Disclosure: This post may contain affiliate links. If you click on a link I may make a small commission at no extra cost to you. You can read the full disclosure here.

Last Updated on October 23, 2022 by Chris Panteli

Unifimoney Review

The financial world has rapidly transitioned to a more digital-centric approach in recent times. It started with Robinhood but has slowly become an all-encompassing situation with some of the brightest financial minds across the globe participating.

Should I use Unifimoney?

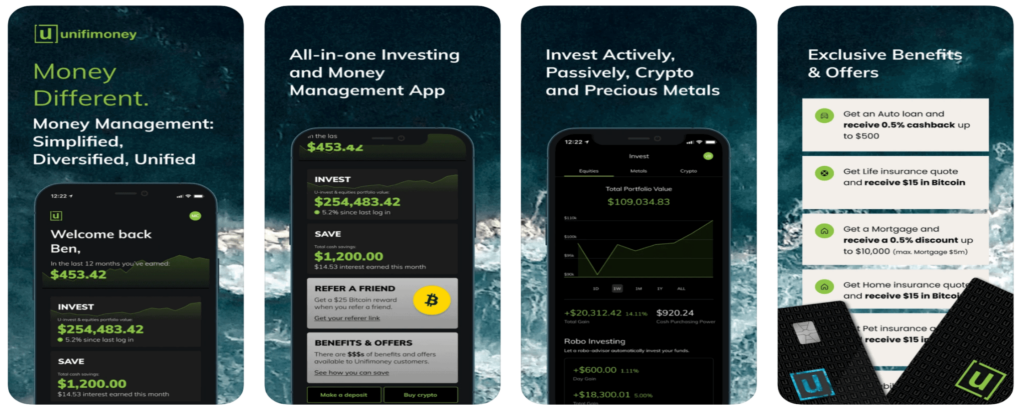

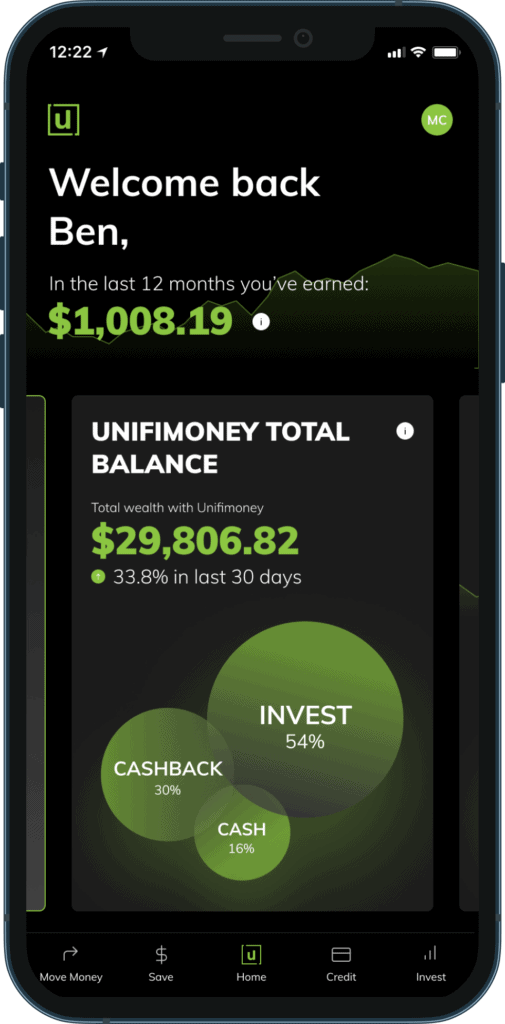

If you are looking to simplify the management of your money and financial assets then Unifimoney is worth considering. The elegantly designed mobile application combines high-yield savings, traditional and crypto investments, portfolio auto-investing, loan management, and much more. The company also calculates that saving and investing from as little as $7 a day from the age of 26 could mean you build a $1m+ portfolio by the time you retire.

