Disclosure: This post may contain affiliate links. If you click on a link I may make a small commission at no extra cost to you. You can read the full disclosure here.

Last Updated on January 21, 2023 by Chris Panteli

Best Finance Apps

Managing your money doesn’t have to be complicated. Gone are the days when you needed notebooks and spreadsheets to categorize your expenses. Now the market is full of free and paid apps that automatically do the job for you.

Ready to make managing your money easier? Here are the best finance apps to save, invest, and track your money as recommended by finance experts.

1. Mint

Mint is one of the most recommended and highly rated finance apps. It’s free to use and offers a wide range of features so there’s something for everyone.

“Mint allows you to connect all of your accounts in one place so that you can see your entire financial picture at a glance,” says Harry Turner, founder of The Sovereign Investor, an investing education website.

“It creates personalized budgets to help you achieve specific financial goals, such as “conquering” your loans or “crushing” your credit card debt. The expense tracking feature then tells you whether you’re adhering to that budget or whether you need to rein it in a bit.”

The app also offers bill reminders, done-for-you price negotiations, and tools to help you pay off debt.

2. Acorns

Acorns is a convenient app if you’re trying to save money. “The app works by rounding up your purchases to the nearest dollar and automatically investing the spare change into a portfolio of exchange-traded funds (ETFs),” says Melissa Terry, CFA at VEM Tooling.

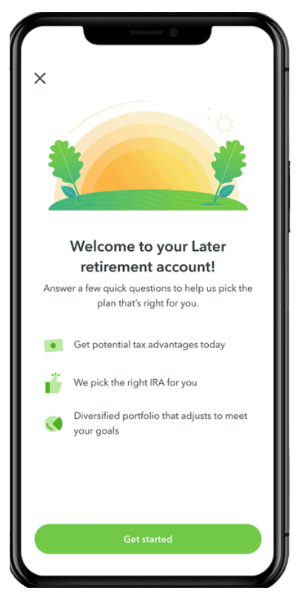

Acorns Later Retirement

An easy, automated way to save for retirement. You can put your extra cash to work for as little as $5 at a time – straight into an IRA and portfolio that’s right for you

“It helps me put away money on a regular basis without thinking about it,” says Jaanus Põder, founder and CEO of Envoice, an expense reporting and purchase management solution.

The app also offers personalized investment advice, banking features, and shopping rewards.

3. Digit

Digit offers a similar convenience as Acorns. “It analyzes your spending habits and automatically transfers small amounts of money from your checking account into a savings account,” says Andrew Lokenauth, adjunct professor at the University of San Francisco and founder of Fluent in Finance.

“It also offers a feature called “Boost” which allows you to set custom savings goals, and the app will automatically save more money when you are close to reaching your goal.”

Like Acorns, your money is then distributed in a diverse portfolio of stocks and bonds. The biggest difference between the two apps is that Digit is more geared toward savings while Acorns is investment-focused. Another difference is the fees as Digit is $5 a month and Acorns is $1-$3 a month.

4. You Need a Budget

You Need a Budget (YNAB), is (as the name explains) a budgeting app that automatically creates a monthly budget for you based on your income and expenses.

It syncs with your bank account and tracks expenses in real-time to create a detailed financial breakdown so you can understand where your money is going. You can also set savings goals and create a custom plan to pay off debt.

Users can also access a dedicated “Learn” section full of webinars, videos, and articles addressing common finance concerns.

5. Robinhood

Robinhood is one of the most recommended apps for investors, especially beginners. “It offers commission-free trading on a wide range of investment options, including stocks, options, ETFs, and cryptocurrency,” Lokenauth says.

The app is helpful for investors at all levels as you can buy fractional shares for as little as $1, set up recurring investments, borrow money to buy stocks, and access investing advice for free.

But wait, it gets better if you pay for Robinhood Gold, its subscription program. $5 per month gets you 4% APY on your idle cash and 7% interest (vs 11% for non-subscribers) for borrowing money.

6. Charles Schwab

If you’re a more advanced investor, you may want to opt for Charles Schwab. “You can set up automated recurring transfers into it and it will invest automatically based on your preferences,” says Brian Davis, a real estate investor and founder of SparkRental, a passive income and investment education platform.

“The app rebalances your account automatically, and can even provide tax loss harvesting to help you show paper losses on your tax return.”

Want more? The app also lets you deposit checks and pay bills on the go for added convenience.

7. Qapital

What if an app could do everything for you? Well, we have something for you.

Qapital uses behavior science to help you save and invest money. You can set up custom savings goals (like a dream trip), automatically save a fixed percentage of your salary, and invest your saved money in a pre-built portfolio so everything is done for you without you even opening the app.

You can also set up rules based on your spending habits. For example, you can save $1 every time you make a purchase above $25.

This kind of customization and automation makes saving money simple, especially for busy individuals and total beginners who struggle to get started. “You set it up in five minutes, and it takes care of everything,” says Steven Holmes, a senior investment advisor at iCash, who recommends this app.

8. Trim

Want to keep lowering your living expenses but don’t know how? Trim does the job for you.

The app analyzes your spending habits and finds where you can save money. But that’s not all. The app also negotiates bills and cancels unwanted subscriptions for you so you can sit back and save money automatically.

9. Pigeon

Discussing finances with friends and family can be uncomfortable, especially when you’re lending each other money. Apps like Pigeon save you the awkward conversations by sending automatic repayment reminders and even drawing up a legal contract to protect you in case things go wrong.

“Whether a loved one needs help covering unexpected expenses or kickstarting a business, Pigeon supports the entire loan process from start to finish, keeping track of IOUs, setting up payment schedules, moving money online, sending automatic reminders, encouraging on-time payments, educating their users, and more,” says Brian Bristol, founder and CEO of the app.

10. Honeydue

Speaking of sharing money with loved ones, here’s a way to stop arguing with your partner about who should pay.

Honeydue is a finance app for couples that lets you create a shared budget (say, for an anniversary celebration), send each other payment reminders, and manage joint bank and credit card accounts so you’re on the same page about how to spend the money.

The app also has a handy feature to split expenses and keep track of who owes what.

Recommended:

- 14 Best Apps To Sell Photos And Make Money

- 33 Awesome Apps That Pay You (Money From Your Smartphone)

- Cash App Free Money Code + 15 More Ways

- 10 Awesome Local Deals Apps To Save Money

- 31 Awesome Highest Paying Apps

- Cash App Flips {Legit & Scams}

- 17 Awesome Apps Like Mistplay

- 17 Legit Cash App Games That Pay Real Money