Disclosure: This post may contain affiliate links. If you click on a link I may make a small commission at no extra cost to you. You can read the full disclosure here.

Last Updated on October 23, 2022 by Chris Panteli

Budget Categories to Organize Your Finances

Being able to sort out your finances might seem like a never-ending process, but it doesn’t have to actually feel that way. Using budget categories could be exactly the type of organization and structure that you need in your daily life.

Now, before you tell me how much I’m sounding like your mom trying to lecture you about being money-smart, hear me out. The planning and preparation of your finances that you do now will only HELP you in the future. And if you’re here to figure out the best way to learn how to budget, you’ve taken the right first step.

Sitting back and looking at a bunch of numbers and then trying to figure out what to do is a backward approach when it comes to finances and budgeting. The best thing that you can do to budget your money is to set up budget categories and then figure out the best ones that fit within you and your financial needs.

- Budget Categories to Organize Your Finances

- Top Budget Categories

- What Are The 3 Main Budget Categories?

- How Do You Create An Effective Budget?

- What Are The Main Elements Of A Personal Budget?

- Personal Budget Categories To Consider

- Expenses For Your Monthly Budget

- Understanding How Needs Versus Wants Can Affect Your Budget

- How To Stick To Your Budget

- Budget Category Percentages

- How To Win At Budgeting

- FAQs

- Budget Categories to Organize Your Finances

Top Budget Categories

One of the biggest things to keep in mind when trying to organize your money is that not all budget categories are going to apply to you. This master list of budget categories is meant to get you thinking but it doesn’t mean that you’ll need to use them all.

In fact, the more that you can actually simplify your finances, the better. We already live in a world where it seems like there’s a ton of stresses and rules so if you’re able to keep your money simple, talk about a huge relief! Having simple budget categories is one of the best approaches you can take.

What Are The 3 Main Budget Categories?

Here’s the deal. There are probably many “main” budget categories that you could consider but when it comes down to it, less is more. If you can break up your budget allotments into needs, wants, and fun then that can help you divvy up your money easily.

In more technical terms, they’ll be called fixed expenses, variable expenses and then non-needed expenses (aka wants) as well.

How Do You Create An Effective Budget?

Understand that your budget is going to be just that…a budget that works for you. Don’t compare your budget to anyone else because every person’s situation is different. People have different careers and make different levels of income or choose to spend more freely than others. There are also people who choose to save more than is “recommended” as well and that doesn’t need to be something to derail you, either.

