Disclosure: This post may contain affiliate links. If you click on a link I may make a small commission at no extra cost to you. You can read the full disclosure here.

Last Updated on October 23, 2022 by Chris Panteli

Tips For Living With Very Little Money

Living paycheck to paycheck is a struggle millions in the United States are living through right now.

You may be searching the sofa right now hoping to find some loose change just to buy a pack of ramen and not starve. Most of us have been there. Especially in our struggling student days when the bank account always seemed to be empty.

On top of that, nothing makes struggling financially worse, than seeing others enjoying success. Seeing friends or family buying cars or homes can give you a twinge of jealousy. That’s a normal feeling. We’re only human after all.

When you’re living on very little money it feels like there’s no end in sight. You may have plans to earn more in the future, but right now you need money to survive.

These tips for living with very little money have been put together to show you some light at the end of the tunnel. Simple lifestyle changes that anyone can do can help you survive right now.

- Tips For Living With Very Little Money

- How Easy Is It To Live On Very Little Money

- 23 Tips For Living With Very Little Money

- 1. Make A Budget

- 2. Downsize

- 3. Buy Second-Hand Clothing

- 4. Eat Out Less

- 5. Use The 30-Day Rule

- 6. Cut Unnecessary Subscriptions

- 7. Join The Local Library

- 8. Change How You Commute

- 9. Declutter

- 10. Grow Your Own Veg

- 11. Quit Smoking

- 12. Cut The Credit Cards Up

- 13. Learn DIY

- 14. Pay Off Debts

- 15. Conserve Energy And Water

- 16. Work From Home

- 17. Reduce The Grocery Bill

- 18. Learn To Say No

- 19. Exercise Outside

- 20. Start An Emergency Fund

- 21. Reduce Your Bills

- 22. Start A Side Hustle

- 23. Make Your Own Stuff

- What Does Living Frugally Mean

- FAQs

- Tips For Living With Very Little Money

How Easy Is It To Live On Very Little Money

Living on very little money isn’t easy. It’s especially hard if you live in an area with a high cost of living.

Having said that, you can make living on very little money easier by making a plan to achieve financial freedom.

Your plan will be unique to you as your needs will be different from another person’s. To create a plan, you need to ask yourself one question, what are your goals?

Depending on your answer you can now figure out how to get there.

For example, if you want to get rich, then your plan needs to include how to earn more, spend less, and build wealth.

Whatever financial goal you want to achieve, these tips for living with very little money will help you get started.

23 Tips For Living With Very Little Money

These tips for living with very little money will cost you nothing to do. If you can make some or all these changes it could mean you have a little less to worry about and a little more money to spend!

1. Make A Budget

I would argue that making a budget is the most important step to take toward becoming financially independent.

Knowing every cent that goes in and out is essential for both short-term and long-term planning.

However, you may feel differently. Especially if you can barely pay all the bills right now. Some months you may not even have enough money to cover everything.

If you’re in that situation right now, then a tight budget is even more important.

A budget won’t magically help you earn more money. But it can help you see problematic spending sooner. Using the budget to free up money by cutting out an unnecessary expense is almost as helpful as a pay rise.

