Disclosure: This post may contain affiliate links. If you click on a link I may make a small commission at no extra cost to you. You can read the full disclosure here.

Last Updated on October 23, 2022 by Chris Panteli

Learn eToro

So why learn eToro? The money-making opportunities online are vast – but some of the most highly profitable earners can be rather complicated for the uninitiated. From the complexities of financial derivatives, selling put-options, day-trading margins, and everything else you may have heard in The Wolf Of Wallstreet.

But that doesn’t mean the less FinTech savvy amongst us should be excluded from all the fun. And that is where eToro comes into the picture – a truly democratized way for everyone to trade the financial markets.

The information contained on LifeUpswing.com does not constitute financial advice

eToro USA LLC; Virtual currencies are highly volatile. Your capital is at risk.

Learn eToro Forex Trading

If you have browsed the internet over the last few years, then you will have undoubtedly come across forex trading. Often touted as the largest financial market in the world – with easy access via reputable brokers. Well, although it’s true the market is huge (a daily volume of $5.1 trillion, vs. $84 billion for equities worldwide), it doesn’t mean that trading is easy.

I have opened and closed a number of different trading accounts over the years, with a multitude of brokers. Unfortunately, my forex trading career has not quite yet resulted in a retired life of leisure. I’m probably a good few years away from mooring my yacht in the Marbella harbor. In fact, my uncles fishing boat in Cyprus’ Larnaca bay is as close as I’ve been.

Now, this doesn’t mean you can’t make decent money trading forex. The ease of access and low barriers to entry make it very possible. Also, the sheer volume of brokers competing for your business means it’s definitely a buyer’s market. Historically, trading these types of financial instruments was very expensive and reserved solely for institutional investors. The rise of the internet, however, has ensured easy access to well-regulated brokers offering low-cost solutions.

Learning Forex

Trading is a skill that requires vast knowledge and lots of practice. You can certainly find a wealth of free education on the internet and begin your new career path immediately. I wholeheartedly recommend babypips as a place to start. Their School of Pipsology is completely free and of the highest quality.

This educational journey is going to take some considerable time – so beforehand it’s a good idea to dip your toes into the forex waters. That’s where eToro comes in. You can invest with as little as $200 (£160) or $50 for US accounts.

What is eToro?

eToro is a broker that gives clients the ability to trade forex, stocks, ETF’s, CFD’s and cryptos. Now it’s worth noting at this point that eToro is by no means the most competitive. With regards to forex (which is traded as CFD’s – whereby you don’t actually own the underlying asset), there are probably more competitive brokers available. However, the slightly higher price is justified by the world-leading service they offer. And that service is called CopyTrader.

A CFD or Contract for Difference is a financial instrument that only considers movement in the price. it facilitates the opportunity to profit from this price movement without owning the underlying asset. CFDs can be traded with leverage – whereby a much larger position can be controlled with a smaller amount of invested capital.

Leverage is a double-edged sword – as profits can be greatly magnified, so can losses. This is why it is so important to be well educated and to have a solid foundation for any trading strategy implemented. Before starting to trade on your own, it is a great idea to follow the trading of others. You can learn their strategy through eToro’s CopyTrading opportunities. This gives you a chance to invest while you learn.

eToro USA LLC; Virtual currencies are highly volatile. Your capital is at risk.

What is CopyTrader?

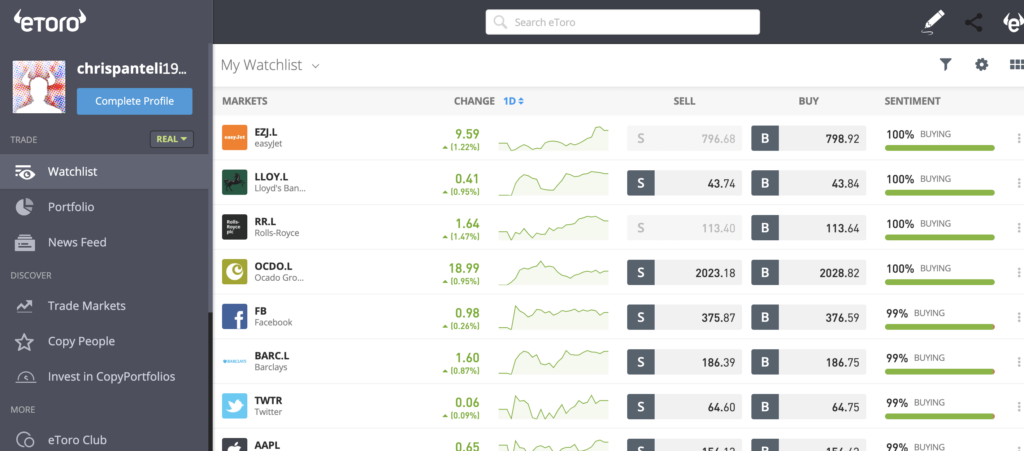

eToro is first and foremost known for being a social trading platform. It’s basically Facebook but for traders. However, instead of uploading pictures of your dog – the platform offers the ability for others to trade on your behalf. This is all done through its gorgeous platform that’s both highly functional and extremely intuitive.