Among these innovations is a financial service called Unifimoney and it promises to stand out from the crowd with a wide array of relevant services.

Whether it’s saving, investing, or signing up for a loan, Unifimoney advertises itself as being an all-in-one option for the average person in America.

Keeping all of this in mind, it’s time to dive deeper into what Unifimoney is all about, how it works, and whether or not it is the right option for you moving forward.

Quick Summary

Unifimoney App

Summary

The Unifimoney app aims to seamlessly integrate your high-yield checking account, credit, and debit card, and investing. It makes the overall management of your money and personal finances effortless whilst providing a feature-rich platform to maximize the growth potential of your wealth.

Tap twice to load then open Video...

What is Unifimoney?

Let’s begin with the basics.

Unifimoney is based out of San Francisco and is noted for offering a long list of cutting-edge financial services through digital means. This includes an all-encompassing digital app that’s accessible from mobile devices.

The development team has cultivated a brand that is all about security, stability, and adherence to national regulations while innovating how accessible financial services are.

Unifimoney is a brand that caters to those wanting new-age technology to help with all facets of money management. They are advertised for being a brand that wants to automate money while helping those wanting to maximize how their funds grow.

Key Features

The app is still growing, and more components are planned to be released over time from the team behind Unifomoney. But this relatively new player in the Fintech market is already offering lucrative Unifimoney promotions and pushing the boat with these awesome features:

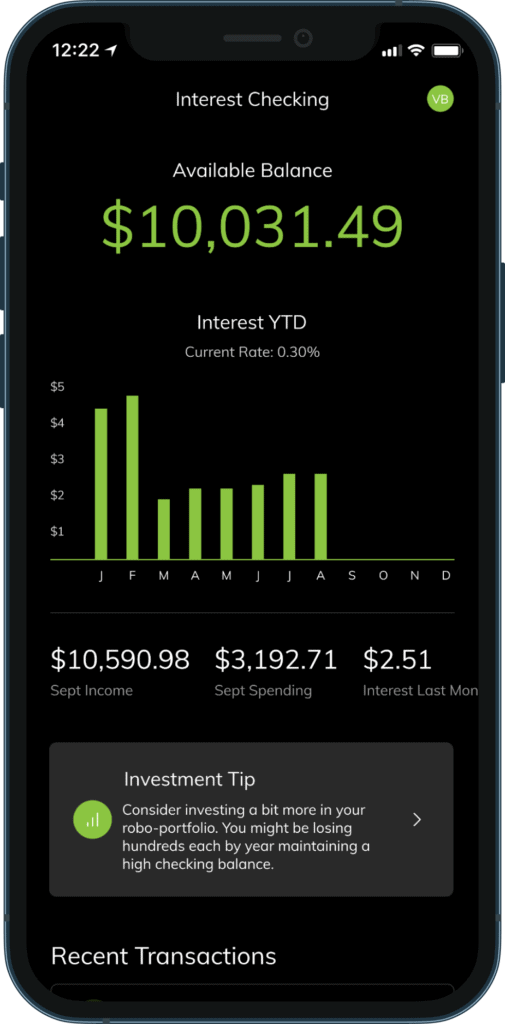

High-Yield Checking

The high-yield checking and savings account is a hybrid setup designed by Unifimoney. It allows users to signup and then transfer their funds to the account while gaining access to a myriad of features. The rate on these accounts is high and in line with some of the best offerings on the open market right now.

Unifimoney has created a seamless process for depositing funds and allows users to retain as much flexibility as possible when it comes to growing their money.

With the interest rate being competitive, it is a good option for those who want to move away from traditional banks that offer reduced rates.

