it out. Airbnb is a great way to earn some extra money, whenever you need it. The great thing about using a room in your house is there are very little upfront costs involved. Maybe it could do with a lick of paint, but that’s about it!

This isn’t like managing a hotel or bed and breakfast, opened all day every day for anyone to stop by and stay. You can literally rent out a room in your house whenever you’re wanting to earn a little bit of extra money.

You can drastically cut your household expenses by getting a lodger to literally chip in and help. According to Earnest, Airbnb hosts make on average, about $924 a month. That could cover your entire mortgage and some!

17. Walk Everywhere

Put on your hiking shoes and get out the front door. You can walk off some weight while fattening up your bank account at the same time. Yes, you heard that right. You can actually earn money by walking and losing weight.

If this piques your interest, Sweatcoin is where you need to be! This app will pay you money for every step that you take. You can download it for free and leave it running in the background on your smartphone. It’s a great way to improve your health while leaving your car parked in the driveway.

18. Buy Generic

Name brands might be something that you need to consider cutting from your list. If you start doing a bit more shopping at Dollar Tree, you’ll find a lot of items that you can replace in your home with much cheaper, and more affordable, options.

There’s a big misconception that just because something is made from a name brand company it’s worth the price and better. This isn’t always the case. Try buying generic for a while and see if you can truly tell the difference.

One thing is for certain, your wallet certainly can.

Another big perk of shopping at Dollar Tree is that if you happen to have one in your area, they’ll ship from their online store to your local store for free. Talk about a great way to save even more money on already super affordable items.

19. Buy Second Hand

Forget the notion that you need to buy everything brand new. In fact, that’s pretty much the opposite mind-frame that you should have if you’re trying to trim your budget and cut down on monthly expenses.

Second-hand options are actually a great route to take because you’ll often find items anywhere from 50%-85% cheaper than buying brand new. And when you’re counting every penny, you’ll find that buying second-hand items can be a quick fix to cutting your budget fast.

eBay is an obvious first port of call for second-hand winners, just do a simple search and make sure the seller has a good rating. Also, check to see if there are any faults listed as well. Facebook is also a fabulous place to buy second hand, and can often be very fruitful for larger items. I managed to snag a solid oak table from a friend of a friend not so long ago!

Absolute bargain for the quality!

Recommended:

- The Complete Guide to Making Money on Etsy

- Etsy SEO: How to Optimize Your Store to Boost Sales

- 14 Awesome Things To Sell On Etsy

20. Meal Plan

We all know that going to the store hungry is one of the biggest mistakes you can make. So why do we all keep doing it over and over? We’re adults, we should learn from our mistakes, right?

$5 Meal Plan

Let the team at $5 Meal Plan save you money and time by planning your food for the week!

This is where the $5 Dollar Meal Plan comes into play. Take away the need to go to the store without a plan of action. Don’t overthink what is for dinner, and use this meal plan as an easy way to budget for your weekly meals easily time and time again.

21. Store Your Meals and Freeze

Meal prepping is an easy way to save money. One of the best ways to meal plan and get ahead for the week is to purchase freezer bags or freezer storage containers.

The best way to maximize your savings is to see what food items are on sale for the week.

Once you do this, you can then stock up and cook large batches of your favorite dishes. Then simply bag the food up, label, and deep freeze. You’ve then managed to lock in those savings for meals you can access in the future!

Just don’t forget about that incredible chicken curry and leave it at the back of the freezer. Stay on top of your planning and watch your food expenses plummet!

Did you know, technically you can freeze food indefinitely and it’s still safe to eat, as bacteria will not grow! But generally, 3 months is a good rule of thumb before the quality starts to deteriorate somewhat.

22. Don’t Eat Out – Make Date Nights At Home

Paying someone else to feed you is expensive. And while it might be tasty, it costs a lot of money to go out to eat all the time. Not only are you paying for that convenience for someone else to cook for you but then don’t forget that you have to pay at least a 20% tip or more as well.

Instead of having a date night, swap that out for a movie date night at home. This can be as simple as finding a fun movie on Netflix to binge-watch or create a fun and tasty dish together in the kitchen.

You’ll be amazed that date nights at home can be at least 50% less in cost than going out, and sometimes doesn’t even have to cost you a dime.