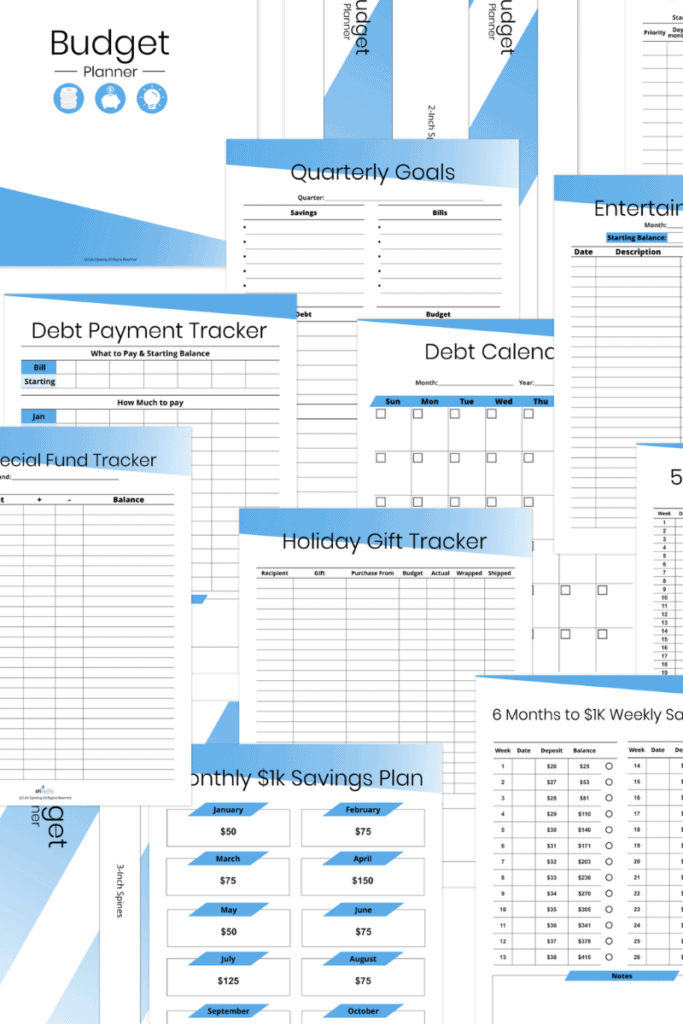

Beautiful 165 Page Budget Planner Printable

Do you feel overwhelmed when it comes to organizing your finances? With this incredible 165 Page Budget Planner Printable you can take back control of your money, keep on top of your budget and totally rock your finances; stress-free!

Taking ownership of your personal finance will help you become financially savvy. Although it may still be a long road until you become financially successful, that first budget is vitally important.

2. Downsize

Downsizing is one great way to cut costs. What are your biggest expenses? Housing, running a car, and food takes up the biggest chunk of most people’s budget.

Car

If you have multiple cars in the household, could you get rid of one or more of them?

Selling a car will save you money on insurance, gas, and maintenance costs. Plus, you might gain money from the car sale.

Depending on where you live, having a car may be essential. Especially if you live in a rural location. However, could you downsize to a cheaper car?

A smaller car is usually cheaper to run. If you can still do what you need to, then it’s worth considering.

Move House

Ok, this is a big suggestion. Moving house isn’t a decision you can take lightly.

Consider your options though. Could you move to a cheaper area? Would a smaller house be a possibility?

Moving house could save you thousands of dollars every year. It’s worth investigating to find out if it’s an option for you.

Recommended: Creative Ways to Buy Your Parents’ House

3. Buy Second-Hand Clothing

Buying cheap clothes isn’t always cost-effective as they often need replacing sooner. Buying good quality clothes that last a long time means saving money in the long term. The problem is that buying quality clothes can get expensive.

The solution is to buy second-hand clothing. You can get high-end clothing for cheap. Plus, your wardrobe should last longer.

Finding second-hand clothing is easy. Check out your local thrift store or find yard sales to visit in your neighborhood.

Online options are plentiful too. People often give stuff away for free, including clothes. Try your local Facebook marketplace and Craigslist to find bargains or even free clothes and local deals apps.

You could also head to eBay. Lots of sellers on eBay sell bags of clothing cheap. This is a great way to find cheap kids’ clothes too.

Other ways to save money on clothing include washing less, line drying if you can, and only buying what you need.

Here’s another great money-saving tip. Don’t buy clothes you will only wear once, rent them instead! If you need to attend a wedding, important work event, or a party, then you can rent clothes for these occasions. This is much cheaper than buying something you will only wear once.

4. Eat Out Less

Eating out is easily one of the biggest expenses in every budget. Grabbing lunch at work and going out to eat a few nights a week can add up to thousands of dollars a year.

