Disclosure: This post may contain affiliate links. If you click on a link I may make a small commission at no extra cost to you. You can read the full disclosure here.

Last Updated on October 25, 2023 by Alex

Cashing a check may seem like a straightforward process, but when it comes to third-party checks, the rules can be a bit more complex.

Whether you’ve received a check made out to someone else that’s been endorsed to you or you’re the original payee looking to delegate the cashing duties, understanding how third-party checks work is crucial.

In this guide, you’ll learn who cashes third-party checks. Plus, all the questions you might have about third-party checks will be answered right here.

What Is A Third-Party Check

A third-party check refers to a financial instrument where the payee (the person or entity to whom the check is written) endorses the check to someone else. In a typical check transaction, the payee is expected to deposit or cash the check for themselves. However, when the payee endorses the check over to another party, that party becomes the third party in the transaction.

Here’s a breakdown of the parties involved:

- Drawer: The person who writes the check

- Payee: The person or entity to whom the check is made payable

- Third Party: The person or entity to whom the payee endorses the check

Banks and financial institutions may have specific policies regarding third-party checks. Some banks may accept them without issue, while others may have restrictions or additional requirements to mitigate the risk of fraud.

Always check with your bank or financial institution regarding their policies on handling third-party checks.

Who Cashes ThirdParty Checks

Cashing a third-party check can be more complex than cashing a check made directly to you. Not all banks or check-cashing services will accept third-party checks, and those that do may have specific policies and requirements. Here are some options for cashing a third-party check:

- Bank

- Check-Cashing Services

- Retailers and Grocery Stores

- Prepaid Debit Cards or Credit Card

- Credit Unions

Always keep in mind that policies regarding third-party checks can vary widely among institutions. Before attempting to cash a third-party check, it’s recommended to contact the bank or check-cashing service in advance to inquire about their specific requirements and fees.

Additionally, make sure the check is properly endorsed according to the institution’s guidelines. Check this great guide for finance apps that can help you here.

Banks That Cash Third-Party Checks

Banks offer many services including online banking, direct deposit, and depositing a payroll check. You can also visit a bank to cash a third party check. Here are some of the best-known banks you can visit for check cashing services.

Citibank

Citibank offers a check cashing service for various check types, including cashier’s checks and a government check. While Citibank does permit the cashing of certain third-party checks, there are specific requirements in place for such transactions.

For non-customers seeking to cash checks at Citibank, the bank restricts this service to checks drawn from Citibank itself. On the other hand, Citibank account holders can cash checks up to the available balance in their checking account. If the check amount surpasses the available balance, the excess may be deposited into the account.

Citibank may impose the condition of the original payee verifying or guaranteeing their endorsement for certain transactions. Importantly, an account holder of Citibank are exempt from fees associated with these services. However, for non-account holders cashing third-party checks drawn on Citibank, the maximum limit is set at $5,000.

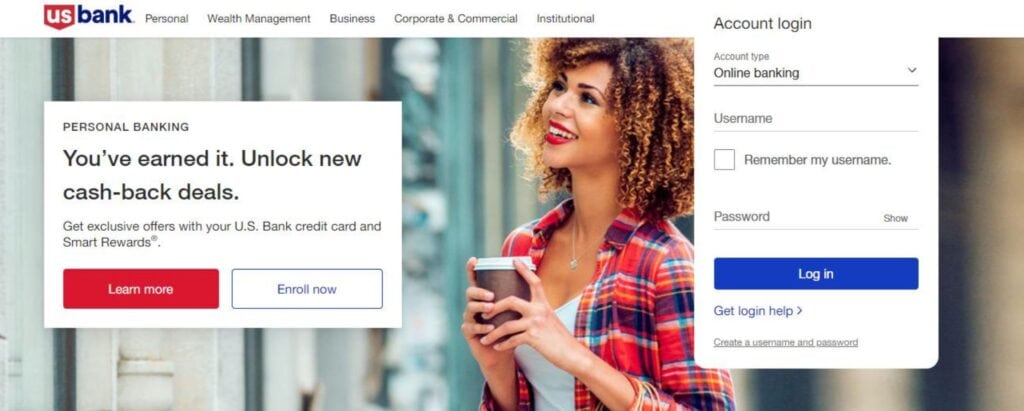

US Bank

US Bank provides an option for cashing third-party checks. Customers of U.S. Bank have the option to either cash or deposit third-party checks in person at a branch. However, non-customers are restricted to cashing only third-party checks drawn on U.S. Bank.