Recommended: 51 Best Cheap Date Ideas For Teens

23. Take A Packed Lunch To Work

It’s very hard to work somewhere where you feel like you’re missing out every time that your coworkers are going out to eat. We’ve all been there; we all know that it takes discipline to say “no” and save money instead.

One of the biggest “extra” costs besides commuting costs is food and when you pack your own lunch, you’re eliminating that extra financial stress from your budget.

And if you’re wanting to have a bit more bonding time with your coworkers every once in a while, just add that into the budget for the month. When you’re trying to trim the fat from your expenses, that doesn’t mean that you can’t have a bit of fun here and there.

24. Budget Properly

Maybe one of the biggest questions that you truly need to ask yourself is if you’ve sat down and created a budget properly. “Winging it” every day and trying to save money really isn’t going to work. It might seem like it is in the beginning, but over time, it’s going to be scattered and leave you feeling stressed.

But if you can sit down and write out your budget properly, you’ll find that you’re way more likely to stick to it and make it work. Budgets are meant to be a guide that can help you stay within your financial means.

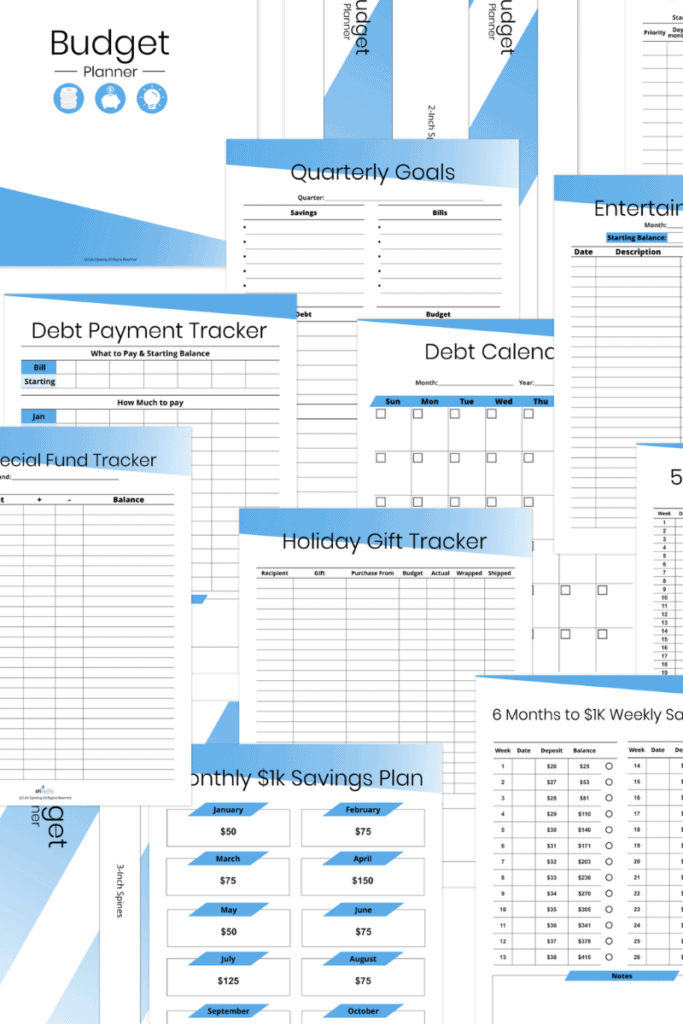

Beautiful 165 Page Budget Planner Printable

Do you feel overwhelmed when it comes to organizing your finances? With this incredible 165 Page Budget Planner Printable you can take back control of your money, keep on top of your budget and totally rock your finances; stress-free!

The great thing about budgets is that they can be altered anytime that there are changes in your life. And as your situation develops over time, you can be more flexible in reducing your expenses in the areas that require it.

25. Use The 30-day Rule Before Big Purchases

This just might be one of the best rules to save money, ever. We’re all human and what this means is that we’re all tempted to make big purchases impulsively. But slow your roll and really allow yourself time to think about that purchase before pulling the trigger.

For this to sink in, you need to give yourself at least 30 days to figure out if it’s a good purchase or not. Oftentimes we buy things based on “wants” which is an impulse buy that results in buyers’ remorse later.

By allowing yourself time to think, that “desire” may subside and go away which is further proof that there was never a need for it in the first place.

Cut your expenses by eliminating purchase you really don’t need!

26. Save Coins

So many people just get rid of their change or toss it aside, not giving it another glance. But it’s a true saying when you’ve heard that “every penny adds up”. This is 100% the truth.

