Disclosure: This post may contain affiliate links. If you click on a link I may make a small commission at no extra cost to you. You can read the full disclosure here.

Last Updated on May 22, 2022 by Chris Panteli

Improve Your Credit Score

So are you looking to borrow some money, buy a new car on finance or apply for that first time mortgage? Worried if you will be accepted for credit? Then you will surely be looking to find easy ways to improve your credit score. I got you covered.

It’s one thing to make money and save money, but sorting out your finances is just as important.

It’s worth noting that the UK has a slightly different system than in the US. Whereas most lenders in the US rely on a single credit scoring system – in the UK, lenders produce their own score with information from 3 credit rating agencies. However, much of the advice for improving your rating is also relevant across the pond.

- Improve Your Credit Score

- Why Would you Need an Easy Way to Improve your Credit Score?

- Clearing The Credit Card Debt

- What is a Credit Score?

- Before you get Started

- Step 1. Start Credit Building

- Step 2. Register to Vote

- Step 3. Do Not Apply For Too Much

- Step 4. Cut those Cards

- Step 5. Pay on Time

- Step 6. Ditch the Joint Account

- Step 7. Find Out If You’ve Been Flagged

- Conclusion

- 7 Easy Ways to Improve Your Credit Score

Why Would you Need an Easy Way to Improve your Credit Score?

When I left University I had credit card debt, spread across 2 cards and no savings or means of clearing them. Fortunately, the free hotel that was my parent’s house welcomed me home. Within a couple of weeks, I also landed a job.

The debt I had accrued was by no means inconsequential and had put me into a very stressful situation. I was eager to rectify this, so I made a plan.

Knowing that the interest-free period on both my cards would expire within months had me scared. My party days were now behind me, and the last thing I wanted in this new fangled world was debt. I was also acutely aware that making late payments, or worst, missed payments would destroy my credit score.

So before I could start thinking about ways to improve my credit score, I first needed a plan to prevent it from getting any worst. (I had made late payments and gone overdrawn whilst at University). What? I was 18, you only live once and all that.

I’m happy to say that after a lot of hard work, a vigorous savings plan and a massive reduction in alcohol consumption, it paid off. Well, I paid it off. All of it.

Clearing The Credit Card Debt

So, now I had managed to reset myself back to zero, I needed to know the extent of the damage. I signed up for a FREE credit score service (Experian), plugged in some information and waited for the results.

To no surprise, it wasn’t good. The report is quite comprehensive but is also surmised with a colourful rainbow rating graphic. The possible results span across 5 headings, which include excellent, good, fair, poor and very poor.