Invest

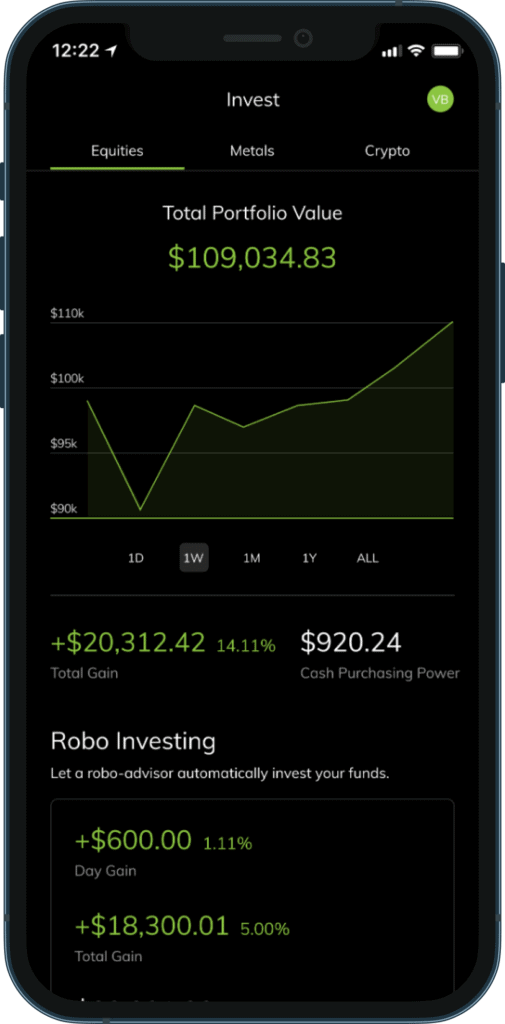

A big part of what makes Unifimoney unique is its investment features. Unifimoney Invest is all about setting high standards when building a long-term investment portfolio.

All trades made within the portfolio are free of cost due to the no-commission structure offered by the company.

Users can signup for either the roboadvisor or run a self-managed account based on their preference. Both are readily available options for those who are looking to invest through Unifimoney’s platform.

They also offer thousands of investible assets including stocks, precious metals, and cryptocurrencies. Users can deposit their funds and gain access to all of these assets at once to determine what is best for their needs moving forward.

All automated investment options can be managed through a diversified approach to investing. The roboadvisor is programmed to maintain a steady stream of passive income while making sure the portfolio continues to trend in the right direction.

Visa Signature Credit Card

Along with offering a comprehensive set of options for high-yield checking accounts, Unifimoney also provides access to a complete Visa Signature Credit Card.

They are partnered with Visa and provide a contactless payment option.

This credit card is sent directly to the user as soon as they signup and can be used wherever credit cards are accepted. The user’s accounts are linked with the credit card and can be used to pay for different items depending on what they deem is best for their financial needs.

Unifimoney offers a flat cashback rate making it easier to signup for the credit card and get a good return on the investment.