In fact, if you are someone that uses cash quite frequently, you probably have a pretty big stash of coins. You can easily collect the coins using a coin jar and then cash it out monthly at the bank. This money can then go into your savings or help to pay a portion of your bills.

And since you weren’t expecting it to equate to much, any little bit really does help. Some people keep their coins in a special jar which just adds a bit of fun to the experience. The bigger the coin jar, the more change it will hold. And then when you cash it out, it’s a lot of fun to see just how much money you’ve truly saved up without even giving it a second thought.

This is a fairly passive way to reduce your expenses by actually saving extra cash to pay towards them.

27. Get Free Starbucks Coffee’s

Cutting expenses, doesn’t mean that you have to cut out everything in your life that you love?

What kind of fun is that?

While most of this post has talked about ways to trim your budget, you can still indulge yourself and your wants every now and then.

One of the biggest satisfactions that you’ll love having is being able to get free Starbucks coffee several times throughout the year. And when a cup of coffee can cost you $5 or more each time, it really is a fun way to save money while also getting your caffeine fix, too.

Another way to cut expenses when it comes to your Starbucks coffee is to buy a bag of ground Starbucks and keep it at your house. That way, you’re not tempted to buy an expensive cup of coffee every morning when you can easily make up an entire pot at home for much less money.

28. No-Spend Day

Challenge yourself to spend zero dollars on just one day.

Nothing.

Nada!

This sort of habit change, even for just one day, can be a real eye-opener about how much money you usually spend daily.

Once you get the hang of how simple a no-spend day can be, challenge yourself to a no-spend week, and really take it to the extreme. Of course, you’ll have to pay for necessities like gas, etc, but anything else, you should go without and find an alternative!

The purpose of this money-saving exercise is to help you realize that you don’t have to spend a ton of money, or any money if you don’t need to.

29. Make Your Own Cleaning Products

If you have a cleaning budget that you spend monthly, let’s talk about how to trim it down. Cleaning products are important, we all know this. But it doesn’t have to cost you a ton of money.

Thanks to the lovely internet, there are so many DIY cleaning recipes that you can easily make yourself. Not only will this make you feel super independent of the need to go shopping but it will also help you save money as well.

Plus, when you make your own cleaning products, it’s typically a given that they won’t have the harsh chemicals in them that the over the counter products have.

Check out these 8 Homemade Cleaners That Actually Work.

Recommended: How to Make Candles At Home To Sell: Awesome Side Gig

30. Quit The Gym

If you’re a gym rat, this might be a hard one for you. But quitting your gym and finding another way to get in your workout needs to be on your radar. Beach Body is a great program that you can invest in instead and it won’t cost you anywhere near as much as a monthly gym membership.

You can also do this workout at home which will save you commuting time, gas costs, parking fees, etc.

The seasonal weather is another factor to consider and shouldn’t be taken lightly. When the weather in your area is nice, use Mother Nature to her full advantage and get outside to work out. You’ll find that going for a run, taking a hike, biking, or playing a game of basketball are all super-effective workouts that will literally cost you nothing.

31. Pay Cash Only

Paying with cash hurts.

Maybe not physically, but mentally and emotionally it does. Your brain is going to tell you that when you pay in cash, it’s a harder process because you’re handing over something and in return, getting back less than you had. For this reason, paying with cash resonates more because when you pay with a bill and get change back, it’s an immediate response to what is happening.

And this immediate response is very different from the feeling we get when we swipe a card. Because when we buy things with “plastic”, it just doesn’t really feel real.

If you acknowledge that and want to fix it, try paying with cash for a week or a month and see if you become more aware of your spending habits. this may well be a very simple way to psychologically induce a drastic cut to your expenses.

32. Use Amazon Prime

Amazon is quite the powerhouse of online shopping. And love it or hate it, you have to admit that they’re good at what they do and they’re efficient. Being able to use Amazon Prime for your shopping needs makes it convenient and a cost-effective way of shopping.

What you’ll find from using Amazon Prime is that you will save money, quickly. You won’t have to pay for shipping, you’ll get deals and great pricing options with more choices for products, and you can even stream movies or download books as well.