No one is saying you should never go out. Everyone should socialize and treat themselves on occasion.

The goal here is to do it less. If you buy lunch every day, could you cut that down to once a week? The rest of the time you make your own lunch and utilize cheaper food options.

If you eat out a few nights a week, could you cut this down? Instead of eating out, you could you arrange meals at home? Perhaps you and your friends could take turns to host. That way you are still spending time together, but spending less money.

5. Use The 30-Day Rule

The 30-day rule is one of my top money-saving tips. When you are considering buying something nonessential, then don’t buy it immediately.

Instead, wait 30 days. If at the end of the 30 days you still want the item, then go ahead and buy it.

By following this rule, you will find that most of the time you don’t go ahead with the purchase. This means you can use the money for something more important.

How can you decide what’s essential or nonessential?

Essential spending would include food, housing costs, and medicine. Things you must buy.

Nonessential is anything you could live without. A new video game, designer shoes, or expensive jewelry are examples of nonessential items.

6. Cut Unnecessary Subscriptions

Individual subscriptions often cost just a few dollars a month. That makes them easy to forget about.

If you’ve made a detailed budget, you should be able to see exactly how much you spend over a month on subscriptions. Add it up now, I bet the answer will shock you!

Let’s say you subscribe to your favorite magazine, the gym, Spotify, Netflix, Xbox Game Pass, Amazon Prime, and Microsoft 365.

Those subscriptions could be over $100 a month!

Chances are you subscribe to much more. Most of us sign up for multiple streaming services.

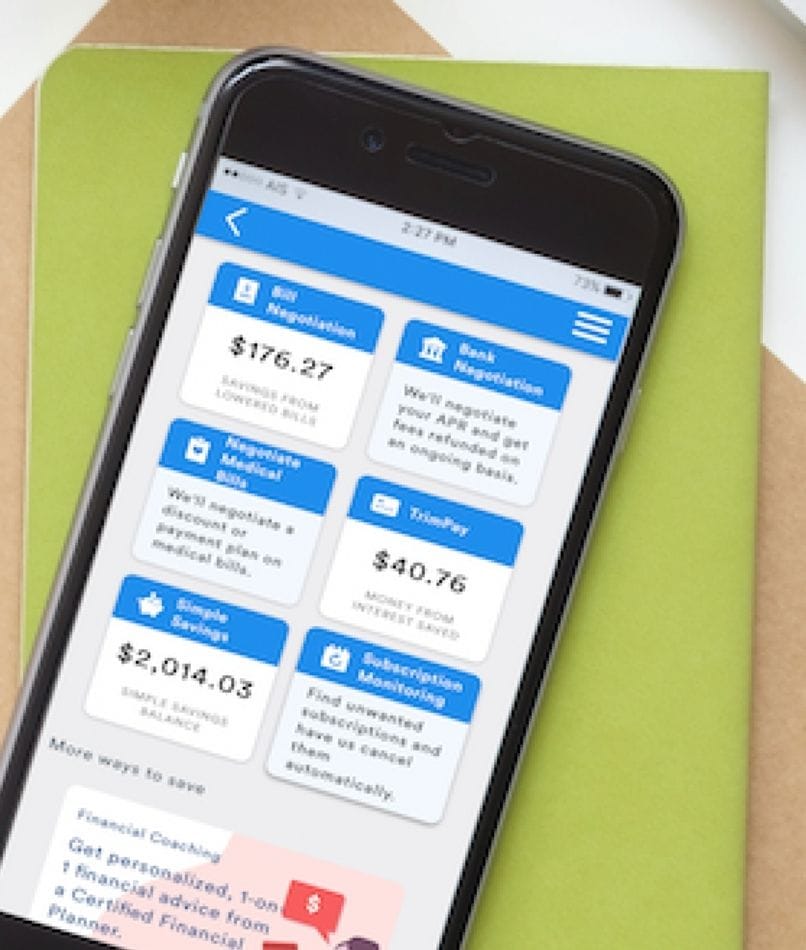

Trim

Ready to save?