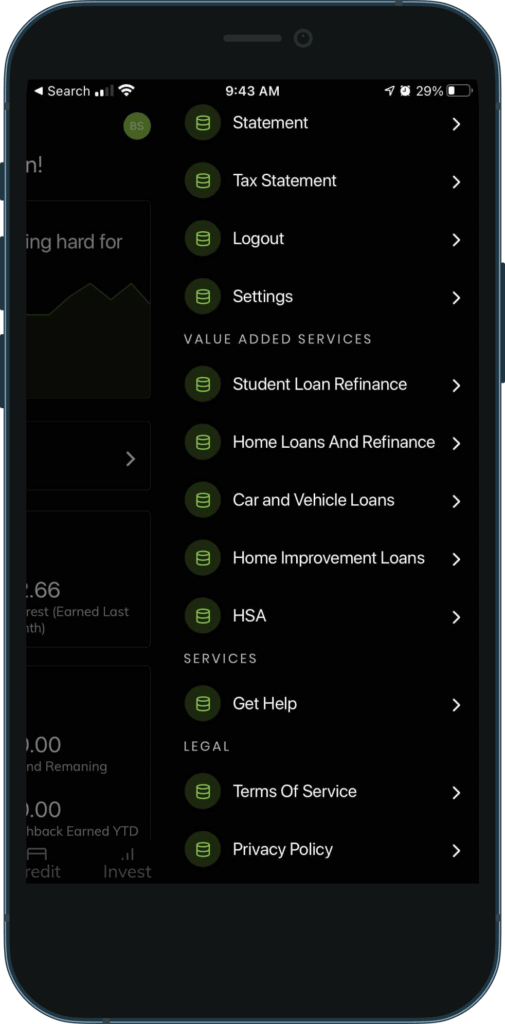

Lending Options

The financial company also offers access to a long list of high-quality lending options for those in need of funding right away.

Each option is structured through a simple setup making it easier than ever before to apply for loans.

As of right now, the company provides access to several different types of loans and each one has a separate category.

These include:

- Student Loan Refinancing

- Car Insurance

- Home Loans

- Home Improvement Loans

- Car Loans

Users can go through and apply for a loan that is in line with what they require.

A representative takes the time to go through these details and helps find the best interest rate for the situation at hand.

Mobile App Experience

One of the most important parts of using Unifimoney is their crown jewel. This would be the app that comes along with their financial services and is the face of their user experience.

Unifimoney is built on the idea of providing a digital-centric financial experience and it is all done through the beautiful app.

For those interested in going with this company, it’s important to analyze whether or not the app lives up to the billing. Does it offer a UI that is appealing and easy to enjoy when working through a long list of financial services? Is it easy to keep track of your investment accounts without getting lost or confused along the way?

Here is a detailed breakdown of the mobile app experience and how it holds up against the competition.

User-Friendly

When analyzing the mobile app, it is easy to understand why the company is doing well. They have a beautiful design that is easy on the eyes and works well in all situations. You can easily toggle through the different categories while also maintaining access to your linked accounts.

The simplicity and usability of the interface are impossible to ignore.

They have everything linked to the point it is never out of reach. A few taps and users can get to precisely where they want to be on the app without delays and/or unwanted interruptions.

The gorgeous green and black hues on the screen are appealing and stand out for all the right reasons. They have fully integrated their financial services through the app making it easy to toggle through as required.

Everything is quick, snappy, and perfect for modern standards.

Well-Integrated Features

One of the most important aspects of a user-friendly mobile app is how well-integrated the features are.

There is nothing worse than hopping onto an app and then getting confused about where to go next. Even if the app looks good, this is an issue no one wants to deal with.

However, Unifimoney has put in the time to make sure this is not a problem.

The app is an absolute joy to use and provides all the perks an individual needs when managing their money. Whether it is going towards an automated investment account or a self-managed account, everything is cited in an easy-to-understand manner.

The simplicity of the app and how it works are beneficial for those who want to see appropriate results. Each financial service is easy to get to and you can get all of the information in one place instead of having to hop around.

This makes it a lot easier to optimize your time spent on the app.

Responsive

Speed is something you are not going to worry about with this app.

It is a unique app that has been cultivated with a lot of care. Each part of the mobile app is responsive and intuitive making it fun to use.

The team behind it has taken the time to think about everything. This includes how responsive the buttons are, how commands work, and how long it takes to get to different financial services through the app. Even those with multiple accounts won’t have too much of a problem.

Easy To Signup

The KYC process is a breeze and everything is protected.

Earn up to $100 worth of Bitcoin when you deposit with Unifimoney

The Unifimoney app allows you to effortlessly manage your money and grow your wealth. Features include Auto-Investing, High Yield Checking, Commission Free Trading, and Cryptocurrencies.

They have spent a lot of time when it comes to onboarding users and it shows. The attention to detail is welcome as it demonstrates competency and the willingness to look at everything before bringing new users online.

Once you have signed up, it is easy to go through and set up accounts.

Everything is easy to manage and will not take up a lot of your time. This is just as important as any other step in the process and it is something to account for as a new user.