Amazon does have a yearly fee that you’ll have to pay but you’ll recoup that in the savings very, very quickly (and if you’re a student, teacher, or qualify for low-income assistance, you might be able to get your Amazon Prime membership even cheaper, too)

Try Amazon Prime 30-Day Free Trial

33. Get An Electric Toothbrush

Taking care of your teeth is important!

The last thing that you want to have to do is head to the dentist and pay a huge bill. To make certain that this won’t happen, invest now in an electric toothbrush to use to keep your teeth and your gums as healthy as possible.

When you understand that a dental procedure like a root canal can cost almost $2000 or more, a $50 toothbrush seems like a great way to save money in your budget.

The use of electric toothbrushes resulted in a 22% less gum recession and 18% less tooth decay over the 11-year period.

Sometimes, buying items for your healthcare now is a great strategy to avoid expenses down the road. Also, you get to keep that Hollywood smile and look great!

Final Thoughts On Drastically Cutting Expenses

Overall, cutting expenses from your budget can feel a bit nerve-wracking and strenuous. And rightfully so. Anytime anyone makes a change with their financial situation it can be slightly disconcerting.

But what will help you adjust to this new lifestyle is to understand your purpose for wanting to slow down your spending. As I mentioned earlier, having goals set or a reason in place on why you want to start saving more money is really going to help maintain your enthusiasm.

The other big kicker to think about when it comes to saving money is that you need to give yourself time to adjust. If you’ve been freely spending for years, a change in your spending habits isn’t going to happen overnight. While you might start to notice your savings adding up quickly, you’ll still need to focus and stay on your money-saving path.

At the end of the day, as long as you’re happy with your efforts and how much you’re cutting from your budget, that really is all that’s going to matter.

And if you’re not happy with it, simply adjust and adapt!

Just because you set a budget doesn’t mean that your budget is set in stone. Altering your budget when your life changes or throws you a curveball is a perfectly acceptable thing to do. Job changes, moves, and changes in your lifestyle; all of those are aspects that you need to consider when you’re looking for ways to cut expenses and spending.

Once you get a handle on that, you’ll start to see that cutting out any excess spending can be a great way to get back on track and ease into a healthier financial situation.

Recommended: 22 Awesome Low Stress Jobs After Retirement

FAQs

How do you control your expenses?

As this giant list of options suggests, you really have to look at what you’re spending and figure out what you can trim. Creating a budget that you’re hoping to stick with is also important as well.

Keep in mind that if you try and do a budget on the fly, it’s not going to stick or last long at all. The more that you try and loosen up your budget, the less likely that you’re going to be to stick to anything at all.

To control your expenses effectively, you have to be truthful about where your spending faults are. And this is going to be an area that is going to have a different answer for every single person.

Some overspend on food, others, clothing, and a large portion of people overspend on activities and other forms of entertainment. Until you can understand where you’re seeping money constantly, a budget won’t be able to cut out much.

What causes overspending?

This is actually a pretty deep question. For some people, overspending is just a lack of self-discipline. (I’m that way when it comes to eating ice cream but that’s another story for another day)

The other major reason that people tend to overspend is that they’re just now aware of what they’re spending. There are millions of people that don’t have an actual concept of what a budget is and for this, they’ll overspend time and time again.

How do I convince myself to save more?

If you’re not ready to start saving money, you’re going to feel like you’re just climbing an uphill battle. To start saving money and trimming your budget, you really do need to be on board with the concept that you’re ready to start a budget.

Ask yourself the hard questions before you start. Because if you don’t, and you start, you’re going to allow yourself to get off track without giving it a second thought.

Even more than that, give yourself a true reason as to why you need to save more money. Are you struggling to pay your bills? Do you need to start a retirement fund because you haven’t yet?

Do you have children that are getting older and are going to be heading off to college? All of these reasons are valid and are great reasons to save more money.

Is spending money bad?

No, it’s not. Cutting expenses shouldn’t be viewed as a restriction or a bad thing and wanting to spend money shouldn’t be a reason to feel shame. In fact, when you spend money responsibly, it’s not bad at all.

There are many people that will say that money is the root of all evil but there’s really no truth to that, either. Money is only as “evil” as you make it be and if you’re in a good spot with your finances, it’s not going to be evil at all.

But the moment that you start fearing your money or are finding yourself scared it’s time to step back and evaluate your spending habits.

Now that you know how to cut expenses, it’s time to implement and start doing this in your daily life. You can easily save money monthly as long as you’re ready and prepared to do so.