Let Trim do the work for you:

✅ Negotiates Your Bills

✅ Finds & Cancels Subscriptions

✅ Negotiates Medical Bills

✅ Lower APRs and Bank Fees

Significant savings can be made by cutting down subscriptions. Think about what you really need and cancel everything else.

If you really want to revolutionize your spending habits, then you could cut other things like cable and even your cell phone.

7. Join The Local Library

The local library is a goldmine of resources. Whether you want to entertain or educate yourself, the library has got you covered.

Books are amazing, but you can get so much more from your library. Most libraries offer DVDs, magazines, music, and even video games.

Libraries are free to use, and you could save a fortune by not having to buy things.

Thanks to the Libby app, you don’t even have to go to the library. You can loan books via your device to read at your leisure.

8. Change How You Commute

Commuting can be expensive. Depending on where you live you might be able to save money.

Could you bike to work? You could still keep your car, but use it less.

Is carpooling or public transport an option for you? Carpooling means you and your colleagues can all save money. Make sure to agree upfront on how much everyone will contribute to gas.

Walking will always be the cheapest way to travel. It’s not practical for everyone, especially if you live in a rural location. Even if you walk once or twice a week instead of driving, this could mean significant savings.

All these ideas can save you money, help the environment, and boost your health. Give them a go when you can.

9. Declutter

Decluttering your home not only helps save money, but you can make some money too.

When you live in a cluttered home it’s easy to lose things. That means you might be buying stuff you don’t need to!

Decluttr is one platform that lets you sell your old tech stuff easily. Cell phones, gaming consoles, and tablets are a few of the things you can sell.

10. Grow Your Own Veg

Growing your own veg is a great way to cut the food bill. You also get to eat delicious fresh veg every day. Tomatoes, carrots, lettuce, herbs, and peppers are a few things you can grow yourself.

Don’t worry you can still grow your own veg even if you don’t have much outside space or live in an apartment. Consider growing microgreens.

Microgreens can be grown anywhere. Even a windowsill is enough space to grow your own microgreens.

If you grow your own veg and have a surplus, then you could sell some of it. This means extra cash for you and others can save money.

11. Quit Smoking

Smoking is like literally burning money. Plus, it’s extremely bad for your health.

If you won’t quit smoking for health reasons, perhaps you would quit in order to protect your bank balance.

Let’s say you buy a pack of cigarettes every day. The average pack costs $8.00, that’s a mammoth $2,920 per year if you buy a pack a day.

Think of what you could do with that money? Saving for a house, going on a dream vacation to New York, or treating yourself to that car you always wanted is all possible if you quit smoking.

12. Cut The Credit Cards Up

Credit cards are one of life’s necessary evils. To get credit including a mortgage you need a good credit score and using a credit card helps with that.

In an emergency, a credit card is also a useful thing to have.

The downside is if you’re an impulsive spender, or you can only afford to pay the minimum payment every month, then you are trapped in credit card debt. Even small credit card debts can take decades to pay off.

Cutting up the credit cards can help prevent you from sliding further into debt. If you can trust yourself not to use it, then keep one for genuine emergencies. Otherwise, cut those cards up!

13. Learn DIY

DIY can be a game-changer for your finances. No more having to replace broken stuff. You don’t need to fork out hundreds of dollars for a tradesman to repair things.

If one of your parents was a DIY enthusiast, hopefully, they passed those skills on.

For anyone with zero DIY knowledge, you can easily learn thanks to platforms like YouTube. Any project big or small will have an online tutorial.

Tap twice to load then open Video...

Home repairs, car maintenance, fixing broken furniture, and decorating are all topics you can teach yourself.

14. Pay Off Debts

Debt is a massive strain on finances. High-interest debts can really impact your finances and your mental health. Credit cards, loans, mortgages, and student loan repayments can take a big chunk of your money every month.

Devising a strategy to pay off your debts is essential to becoming financially independent.