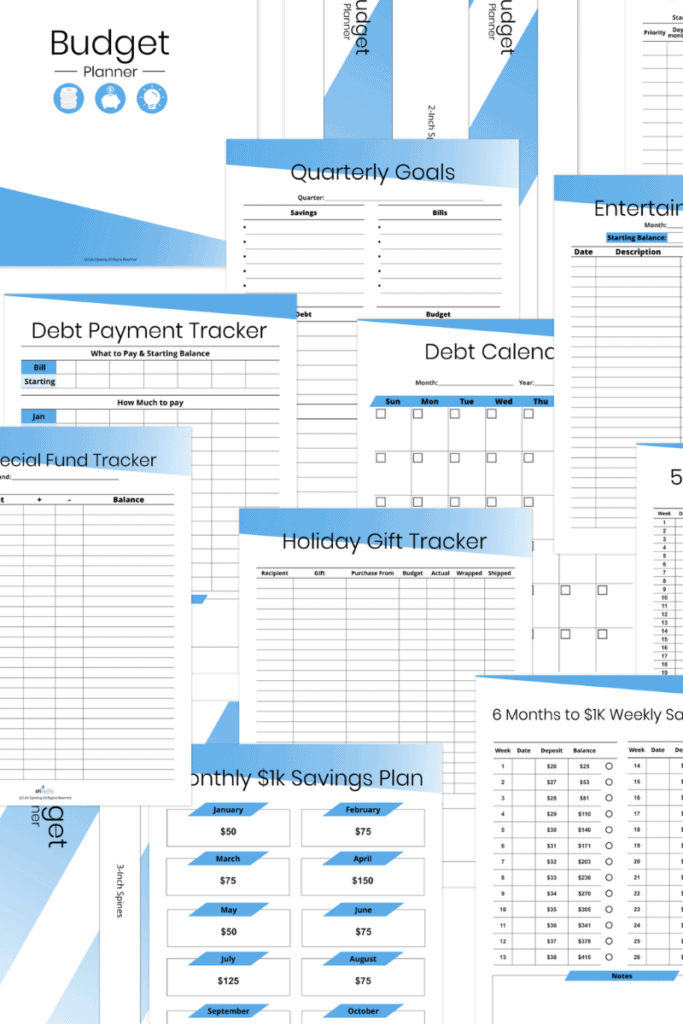

Beautiful 165 Page Budget Planner Printable

Do you feel overwhelmed when it comes to organizing your finances? With this incredible 165 Page Budget Planner Printable you can take back control of your money, keep on top of your budget and totally rock your finances; stress-free!

To create an effective budget, you need to understand your own strengths and weaknesses. Creating a budget can be quite difficult for certain people so this isn’t necessarily a time to set “pie in the sky” goals that aren’t going to be obtainable or realistic.

Be truthful and honest with your income and your expenses so that you can logically break it all down.

What Are The Main Elements Of A Personal Budget?

You may also hear a lot of people referring to a personal budget during this time in your life. This is referring to your overall budget and is dedicated personally to you and your expenses.

A personal budget is just that. A budget for you and your family, if applicable. You can easily break down a budget that fits personally for you by putting your spending and expenses into the three main budget categories that we touched on before.

Don’t make it more complicated than it has to be in the beginning. If you want to dive deeper into it later once you get the hang of it, you can easily section out your monthly spending even more.

Ready to dive into some of the best budget categories to break down your finances and spending? Here are some of the categories that can help you create a solid financial plan.

Personal Budget Categories To Consider

This list of categories for your budget can easily help you prioritize and know where to spend money, where to save money, and where to alter how you spend overall.

Income Category

Before starting anything, you do need to list out all your monthly income. While you might be tempted to include your gross income, don’t. This needs to be your take-home pay, after taxes. You need to have your actual income listed of money that you can spend or save.

This also needs to focus on the fixed monthly income that you can depend on 100%. You can have your bonuses and commissions from work listed as an “extra” boost, but don’t include those figures in your monthly total income. The reason for that is because there might be months that you don’t make bonuses or commissions, or they can easily go away, too.

But when you’re trying to figure out your budget, you need to focus on money that you can depend on no matter what.

List out your salary or hourly pay as well as any income that you get from rental property as well. Basically, anything that is “fixed” monthly makes certain to include it.

After you’ve got a good grasp on what you earn monthly, it’s time to add in all the expenses.

Expenses For Your Monthly Budget

As mentioned, these will vary per person so not all of this will fit into your finances. Pick and choose the ones that fit your life and start to include them as your expenses.

Mortgage/Rent

Housing expense is one of the biggest expenses that is going to be part of your monthly budget. This is considered a fixed expense and is one that is a need, for sure.

Make certain that you include all the items associated with your monthly mortgage or rent, such as:

- Rent/Mortgage Payment

- Home/Renters Insurance

- Property Taxes

Utilities

Even though these monthly expenses are dealing with your home, they fall into their own budget category because they can vary each month. It can be hard to “guess” what your bill is going to be but as long as you have a good idea or an average, you can stay on track with your monthly expenses. Utilities to budget for include:

- Electricity

- Water

- Sewer

- Trash

Grocery Expenses/Household Items Expenses

The amount of money that you spend on food and other household items is going to be your next biggest expense after your mortgage and utility payments. This budget category can tend to be a bit tricky at times though because it’s easy to bust your budget when you’re being tempted at the store.