Now the copy trading element of the eToro platform is what allows you to access the world of trading -even with limited trading knowledge. You simply select traders that you wish to follow – and the system will automatically open trades from your account that exactly replicate that of the traders you have copied.

Before you dive straight in there are a few things you need to know. Firstly, it is not as simple as just picking traders with massive returns – and expecting to see the same results. The statistics need to be carefully analyzed and interpreted in order to make well-informed decisions on whom to copy.

Secondly, your account will need to be closely monitored. Changes in the market environment – such as the current Coronavavirus outbreak – will impact different traders and the strategies they have chosen to implement. This doesn’t necessarily mean that all strategies will stop delivering good returns. However, you should check your portfolio at least once a day and exercise caution and good judgment.

Getting Started

Now let’s get started with setting up and learn eToro – and then I will explain some simple ways to ensure you are selecting the right traders to follow. It is worth mentioning at this point that the minimum amount required to copy a trader is $200 per trader. I personally recommend that you follow at least 2 traders (ideally 3) at any given time, thus diversifying your risk to maximize your results. Therefore at a minimum, you should open an account with $500 or $1000 (£810) if you can.

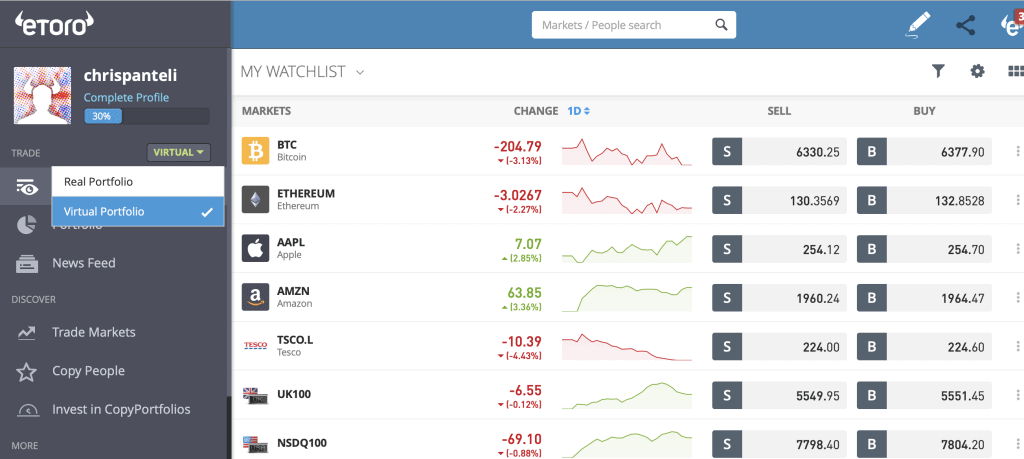

You don’t need to trade with real money on eToro straight away. You can use the virtual account to familiarise yourself with the platform and its features.

eToro USA LLC; Virtual currencies are highly volatile. Your capital is at risk.

Real vs Virtual

Once you have joined eToro you will then be eager to get started and begin following traders. Make sure you familiarise yourself with the platform first. I would suggest spending a least a couple of weeks in the virtual environment. Practice doing your CopyTrader research and selection – and actively managing your portfolio.

Above you can see in green text ‘REAL’. To switch to the virtual account simply select the drop-down arrow and select ‘Virtual Portfolio‘:

Make sure you always check which account is active before managing trades. You do not want to be playing around accidentally in your real account. Similarly, you do not want to have wasted your time choosing great traders to follow – only to find your account was in virtual mode. Leaving profits on the table is worst than losing trades – trust me.

How to Select the Best Traders

As I have already mentioned trading is an art form. It requires great skill, discipline, and experience. Likewise, selecting these types of traders to copy is an art form in itself. You can’t just randomly pick traders and expect your account to grow. In fact, not having a solid strategy in place for your trader selection process is a definitive way to blow an account.