Pros of Unifimoney

1. Commission-Free

When looking at the advantages of Unifimoney, it all starts with the basics. The commission-free structure is impossible to beat and it is something that is becoming common in the financial world.

Whether it is the likes of Robinhood or other financial platforms, a commission-free structure is a must for those who want their money to work for them.

Unifimoney has the same line of thinking with its investment accounts making it easy to buy stocks online. You can sift through the different assets and pick out the ones that work best for you. Even if you are investing a small amount, you can make the trade without having to pay a penny.

This is ideal for those who do want to ensure all of their funds go towards investing in key assets.

2. Real-Time Fractional Investing

Fractional investing is all about maximizing efficiency and being able to purchase smaller amounts. This is a unique feature that allows Unifimoney users to get their hands on key assets without having to pay more than they want to.

This is a good feature as it allows the portfolio to keep ticking along even if small deposits are made. Even if a user buys 0.5 of an asset, it is going to become easier to purchase assets that have larger price tags per unit.

This is where fractional investing becomes a great option for those who want to find a good way to keep depositing money into their portfolio.

3. Excellent Rates

Most users are going to enjoy the rates that will come through Unifimoney. Their platform is not just about usability but also providing access to some of the better rates on the market right now.

These rates are great for both investing and the savings accounts available through Unifimoney.

If you are thinking about opening a new savings account, the yield you are going to get here will be impressive. It is going to make things a lot easier when it comes to funding money through the account and ensuring it grows over the long haul.

These rates are not only competitive on the investing side but also in terms of their lending options. Those who are thinking about getting a home or car loan can rely on what Unifimoney has to offer. Their rates are great across the board.

4. Exceptional App Interface

The app interface is a masterpiece when it comes to efficiency, performance, and quality.

They have thought of everything when designing this app and it is marvelous for the industry. Anyone that is thinking about taking the next step when it comes to money management should take a peek at what this app has to offer.

The integration is impressive and something that will blow you away as soon as you hop online.

Whether it is the simple signup process, gorgeous aesthetics, and/or how swift everything is, they have done a great job engineering the app.

5. Automated Investing

A lot of users are new to the world of investing and may not want to run a self-managed account. Unifimoney is aware of this and makes sure users can take advantage of their roboadvisor when setting up an account.

The roboadvisor will keep running the account in the background once the account is up. This means you just have to deposit the funds and the app will do the rest while you look at how things progress.

This is great as it simplifies a part of investing most people find challenging.

Just having this option is a plus but it is also one of the better roboadvisors on the market right now. This is what makes it appealing and a must for those who are still learning the ropes of how to invest properly.

6. Great Customer Service

Customer service is one of the most important parts of running a financial business and the same applies to Unifimoney.

Users that are going to be signing up for a checking account or an investment portfolio will want to know there is a representative available around the clock. With Unifimoney, they prioritize customer service and have one of the better response times in the industry.

They are on top of things right away and will not let users down in this regard.

It is an appealing benefit because it shows they care and they do offer immediate advice to those who require it. Just having this option is a serious plus.

7. FDIC Insured

Protecting your assets is critical and it is something you are not going to want to compromise on.

Unifimoney is FDIC insured up to $750,000, which is a respectable amount for those setting up portfolios. These funds are going to be fully insured by the FDIC ensuring you don’t have to worry about losing them.

This is good for those who want peace of mind and don’t like the idea of risking their funds with a new financial service. Unifimoney is a growing business and it is these details that matter when it comes to relying on a specific financial company.

8. Simple Transaction Rounding

An advantage that has popped up over recent times has to do with transaction rounding. This entails a small amount being “rounded” from credit card transactions that are made through Unifimoney.

These amounts are rounded and then added to your account inside Unifimoney automatically.

The idea is to create a simple habit of saving a bit of money after each credit card transaction. The cents will start to add up as you spend more and more money. This is great for those who don’t want to take the time to deposit the funds on their own and want an automated process that continues to grow their account.