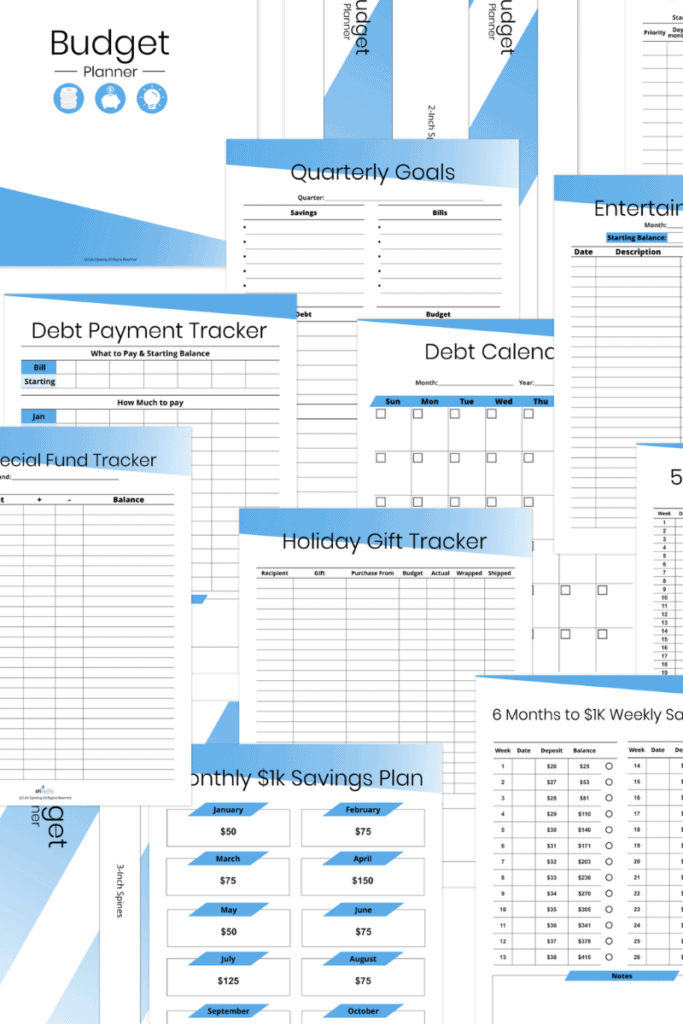

Beautiful 165 Page Budget Planner Printable

Do you feel overwhelmed when it comes to organizing your finances? With this incredible 165 Page Budget Planner Printable you can take back control of your money, keep on top of your budget and totally rock your finances; stress-free!

I was poor, not the worst possible outcome, but not far off. So I had my work cut out and I needed a plan. That’s why I’m sharing with you my 7 easy ways to improve your credit score.

What is a Credit Score?

A credit score is a means of determining your worthiness of being lent money. For lenders, they wish to know the likelihood of them getting back what they have loaned you.

In the UK, individual lenders determine your credit score using the information you have provided on your application – as well as your credit report produced by one of 3 credit agencies.

The exact criteria individual lenders use is not publicly known. However, it is possible to find the scores assigned by the credit agencies with the reports they hold on file for us.

The higher the score, the better, and the greater the chance of being accepted for the credit applied for. Also, perhaps somewhat counterintuitively, people with a better credit history are more eligible for better rates.

Meaning, those that struggled with managing credit before, often have higher repayments for credit extended in the future.

All is not lost though, as it is very much possible to improve one’s credit score over time. All that’s needed is some forward planning and a little patience. So let’s delve straight into 7 Ways to Improve your Credit Score.

Before you get Started

This may seem obvious, but to formulate a plan of attack you must first get your hands on that vital information – your credit file. I recommend using Experian – it’s free, easy, and they don’t bombard you with sales emails after signup.

Remember, this is just an agency credit file report, and is based on information they have collected on you. So, if you use a different service for a report compiled by a different agency, the score will be different.

Generally, the differences will be negligible, and the overall score you get will be a good representation of how lenders will perceive you as a borrower.

Check the Report

The important thing to do now is to check through the report. Sometimes, information collected can be inaccurate, and this could be having a detrimental effect on your rating. If you spot any inaccuracies, jot them down and inform the agency you did the check with.

So, if you’re reading this then you probably already know your credit rating isn’t in great shape. Subsequently, this may now be confirmed following the report you have looked through.

However, don’t panic, it’s time now to hike that credit rating number up through to the stratosphere. If I could do it, then so can you. It’s actually quite easy with these 7 Ways to Improve your Credit Score.

Step 1. Start Credit Building

The best thing you can do to increase your credit rating is to borrow on credit – and PAY IT BACK. This starts to build your credit history in a way that will satisfy lenders. Admittedly, this option is better suited to those without any credit history whatsoever (recent adults or those or have never borrowed).

However, even for those with a bad credit score can take advantage of this method.

Your credit history is made up of a number of elements, but chief among them is your proven ability to make regular repayments, on time and in full. For this reason, you should try and take a small amount of credit with low monthly repayments – and pay it back on time, and in full.

There are a number of options available for this exact purpose, and they’re called Credit Builder Cards. The only problem with this type of financial product is they are expensive. You will typically pay much higher interest rates, but don’t forget the purpose is to build some credit history to ultimately increase your score.

A great tip is to borrow a small amount and pay it back over a few months. You can find and compare some Credit Builder Cards here.

Step 2. Register to Vote

This one is simple and takes about five minutes to do online at https://www.gov.uk/register-to-vote. Registering to vote and therefore placing yourself on the electoral roll allows lenders to confirm your identity.

It’s actually quite difficult to get credit if you are not registered to vote – and for such a simple task to do, it really is a no brainer.

Remember, your credit score is a reflection of your ability to receive credit by way of lender approval. Once registered to vote, your identity can be confirmed and this increases your chances of approval. Therefore, your credit score will improve.

Concerned about privacy? There are two versions of the electoral register – the full register and the open register. The open register holds your information but can also be sold.

You can opt-out of the open register and it does not affect your voting rights – it just protects your personal information.

Step 3. Do Not Apply For Too Much

Applying for credit is another important factor in determining your credit score. Simply not making too many credit applications is a really easy way to improve your credit score.