For non-customers availing this service, a fee of $7 is applicable. It’s worth noting that U.S. Bank extends its check-cashing services to various check types, including personal checks and other check varieties.

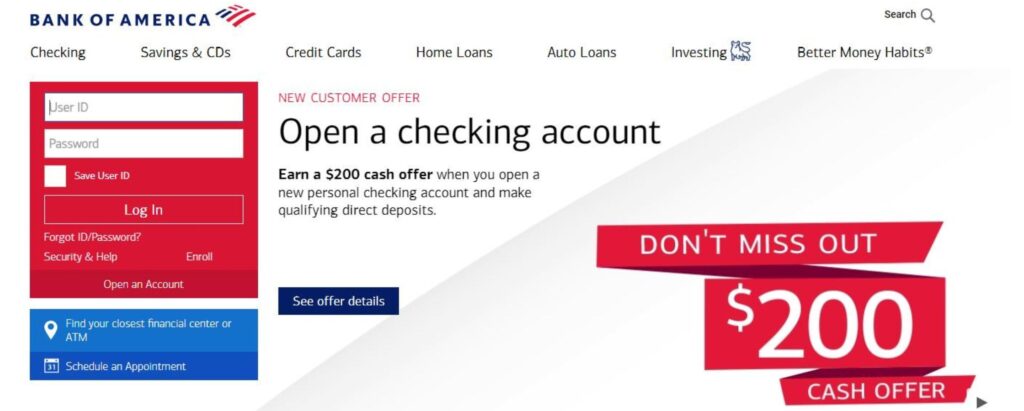

Bank Of America

Certain Bank of America branches offer the service of cashing third-party checks.

The process of cashing and depositing third-party checks is evaluated on an individual basis. Approval is subject to the discretion of the manager at each specific Bank of America location. For depositing a third-party check, the presence of both parties is required.

To determine if your local branch is willing to cash your check, it is recommended to inquire directly at that branch.

Bank of America account holders have the advantage of cashing third-party checks without incurring any fees.

For non-customers, there is an $8 fee for checks exceeding $50 in value.

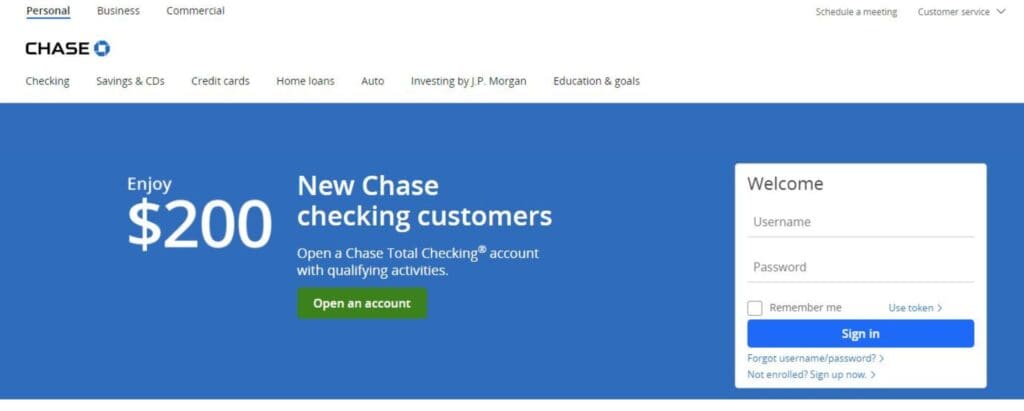

Chase Bank

Chase Bank is an alternative location where you can attempt to cash a third-party check.

For those who are not customers of Chase Bank, the option is limited to cashing only third-party checks issued by Chase, with an associated fee of $8 for checks exceeding $50 in value.

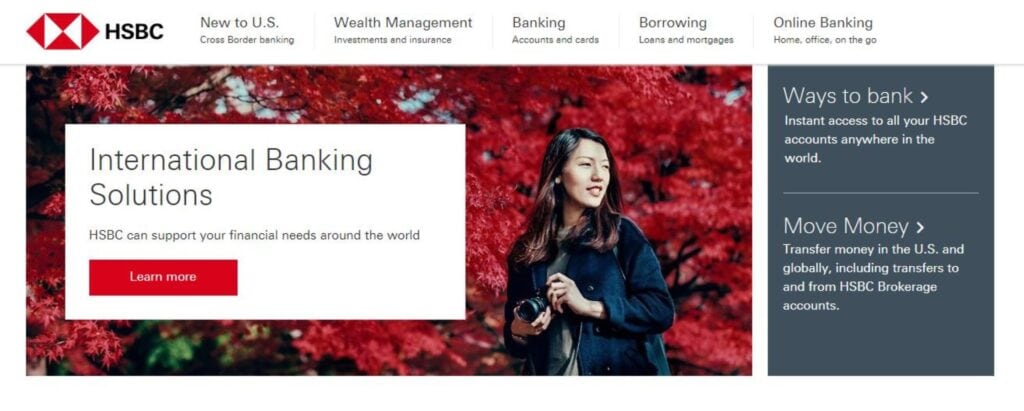

HSBC

HSBC allows non-account holders to cash only business checks and personal checks issued by HSBC.

