Disclosure: This post may contain affiliate links. If you click on a link I may make a small commission at no extra cost to you. You can read the full disclosure here.

Last Updated on October 23, 2022 by Chris Panteli

What Is A Good Salary For A Single Person?

According to recent studies, an estimated 63% of Americans live paycheck to paycheck. Perhaps you are one of them?

No doubt you hope to earn enough to live comfortably sooner rather than later!

What is a good salary for a single person living in the United States?

A good salary will look different to everyone. After all, someone living in New York or San Francisco will need a much higher salary than someone living in South Carolina!

By understanding the average salary needed to live comfortably, hopefully, you can achieve financial freedom.

What Is a Good Salary for a Single Person?

Studies like this one by the National Academy of Sciences (NAS) show that up to a point money does buy happiness.

Think about it this way. If you don’t have to worry about paying rent, affording groceries, and having enough money for some treats or luxuries each month, then your happiness levels are going to improve!

Data shows that low earnings contribute to feelings of poor self-worth. However, once earnings reach an amount enough to meet basic needs plus more, people are much happier! Interestingly, higher earners of over $75,000 don’t see any further boost in happiness.

The median household income in the US stands at $67.521. This is the median income for all households regardless of how many people live there.

What about the average income for a single person in the US?

Data shows the median annual salary for a single person is $35,977. Now that’s some way short of the $75,000 cited by the NAS as the optimal amount to earn to be happy. However, a lot depends on circumstances.

A single person living in North Carolina may be comfortable on $35,977, if you live in Washington DC earning the median salary may not be enough to cover living expenses.

According to the Bureau of Labor Statistics, a good salary for a single person to aim for is an annual income of $51,480. If you earn less don’t worry, it may be enough for you depending on your location, age, and other factors.

Which Careers Pay Well?

Earning at least $50,000 a year is a livable wage in most locations. If you live in a high cost of living area, then earnings of $75,000 or more would be advantageous. Of course, no matter where you live it’s always awesome to earn more!

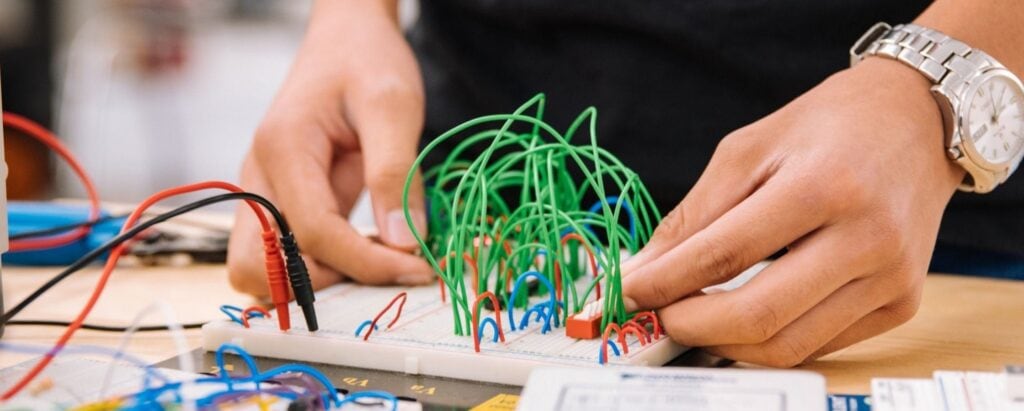

Choosing the right career will determine your earnings both now and in the future.

STEM careers are often the highest-paid opportunities in most areas. The US Bureau of Labor Statistics reports the median earnings for a STEM worker in 2020 was $89,780. This is nicely above the reported amount needed for financial happiness.

As you can see, working in a STEM career pays on average more than double non-STEM occupations. A higher salary like this is well above the national average meaning you can live comfortably. Especially if you are single!

A STEM career isn’t for everyone. The good news is that there are lots of other careers that have a median salary exceeding the average earning potential of a minimum wage job.

Construction, nursing, and sales are examples of non-STEM careers that pay a salary well above the national average. In many cases, you won’t need a college degree either! Not having the burden of a student loan means you can work towards financial freedom much faster.

How Much Should You Be Earning?