Being prepared before heading to the grocery store is the easiest way to stay on budget easily. Make a list and stick to it. Shop the sale items and don’t splurge on anything that you “want”. This may take a while to get used to, but you can easily transition and do this easily over time.

Some items that will fall into your household needs and grocery needs include:

- All food items for the month

- Toilet Paper/bathroom items

- Laundry detergent

- Cleaning supplies

Health Insurance Premiums

Another big-ticket item that you’ll need to be certain to budget for is health insurance for yourself and your family. Some people have the luxury of having this taken out of their monthly paycheck which can overall help with budgeting, but if you’re paying for it out of pocket, this is one expense to not overlook.

The good part about figuring out the expense for health insurance is that you’ll know what your monthly premiums will be for the month since they’re locked in. But once the renewal process rolls around, there is a chance that the monthly premiums will go up.

This is one fixed expense that you can count on for at least 12 months at a time.

Don’t forget to also include dental insurance and any life insurance premiums that you pay in this category as well.

Monthly Debt Payments

This category may, or may not, apply to you but shouldn’t be overlooked. There happen to be millions of people in our world that are in debt, and monthly payments to get out of that acquired debt are just part of the equation.

Paying your debt on time is key to also repairing and building your credit. And the sooner that you can pay off your debt, the less money you’re “throwing away” in those large interest percentages that rack up each month.

If you have wiggle room in your budget, paying off your debt quickly should also be something that is on your radar. Because the trickle-down effect of having no monthly debt payments is a HUGE boost to have more money to spend as you want or need to.

Some monthly payments that you need to have in your budget include:

- Credit Card Bills

- Personal Loans

- Car payment loans

- Student loans

- Subscriptions

Truebill is a genius way to ensure you never spend money on things you don’t use. They can find and cancel unwanted subscriptions for you. They also negotiate bills on your behalf, saving you a ton of cash in the process!

Saving Money

Throughout the whole process of budgeting, your overall goal should be to get out of debt, be able to pay for your monthly expenses without being stressed and to be able to put some money away for the future.

You may also want to consider saving towards an emergency fund. This will allow you to overcome unforeseen financial strains without having to deviate away from your budget.

Don’t get too focused on how much that you’re saving monthly in the beginning because anything saved is a good start. This can be as simple as $10 per week or as grand as an extra $1000 per month. It really all depends on what you can afford to save so that you’re not putting stress on your other financial needs.

One simple tip to keep in mind about saving money is that it doesn’t have to be a painful process. You can even set up a separate savings account with your employer and have a portion of your check transfer directly to your savings so you can save without even thinking about it.

If you can do 10% per month in your savings, that would be awesome. But if you need time to work up to it, don’t fret. As long as you’re diligent about staying the course, your savings account will start and continue to grow over time.

Recommended reading: How to Save Money Fast | 17 Ways to Start Today

“Fun Money” AKA Entertainment Expenses

Let’s talk a bit about the fun side of setting up a budget for yourself. Even though it all might seem like “doom and gloom” during this time, there can be room to have some fun money for yourself as well.

As long as you have paid off all your fixed bills, your required monthly expenses, and put a bit into your savings, why not spoil yourself and your family to have some fun?

Some fun items to spend your money on can be:

- Dinner

- Movies

- Upgrading your electronics

- Planning a vacation

- Getting ice cream

Understanding How Needs Versus Wants Can Affect Your Budget

Have a plan for a budget is a big reason that many people find themselves in a strong financial situation. And if there comes a point in time that you find yourself feeling that urge to splurge and buy something that you don’t need, know that it has a much longer-lasting effect on your budget than you might realize.

A need is something that you need to function and live life. And even though there can be needs that pop up suddenly that can be expensive (new fridge in the kitchen is a prime example), they’re typically a one and done situation that can have you back on track with your budget in a very short time.