Two great methods to help reduce debt that you could try are the avalanche method or the snowball method.

The avalanche debt method is when you target the debt with the highest interest first. You still pay your minimum payments for everything else, but any extra cash you have goes towards that debt with the highest interest rate. Once that’s paid off, you then start on the next highest and continue like this until you are debt-free.

Alternatively, there is the snowball method that many people have used successfully to become debt-free. List all your debts in order of amount owed, then concentrate on paying off the smallest debt first. Remember you still need to pay all other minimum payments as normal to avoid a default.

15. Conserve Energy And Water

Energy and water costs are unavoidable, but you can take steps to reduce the bills.

Make sure you only use what you need and switch things off when not in use.

Always try to find cheaper rates if possible. Some providers offer discounts for certain payment methods. Look for all the help you can get with energy bills and take it.

16. Work From Home

Working from home could save you a fortune. You wouldn’t need to pay for gas, lunch out, or clothes.

Depending on your job working from home might not be an option. However, if your job could be done from home, then why not ask your boss.

17. Reduce The Grocery Bill

Reducing the grocery bill doesn’t mean skipping meals or eating things you don’t enjoy. Instead, you can save cash and still eat well by making a plan.

Grocery Shopping

To save money on grocery shopping, always make a list to take with you to the grocery store. That way you only buy what you need and won’t forget anything.

Try switching to cheaper brands as there is often very little difference.

Buying in bulk can be a big money saver. Rice, pasta, tinned food, toilet paper, and more can all be bought in bulk. They also last a long time in your cupboards. Stores like Dollar Tree can be great places to find everything you need to fill your food cupboard at cheap prices.

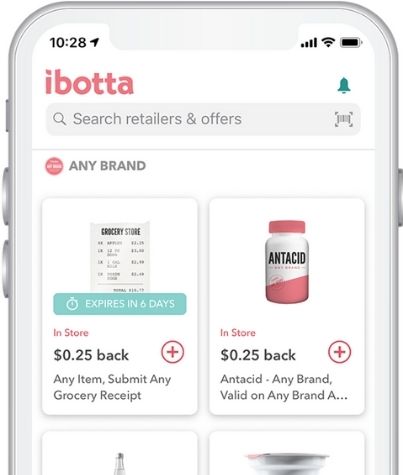

Ibotta

Get cashback on everyday purchases, up to $20 in welcome bonuses, payment as soon as your order is confirmed, and all 100% FREE.

You should also sign up to reward sites that offer cashback, discounts, and sometimes a gift card. Inbox Dollars, Swagbucks, and Ibotta are three great platforms to try. Plus, they offer other ways to earn extra income like playing games or completing surveys.

Batch Cooking

Batch cooking is a brilliant way to save time and money.

$5 Meal Plan

Let the team at $5 Meal Plan save you money and time by planning your food for the week!

After a long day at work, it’s easy to buy fast food or visit a restaurant. By doing a meal plan, meal prep, and cooking your meals in advance you won’t have that temptation. Instead, you can heat up your delicious home-cooked meal when you get home.

Cut Out The Junk

Junk food, sweets, alcohol, and microwave meals all taste great. The downside is these products aren’t healthy and add a lot to the grocery bill.

Cutting these things from your diet completely would be ideal for both your bank balance and your waistline!

If you don’t want to do that, then try limiting how much you have each week.

Drink More Water

Thirst is often mistaken for hunger as the body gives you similar signals.

When you feel like snacking, have a glass of water first. If you still feel hungry after about 20 minutes, then eat something. Most of the time though that hunger feeling will go.

Drinking water instead of sodas will also save you some money.

18. Learn To Say No

It feels bad saying no to people, especially when it’s people you care about. However, learning to say no can be a big money saver.

Think about all the times you’ve helped people out or attended events you weren’t keen on. All these things cost you time and money.

You can save yourself some cash by saying no to the things you don’t want to do.