The service of cashing personal checks is provided free of charge. However, for cashing business checks, non-account holders will be subject to a fee for checks up to $100 and a $5 fee for checks exceeding this amount.

Truist

Cashing third-party checks is a service available at Truist, with specific requirements in place. Non-account holders will be required to pay a fee for checks exceeding $50.

M&T Bank

M&T Bank provides the option to cash third-party checks. For non-customers, the ability to cash third-party checks is limited to those drawn on M&T.

Non-customers will be subject to a fee equal to 2% of the total check amount, with a minimum fee of $3 and a maximum fee capped at $20.

In-person verification for check cashing requires the presence of both the original payee and the third party.

TD Bank

TD Bank may consider cashing third-party checks in specific instances. Like several other banks, the process of cashing third-party checks is determined on a case-by-case basis. To find out whether your third-party check can be cashed, it is recommended to contact your local TD Bank branch directly.

For non-customers utilizing this service, a fee of $7 per check is applicable.

First National Bank Of Omaha

The First National Bank of Omaha may consider cashing third-party checks in certain situations. The process for cashing third-party checks is determined on a case-by-case basis. To ask if your specific third-party check is eligible for cashing, you can contact your local branch of the First National Bank of Omaha directly.

For non-customers using this service, a fee of $5 per check is applicable.

Credit Unions That Cash Third-Party Checks

If going to a bank isn’t an option for you, then a credit union can be an excellent alternative.

Navy Federal Credit Union

Navy Federal Credit Union allows the cashing of third-party checks, subject to specific requirements. For members, the endorsement of third-party checks must occur in the presence of a teller.

Non-members are limited to cashing third-party checks drawn on Navy Federal Credit Union (NFCU). In such cases, both the original payee and the third party must be present for in-person verification.

Check cashing at Navy Federal Credit Union is provided free of charge, applicable to both customers and non-customers.

Connexus Credit Union

Connexus Credit Union offers check cashing services exclusively to its members, meaning non-members are not eligible to cash checks at Connexus Credit Union.

For third-party checks, the endorsement process must take place in the presence of bank personnel.

There is no charge for cashing a third-party check at Connexus Credit Union.

Chartway Federal Credit Union

Chartway Federal Credit Union permits both cashing and depositing of third-party checks for its members, allowing members to process any third-party check. On the other hand, non-members are restricted to cashing only those third-party checks that are drawn on Chartway Federal Credit Union.

Chartway Federal Credit Union doesn’t charge a fee for cashing checks.

Check Cashing Stores That Cash Third Party Checks

Check cashing stores allow third party check cashing. This allows for greater flexibility as many stores are open for longer than traditional banks.

ACE Cash Express

ACE Cash Express serves as a check-cashing establishment that accommodates the cashing of third-party checks. Fees for this service typically begin at around 2% of the check amount, although these fees can differ based on the location and type of the check.

The criteria for cashing a third-party check may differ from one ACE Cash Express store to another. In certain instances, both parties involved may be required to verify endorsements.

Advance Financial

Advance Financial operates over 100 stores in Tennessee, some of which are open 24 hours, providing a potential option for those seeking 24-hour check cashing services. To find out the specific operating hours of your local store, it is advisable to check directly with them.

Advance Financial offers check cashing services for various types of checks, including insurance checks and personal checks.

The fees for check cashing at Advance Financial vary, ranging from 1% to 5% of the check amount for most types of checks. However, for personal checks, the fee is set at 10%.

Cashing a third-party check at Advance Financial requires in-person endorsement of the check, and endorsers may be requested to verify their original signatures.

Check ‘N Go

Check ‘n Go provides check cashing services for third-party checks, with fees typically beginning at around 2% of the check amount. However, these fees can vary based on factors such as the type of check and its amount. To cash a third-party check at Check ‘n Go, it is necessary for both parties to be present for in-person verification.

The Check Cashing Store

The Check Cashing Store is an additional option for cashing third-party checks. However, it’s important to note that not all The Check Cashing store locations offer this service for third-party checks. To determine if your local store provides this service, it is recommended to contact them directly.