When you apply for credit it leaves what’s called a hard enquiry on your file. If you have never received credit before, then a couple of applications in short succession should not have too much of an impact.

However, If you already have a number of lines of credit, then making too many applications in short succession will send bad signals to potential lenders. This will have a detrimental impact on your credit score.

Therefore, your score has a greater chance of improving by limiting your number of applications and making use of the credit you already have.

Step 4. Cut those Cards

This one also has a slight therapeutic effect associated with it. But don’t go reaching for those scissors just yet though, first a couple of things to ensure.

If you have unused credit cards it is worth considering giving them the snip – by which I mean following the correct procedure to close them down. In the eyes of lenders, having too many lines of credit may show signs of reliance on borrowing. Therefore, cancelling credit cards you no longer use may improve your score and chances of borrowing more in the future.

It is worth noting, however, that having more than one card can show lenders your ability to manage credit. Also, lenders take into account something called credit utilisation – a figure they like to see bellow 25%.

If you have £10,000 available credit and you’re using £5,000 of it, your credit utilisation is 50%. If you then cancel a card with £5,000 available, you are then left with £5000 credit – of which you are using all available – 100%. Therefore, your credit utilisation has increased, which will negatively affect your credit score.

My advice would be to only cancel cards when you are no longer using any available credit. This is exactly what I did when I cleared my two cards after University. All credit owed was paid back, no credit was being used, I was back to 0 and the scissors came out. Boy, that felt good.

Step 5. Pay on Time

Possibly the most obvious way to improve your credit score is to pay any debt off in time and where possible, in full. This is obviously so much easier said than done, and could quite possibly be the reason your in debt in the first place.

The reason I had 2 credit cards maxed out at University is that I was living like a typical student, beyond my means and irresponsibly. The debt got bigger and my situation remained the same. I had no means to pay and continued to borrow. This snowballed into a difficult and stressful situation that required the power of hindsight to be avoided in the future.

Paying on time and in full is the easiest way to show to lenders that you can successfully manage credit. This will positively affect your credit score.

You should aim to clear the full outstanding balance on any credit cards in full and on time at the end of each month. This is best practice for improving your credit score. If this isn’t possible for a particular reason then make sure you pay at least the minimum payment. Under no circumstance should you miss a payment.

Demonstrating this prudent behaviour over a sustained period of time will get you the results you have been after.

Step 6. Ditch the Joint Account

There could be a simple reason you have a bad credit score – and a simple fix to improve it. If you have previously held or still hold a joint account (maybe with an ex-partner), then your score will incorporate their financial behaviour.

This is known as a financial association and ex-partners bad financial habits will negatively affect your credit score.

Breakups are very difficult, both emotionally and financially. It is vital though that looking after your financial wellbeing is part of your post break up plan. I split with my fiancé of 7 years and the finances were admittedly last on the list. However, it is such an important part of life – and I am so glad I finally got around to sorting it out.

Ending the financial association you have can be easily completed with two simple steps. Firstly, close the joint accounts you have or convert then to individual accounts. Secondly, contact the credit reference agencies and inform them of the change.

Step 7. Find Out If You’ve Been Flagged

The final step to improve your credit score is checking if you have been flagged for fraud (incorrectly of course). The National Hunter database is a fraud prevention service. The organisation is concerned with the prevention of application fraud within the banking, finance and insurance industry; and to protect victims of fraud.

If you have been mistakenly added to this database for application fraud then you will find it impossible to get credit. The information held is shared with the credit agencies and exists to prevent further fraudulent applications.

You can check what information is held on you by visiting this website and completing a form. If you have been added to the database mistakenly you will need to raise a complaint.

A simple mistake could be the reason for a poor credit rating, and simply following the procedures outlined, fixed within weeks.

Conclusion

So there you have it, 7 Easy Ways to Improve your Credit Score. You can get started straight away. Remember, first you need to get hold of your credit report from a credit reference agency. I suggest you use Experian, it’s simple to do and the report is easy to understand.

Once you have your report check through it and make sure there aren’t any mistakes. If there are, inform the agency from which you received the report.

Then make your way through the list and watch as your credit score goes through the roof. Simple, right?

If you have had success with these steps please let me know. It would be great to see how much improvement some of you guys are able to achieve.

7 Easy Ways to Improve Your Credit Score