I think it’s fair to say you want to earn as much as possible! Depending on your career, your earnings may not be reaching the amount needed to be considered a middle-class income.

Your salary will be the primary factor in your financial stability. Keep in mind that your net income is a better way to measure how wealthy you are.

Net income is the amount of money you’ve got left after every expense has been deducted. Income tax, any housing cost like rent or utilities, and other expenses can be taken off your monthly salary to determine your net income.

Using this data you can work out if your salary is good or not.

For example, person A earns $60,000 a year and person B earns $150,000 a year. Person B is better off right?

Actually, no! Person B has a lot of expenses as they live in San Jose, California. Thanks to the higher than average cost of living in San Jose, Person B has a much lower net income than Person A.

The end result is that in this example $60,000 a year is a good salary.

When comparing salaries yours may be lower than the amount offered in other industries. Yet, depending on where you live and your expenses, you could be considered wealthier!

5 Tips To Supercharge Your Finances

If your salary is less than the national average or just above don’t worry. There are some simple steps you can take to vastly improve your finances.

Implementing these ideas can mean your net income becomes even higher!

The Importance of a Budget

Creating a proper budget is a key step towards financial success. Accounting for every cent of spending makes it easier to see where savings can be made.

Savings in your monthly budget frees up money to be used for other things. Debts can be paid off sooner, savings and investments can grow quicker, and you have more money to buy luxuries!

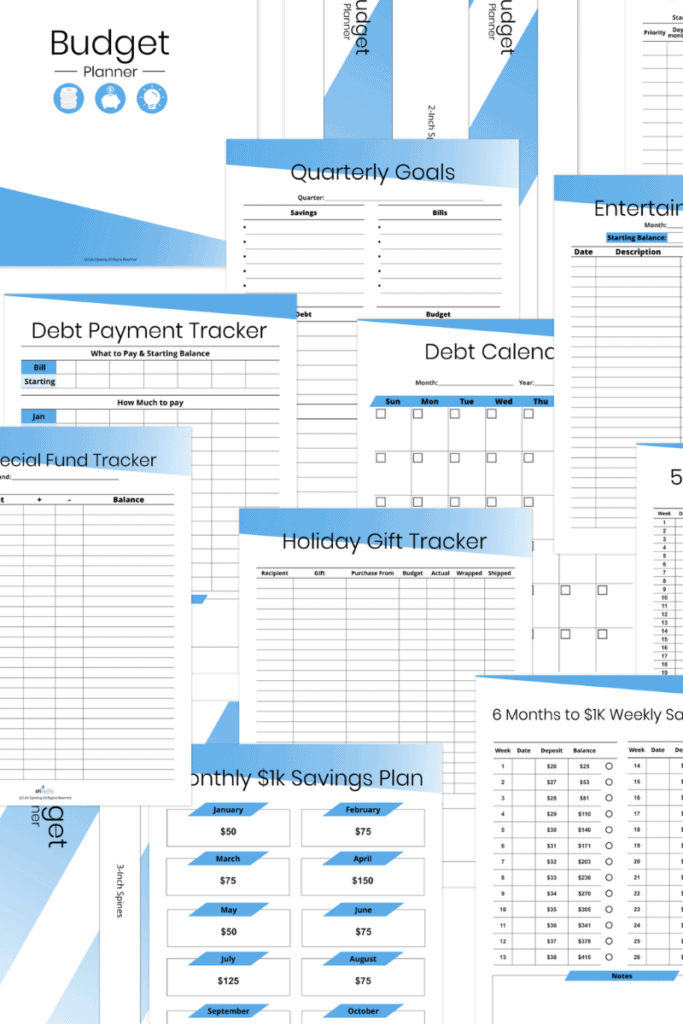

Beautiful 165 Page Budget Planner Printable

Do you feel overwhelmed when it comes to organizing your finances? With this incredible 165 Page Budget Planner Printable you can take back control of your money, keep on top of your budget and totally rock your finances; stress-free!

Make sure to regularly review your budget to make sure it meets your needs. Checking your spending often is the best way to stop problematic spending before it starts.

Build an Emergency Fund

Depending on who you ask there are differing schools of thought about how much an emergency fund should be. Saving enough money to cover 3-6 months’ worth of expenses is often cited.