Bestselling author Penny Reid wrote in her novel Beard in Mind:

‘Don’t set yourself on fire to keep others warm‘

Keep that quote at the forefront of your mind when deciding to say yes or no.

19. Exercise Outside

Gym memberships are expensive and let’s be honest, most of us hardly use them.

Yet, free exercise is right outside. Walking, jogging, and running can all be done for free.

If going outside sounds uncomfortable, then why not try working out at home?

You don’t even need special equipment. Simply fire up YouTube and find exercise channels that suit you. Now get fit for free!

20. Start An Emergency Fund

What are you going to do when you have an unexpected bill?

Most can’t cover unexpected bills of $400. Medical emergencies, car repairs, or a job loss can strike anytime.

For this reason, building an emergency fund is a must.

By having an emergency fund, you are able to cover unexpected bills. That means you can still pay your usual bills and you don’t need to go into debt.

You may not be able to save much right now. However, anything you add to your savings account no matter how small will help you reach your savings goal.

21. Reduce Your Bills

Reducing your bills might seem like an obvious thing to say, but many people overlook this.

Bills may get discounted by switching to a different payment method. Some can be reduced by calling up and asking for a discount.

You can also cancel subscriptions, keep debt to a minimum, and spend less on entertainment.

By doing everything possible to reduce your bills you will be able to effectively live on very little money.

22. Start A Side Hustle

Starting a side hustle is one of the best things you can do when you are living on very little income. That’s because any extra money you can bring in can be the difference between eating or not.

If you earn enough, then you could pay off debts faster, build an emergency fund, or just treat yourself to a well-deserved night out.

When you hear people talk about starting side hustles you might be internally screaming ‘who has the time for that!’

That’s an understandable reaction. Working on a side hustle doesn’t have to mean giving up 100 hours a week and never sleeping again.

You might just do an hour a day answering surveys. Those extra few dollars a day could be all you need. Simple side hustles like answering surveys can be done while commuting to and from work!

A lot of side hustles take time to get started, but once established allow you to earn a passive income. Blogging, selling printables, and creating online courses for sale are great ideas for anyone wanting to earn passively.

There are thousands of things you can do on the side to earn money. Think about your skills and availability when deciding what to do. Side hustle ideas include:

- Freelancing

- eBay flipper

- Uber driver

- Delivery driver

- Mystery shopper

- Dog walker

- Flea market flipper

- Online tutor

- Sell handcrafted items

23. Make Your Own Stuff

Making your own stuff can be a huge money saver. Clothes, furniture, candles, and food are all examples of things you could make yourself.

You may need to spend some money buying tools, materials, and other equipment, but the long-term savings can make this worthwhile.

It’s also a good idea to check local groups online for items people are giving away. Many of these can be repurposed to make something else. Sometimes the items may be reusable and just need a little repair work. Keep an eye out for these bargains.

What Does Living Frugally Mean

Living frugally means focusing on achieving your financial goals and being mindful of every cent you spend.

Frugality does not mean that you never spend money or must deny yourself everything!

A frugal person will tell you the most essential frugal living idea is to save every cent possible. The first frugal living tip that everyone should follow is to track spending. Do this when you are making a budget to record every single expense. Once you know these details you can figure out your next actions to save money.

Budgeting, meal planning, couponing, and buying second-hand are all frugal living tips anyone can do.

You don’t have to switch to a frugal lifestyle if you don’t feel it’s right for you. However, by adopting as many frugal tips as possible, living with very little money will be much easier.

Recommended: 22 Awesome Low Stress Jobs After Retirement

FAQs

Is it possible to live with very little money?

Living with very little money is possible. Millions of Americans live on very little money each week. By implementing the tips in this guide, it will be easier to live on less. You may also find you have more to spend by making savings elsewhere.

Is living frugally a good idea?

Frugal living means you should always be spending less than you earn. That means you have more money to save, invest, and spend.

Deciding to live a frugal life means you need much less than before. If you want to retire early, travel more, or work less, then frugality could help you achieve those goals.