But wants…well, that’s a different story. A “want” purchase is one that can literally derail your entire budget in a very short time. Sure, we all want that new car, but do you really want that new $500/month monthly payment that comes with it? And don’t forget the fact that you’ll have to have full coverage insurance on a car loan so there’s a good chance that your premiums for that are going to go up to.

Plus, this “want” purchase is going to have you locked into that monthly payment for anywhere from 36-80 MONTHS. Just think about how much money you could have saved during that time instead of buying a brand new car.

Bottom line? Prioritize your budget in a way that works for you and your financial needs. Give yourself a bit of wiggle room to make changes so that you’re not feeling stressed because of your money situation.

The sooner that you can learn how to budget, the sooner that you have that financial freedom that you’re searching for.

How To Stick To Your Budget

Keeping on top of your budget can be an extremely difficult task. Especially for those who like to splash out and buy nice things. And while this is an easy way to unravel all the good you’ve done, it doesn’t have to be a reason to let you budget crash and burn!

Remember, you have a very specific category set up to accommodate the ‘fun stuff’ in life. And this is the pot you can tap to spend on stuff you want without compromising the integrity of your budget.

Things start to get a little tricky when that ‘fun pot’ is not sufficient for something you wish to spend money on. Let’s say, for example, you have just seen that your favorite artist is putting on a concert next month, and ticket prices are starting at $100. But you only have $50 available to spend on extra activities. What do you do?

Well, I would suggest attempting the 30-day rule – whereby you wait 30 days to see if it is something you really need and can justify purchasing.

But in this scenario, time is not on your side.

Therefore, wait as long as is feasibly possible to contemplate the purchase, and if it’s definitely something you need, you can use the ‘carry-over’.

This means that you will need to reduce your ‘fun activities’ category by the amount you have overspent, by as many months as it takes to get yourself back to ‘even’. Essentially, you are carrying over the amount you loaned yourself for the previous month. It takes a little planning and some restraint, but it’s a great way to keep on top of your budget.

Budget Category Percentages

Some people prefer to work in percentages, rather than fixed dollar amounts when working with a budget. And this makes sense, in that it gives you a better picture of what’s going on, and where the money is going.

For example, if you had a total monthly income of $5000 and your fixed + variable expenses were $3000, your percentage breakdown would look as follows:

- Income – $5000 – 100%

- Expenses – $3000 – 60%

- Savings – $500 – 10%

- Fun – $500 – 10%

To allocate percentages to your own budget, you simply need to calculate your categories as a percentage of your total income.

Working with percentages also offers the added benefit of being able to make quick assessments and adjustments. For example, ‘let’s try and save 5% more a month this year, or let’s reduce our expense by 10% moving forward’.

How To Win At Budgeting

Budgeting is nothing more than a competition between you and your personal finances. And you clearly want to win at this game, otherwise, you wouldn’t be reading about budgeting. But remember, the mere fact that you are engaging with your finances in this way is a good thing.

So don’t get down on yourself if you slip up slightly or make a mistake. The trick is to be focused, precise, and frequent when addressing your budget. Rule the books with an iron fist and your bank account will love you for years to come.

FAQs

What categories should I include in a budget?

Although there will be countless subcategories that will vary greatly depending on the person budgeting, there should be 3 key categories, including income, expenses, and savings.

What are the two main categories in a budget?

The main 2 budget categories are income (total amount of money coming in) and expenses (things you have to spend in order to keep the lights on).

What’s a good budget?

A good budget is one you can stick to. It’s no good saying you will save 5% of your income every month if you have no chance of sticking to it! Make your budget realistic and accurate, and then adjust accordingly over a period of time.

How do you create an extreme budget?

An extreme budget would see a massive reduction in the ‘spending’ category with a huge emphasis on savings. This can be achieved by adopting a frugal lifestyle approach and would be considered an extreme way to live.