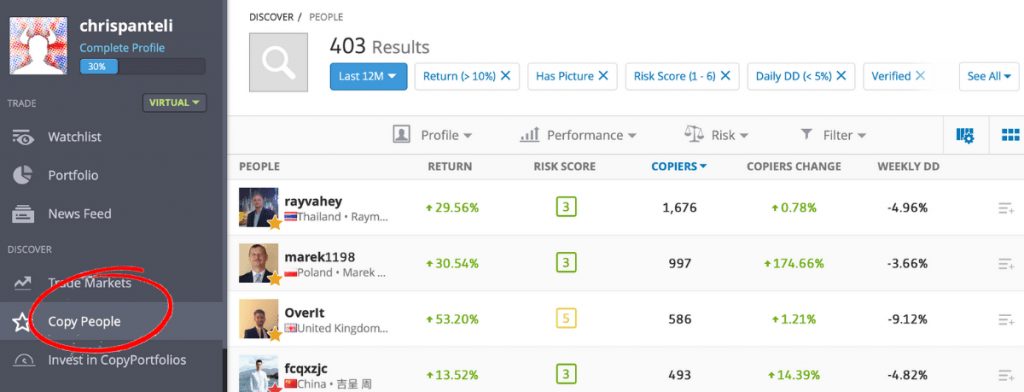

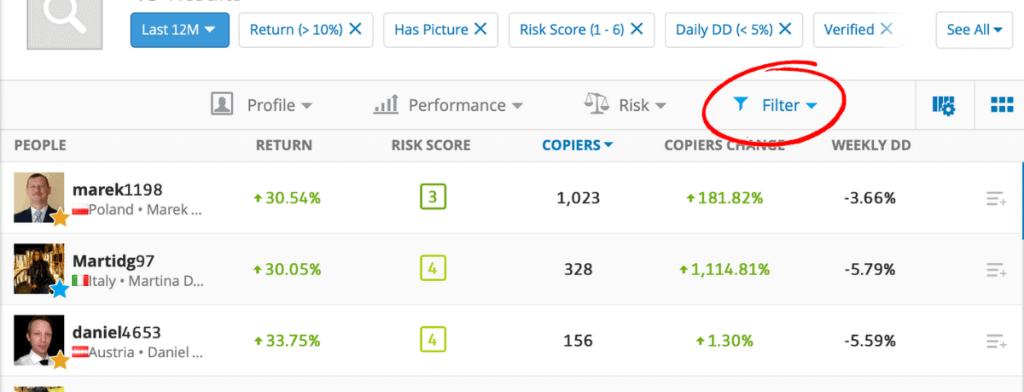

The eToro platform provides a great search function whereby you can filter different traders based on certain parameters. This is where your trader selection strategy will come into its own. There are 4 key criteria you should look at before making your selections.

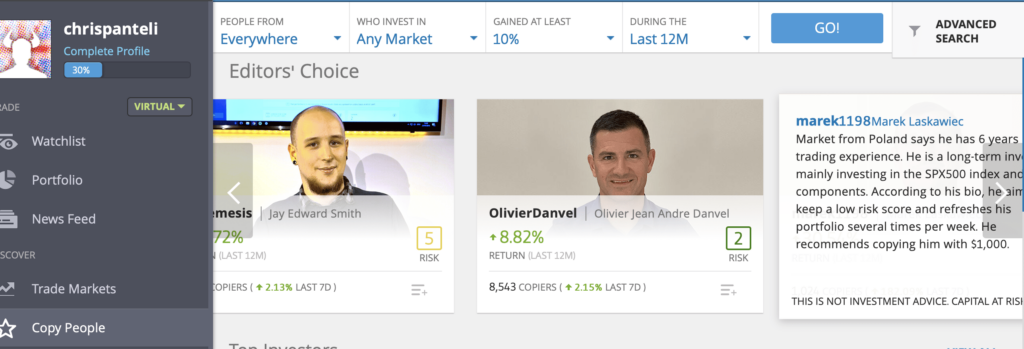

Step 1. Find people to copy:

On the left-hand side of the eToro platform click on the ‘Copy People’ button.

Step 2. This is where the eToro magic happens. Ensure the settings are as below and select the ‘GO‘ button.

Step 3. Now let’s tweak some of your eToro settings to find the very best traders. Select the Filter dropdown button:

From here you will want to make the following suggested changes:

| Profitable Months | Change to | High >80% |

| Profitable Trades | Change to | Medium 70-90% |

| Weekly DD | Change to | Medium 3-10% |

| Daily DD | Change to | Custom <5% |

Step 4. Hit Apply and there you have it. A great list of traders to begin looking at.