Why is an emergency fund important?

Did you know that 25% of Americans have no savings at all? That means not being able to afford an unexpected expense like a job loss, car repairs, or medical costs not covered by health insurance.

By building an emergency fund you can handle financial shocks. That means you can still pay all your normal bills without going into debt.

Reduce Expenses

It might seem obvious to say reduce expenses and you’ll be better off. Of course, you will be better off by spending less!

Start by making a budget and tracking spending. Now you see where your money is going you can decide what to reduce.

Do you eat out a lot or buy lunch on the go? Make a plan to only eat out once a week and start making lunches at home. When grocery shopping, always shop with a list and try cheaper brands. Usually, they are just as tasty!

$5 Meal Plan

Let the team at $5 Meal Plan save you money and time by planning your food for the week!

Check how many subscriptions you have. Often we start paying a few dollars a month not thinking about it for things like gym membership, streaming services, or magazines. If you have a lot of subscriptions you could be spending hundreds of dollars per year!

Cancel anything you no longer need. One tip is to rotate streaming services by signing up each month, watching the content you want, then canceling and joining the next one.

By taking action to reduce expenses and actively monitoring spending using a budget you will save money every month. That means a higher net income and more money available for other things!

Start a Side Hustle

Starting a side hustle to boost your income is a tried and trusted method. You can fit a side hustle around existing commitments which makes it an easier way to earn than taking a second job!

Consider how much spare time you have and your skillset. Based on this you can figure out the best side hustle for you. Try to keep some free time though as it’s important for your mental and physical health to take time out to recharge.

There are lots of side hustles you could try. Blogging, freelancing, investing in real estate, and proofreading can all be done online from the comfort of your own home.

Learn How To Start Your Own Proofreading Business

Alicia made $1,100 the first month after she graduated from one of Caitlin’s proofreading courses – even while she was still working full-time at her retail banking job!

If you want a more active side hustle, then you could be a dog walker, delivery driver, or flea market flipper.

These are just a few ideas of the many side hustles you could do. Even something as simple as selling unwanted clothes and other items can be a good way to earn extra cash each month.

Don’t forget that any earnings from a side hustle must be declared as taxable income. Combining these earnings with your normal earnings should mean your total annual salary range is classed as a comfortable living wage.

Learn the Art of Frugality

Let’s get one thing straight first. Being frugal doesn’t mean ‘never’ spending money. Frugality is about being mindful of every cent that is spent.

Ask yourself this question before spending a dollar:

Can I do this for free or cheaper?

Try repairing clothes or shopping for them at thrift stores rather than buying new ones every time.

Gadgets, appliances, and other household things break down. Quite often we throw them away and buy a new one without a second thought. Instead, try to repair them or replace them with a refurbished second-hand item.

Budgeting, meal planning, and only buying what you need are other steps you can take to become more frugal.

What Is a Good Salary for a Single Person to Live Comfortably?

A good salary to live comfortably will vary wildly depending on your circumstances. Someone living in New Hampshire will need more than a person living in South Carolina.

Net income is a much better way to calculate if your salary is good or not.

Remember, studies show that $75,000 per year is the optimum salary for most to feel happier.

If you earn near that amount, there is a good chance you are more financially secure. Financial security means fewer things to worry about!

What if your salary is less than $75,000?

Most people don’t earn anywhere near that amount. Indeed, the average salary in the United States is a little over $35,000. If this is you, don’t panic. Try to move into a higher-paying field if that’s an option.

Following the other steps including budgeting, starting a side hustle, and reducing expenses is another excellent way to achieve financial security.

FAQs

What is a good salary for a married person?

According to the United States Census Bureau, the median household income in 2018 was $63,179. If your household income is around this figure or higher, then you are earning a good salary.

I’m starting a family, how much do I need to earn to live comfortably?

Whether you are single, a married couple, or a family including children, the data is clear. Earning $75,000 or more a year is ideal for financial happiness.

I’m struggling, can the government help me?

You may be eligible for help depending on your individual circumstances. Check the Supplemental Security Income page administered by the US Social Security Administration. This federal program can provide financial aid in certain circumstances.