9. Use Recovered Ocean-Bound Plastic for Cards

This is an underrated advantage but one that does stand out for those who are thinking about opening a credit card account with Unifimoney.

The company is serious about all of its environmental work and does want to positively contribute to this aspect of living.

As a result, they offer what is known as a recovered ocean-bound plastic credit card. The premise of this credit card is to make sure it is eco-friendly and doesn’t add to the waste on the planet.

This is another example of why Unifimoney continues to earn praise for its work in the financial community. They have thought about these little details and it does show their willingness to listen to what users want.

10. Great Resources

Whether it is the magazine, online calculator, and/or videos, Unifimoney does not leave its users stranded with anywhere to go.

Instead, they have an influx of resources that are up-to-date and easy to go through.

If you have any questions about specific details, you can go through these resources in seconds. You can always speak to a representative but this is an additional benefit for those who want to soak up as much information as possible.

Just having the ability to access these resources is great and they are a joy to go through too.

11. Thousands of Assets

It is not just about starting a simple investing account but knowing you are not going to be limited in any way.

This means you can invest in thousands of different assets based on what you require. Being able to access these assets means you can build a diversified portfolio that will be in line with your vision for the account.

Whether it is through the roboadvisor or a self-managed account on Unifimoney, you will know these assets are going to be readily available at the drop of a hat.

Cons of Unifimoney

1. Fees for Smaller Accounts

Unifimoney has updated its fees – and they are now much easier to interpret and understand.

If you are able to deposit at least $2,000 per month or if you maintain a total balance of $20,000, or more then the active account fee is waived.

If you are someone that is thinking about running an account that is unable to meet these requirements, then you are going to have to pay account fees. These fees can add up and it is something to think about when you are signing up for the first time.

It is worth noting that there is a 90 day grace period before the stipulated requirements will come into effect – so you may be able to utilize this time for your benefit.

If the account is going to grow in the coming days then you will be okay. However, if it is going to remain under this amount then it is highly recommended to pay attention to the fees and determine whether or not it is worth footing the bill on your end.

2. $100 Minimum Opening Balance

Along with the fees, you are also going to have a barrier to entry.

The barrier involves a $100 minimum for the opening balance. This means anyone that is opening an account through Unifimoney is going to need to deposit $100 on day one. If not, the account can’t be opened.

This is something you are going to have to think about as soon as you signup. Make sure to have the funds ready, so you can move forward with the next step. If not, you won’t be able to move forward with the sign-up process.

Final Verdict

Is Unifimoney a great option for your financial leads?

Yes, this is a world-class option that does everything right. If you are someone that has a good amount of money to deposit and/or invest then you are in the right place.

The team behind Unifimoney has put a lot of thought into its financial services and accounts. This means when you take the time to sign-up, you are going to gain access to powerful information. This is great for those who want to do things the right way.

Whether it is the low rates, beautiful UI, or great customer service, you are going to enjoy the perks that come along with this company.

They have put in the time to engineer a high-grade app and it simply gets the job done.

FAQs

Is Unifimoney worth it?

Absolutely. Unifimoney has bridged the gap between traditional banking and the new age of financial wealth management. The feature-rich app allows you to effortlessly control your money from a single location – and make growing your wealth a priority.

How does Unifmoney offer such good value?

Unifimoney money can compete and outdo large banking institutions by minimizing their operating costs. They do not have expensive real estate, thousands of employees, or outdated tech.

Are there any rewards for signing up to Unifimoney?

There are many incentives for depositing with Unifimoney, including the ability to earn Bitcoin for initial deposits and referring friends.

What is the minimum deposit to open an account?

There is a $100 minimum deposit to open an account with Unifimoney.

Unifimoney: Ultimate Review (2024)

If you are looking to simplify the management of your money and financial assets then Unifimoney is worth considering. The elegantly designed mobile application combines high-yield savings, traditional and crypto investments, portfolio auto-investing, loan management, and much more.

Price Currency: USD

Operating System: "Android", "iOS"

Application Category: Banking

4.7