The fees for cashing third-party checks at The Check Cashing Store can vary based on factors such as the location, the amount of the check, or the type of check.

Speedy Cash

Speedy Cash operates 160 locations across the United States, with select locations offering 24-hour service.

Speedy Cash cashes various types of checks, including cashier’s checks, insurance checks, and personal checks. The fees for check cashing at Speedy Cash start at $2.

To complete the check-cashing process, Speedy Cash requires verification of the original payee and the issuing bank, which is typically done via phone.

Retailers That Cash Third-Party Checks

While many retailers and businesses do not typically cash third-party checks due to security and fraud concerns, some retailers do provide this service.

Keep in mind that policies may vary, and it’s advisable to check with the specific location to confirm their policies. Here are some places that may offer third-party check cashing:

Walmart

Walmart may provide check-cashing services, including third-party checks. They often have a MoneyCenter or Customer Service area where this service is offered.

Kmart

Some Kmart stores may offer check-cashing services alongside other money services, including the possibility of cashing third-party checks.

7-Eleven

Some 7-Eleven stores, particularly those with financial service kiosks, may offer check-cashing services.

Grocery Stores

Grocery store chains, especially those with in-store financial services, may offer check-cashing services. Examples include Kroger, Safeway, Publix, and others.

Pharmacy Chains

Pharmacy chains, such as CVS or Walgreens, may offer check-cashing services, including the cashing of third-party checks.

Can You Cash Third Party Checks Online

Cashing third-party checks online can be more challenging compared to cashing them in person at a physical location.

Many banks and financial institutions have implemented strict policies and security measures to prevent fraud, and as a result, they may not offer online options for cashing third-party checks. Online check cashing often requires the payee to be the same person endorsing and depositing the check.

Cashing a third party check online or via a mobile banking app may be possible in some situations.

For example, some providers like Ingo Money offer a mobile check deposit option as part of their app. Century Bank, Regions Bank, and MT Bank are more possible options if you’re looking for a provider offering a cash app that includes the facility of making a mobile deposit.

You’ll need to check with your provider to find out what’s possible. Learn more about checks here.

FAQs

Who can cash third-party checks?

Generally, the payee (the person or entity to whom the check is written) can cash it. Additionally, some banks or check-cashing services allow third-party checks to be cashed by individuals other than the payee under certain conditions.

Can anyone cash a third-party check?

Policies vary by institution. Some banks or check-cashing services restrict third-party check cashing to specific individuals, often requiring them to be account holders or meet specific criteria.

What is a third-party check?

A third-party check is a check that is endorsed by the payee to someone else. It involves the transfer of the check’s ownership from the original payee to a third party.

Are there fees associated with cashing third-party checks?

Yes, fees may apply, and they vary depending on the financial institution or check-cashing service. Fees can be a percentage of the check amount or a flat rate.

Do you need an account to cash a third-party check?

It depends on the policies of the bank or institution. Some places may allow non-account holders to cash third-party checks, while others may require the individual to have an account.

What information is required to cash a third-party check?

Typically, you need proper identification (such as a government-issued ID) and the endorsed third-party check. Some institutions may have additional requirements.

Can I cash a third-party check at any bank?

No, policies vary by bank. Some banks may readily accept third-party checks, while others may have more stringent requirements or restrictions.

For example, you may need a bank account with that bank to cash third party checks.

Are there limits on the amount for third-party check cashing?

Yes, some banks or check-cashing services may impose limits on the amount that can be cashed, and these limits can vary.

Can I cash a third-party check at an ATM?

Generally, cashing a third-party check at an ATM is not common. Many banks require in-person verification for third-party checks.

What if the payee is not present for third-party check cashing?

Many institutions require both the original payee and the third party to be present for in-person verification when cashing a third-party check.

Who should I speak to if I have questions about money matters?

There are a range of options you can seek out if you need advice about debt, investing, saving, or any other money-related questions. Your bank, a financial advisor, or online money services may all be able to provide the help you need.

What are savings bonds?

Savings bonds are a type of government debt security issued by a country’s government to help fund its borrowing needs. These bonds are considered low-risk investments and are often used by individuals as a way to save money over a fixed period. In the United States the U.S. Department of the Treasury issues savings bonds.

What’s a money order?

A money order is a financial instrument that is similar to a check but is generally considered a more secure form of payment. It’s a piece of paper or document that represents a specific amount of money.

People often use money orders for transactions when a personal cash check is not accepted or when the payer wants to ensure that the payment is backed by guaranteed funds.