Now Select your Traders to Copy

Your job now is to delve into each trader’s eToro profile and look at the statistics more closely. The key is finding long-term sustainable growth. Make sure that traders have a decent amount of trade history and a good number of trades executed.

Alarm bells should ring if any trader has massive percentage returns – like 1060% in 12 months. This just means they have taken huge amounts of risk and got lucky. These traders will blow your account instantly.

The filters that have been implemented should almost certainly weed out these profiles and leave you with a healthy list of viable traders to follow – and hopefully grow your account in a safe and sustained way for many months and years to come.

Remember, eToro traders’ past performance is not indicative of future results. You have put systems and measures in place to give yourself the best possible chance of succeeding in the market. By piggybacking on others’ success, good financial returns can come to fruition.

Just remember to continually monitor your portfolio performance and watch how your selected traders are getting on. Market conditions can change and traders’ strategies can perform better or worst accordingly.

The ‘Copying’ part of CopyTrader

Before you jump into following traders with your hard-earned cash, make sure you understand exactly where and how your money will be used. The minimum amount needed to copy any one individual trader is $200. When you have conducted your trader analysis and made a decision to pull the trigger – you will then have 2 options available.

Option 1: Copying All Trades

This means that all the open positions of the trader copied will be followed as per the terms listed (from eToro.com). Note, new positions will also be followed.

- The existing open positions will be opened in the copier’s account with the market rates available at the time of copying (not the rates at which the original trades were opened).

- The trades will have the same stop loss (SL) and take profit (TP) as the original trade.

- They will mirror the Copied Trader’s future actions including changes in SL’s and TP and closing of the trade, from the moment you begin copying them. If the copied trader extends their SL by adding more funds to a position, your SL will adjust accordingly. However, your position amount will stay the same as its initial amount. Therefore, you may sometimes see differences in gain percentage between your copy account and the copied trader’s account.

- You will be able to close a specific copied trade without closing the copy account.

- If the Copied Trader opens a position in markets that are closed during the time they are copied (market break for example), the system will open a Market Order for the copier. Once the market is open, the order will execute into a position with the first market rate.

- To see all of the trades copied from a single trader, go to your portfolio and click the Copied Trader’s name.

Source: eToro

I do not recommend this option, as positions may have been opened for a considerable amount of time. Therefore the basis of the trading decision and the current price will not be aligned – thus negating the logic behind the trade and the ability to achieve a profit.

Option 2: Copying Only New Trades

I like this option, as the trades opened will get you a price that aligns with the trader’s logic. You should not be disheartened if trades do not open straight away. You may have to wait for some time – but this is a better strategy for the long term.

New trades opened will be as per the terms listed.

- Only trades opened after the copy action started will open in the copier’s account.

- New trades will open at the same rate as the copied trader opens them.

- The proportions of the new trades will be calculated from the Realised equity of the Copied Trader (account balance + invested funds).

- The trades will have the same SL and TP as the original trades.

- All of the Copied Trader’s actions will automatically be duplicated in the copier’s account, including changes in SL’s and TP’s and closing of the trade. If the Copied Trader extends their SL by adding more funds to a position, your SL will adjust accordingly. However, your position amount will stay the same as its initial amount. Therefore, you may sometimes see differences in gain percentage between your copy account and the Copied Trader’s account.

- You can close a specific copied trade without closing the copy account.

- To see all of the trades copied from a single trader, go to your portfolio and click the Copied Trader’s name.

Source: eToro

How is my copy investment allocated?

When you invest using CopyTrader your funds will be split proportionally for all positions opened. Therefore, any new trades opened by your copied trader will be reflected in the same ratio for your account. The realized equity (balance + invested funds) will be the basis for the proportions of the copied trades.

For example, a trade opened with 10% of the Copied Trader’s realized equity will open a trade-in your copy account with 10% of the realized equity in the copy relationship.

Disclaimer: 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Learn eToro | Recap

There you have it, the ultimate beginner’s guide to learning eToro. A definite way to Upswing your investments and have time to make decent returns whilst learning the nuances of trading. So remember:

- You should consider whether you can afford to take the high risk of losing your money)

- Filter the Copy Traders as per the suggested changes above

- Learn more about forex trading from the School of Pipsology whilst also being active in the markets

- Check your portfolio at least once a day and exercise caution and good judgment

I hope you have enjoyed my beginner’s guide to eToro and that it brings you some success in the online trading world. Please leave a comment if you have any questions and I will do my best to answer them. The internet is rich with resources to learn about this exciting endeavor. However, make sure you trust the sources and always stay safe in the markets.

eToro USA LLC; Virtual currencies are highly volatile. Your capital is at risk.