Disclosure: This post may contain affiliate links. If you click on a link I may make a small commission at no extra cost to you. You can read the full disclosure here.

Last Updated on October 23, 2022 by Chris Panteli

Ways To Save Money On A Tight Budget

Did you know there are lots of ways you can save money on a tight budget?

It might seem like an impossible task to increase your bank balance whilst you’re already financially strained. But if you approach this seemingly impossible task strategically, your savings will definitely grow.

Instead of thinking about your monthly contributions in whole dollar amounts, change your mindset to think in percentages. That way, no matter what your budget is, you can still set aside some money and put it towards your emergency fund or to growing your bank balance.

In recent years, Americans have been on average saving between 7% and 8% of their monthly income. Trying to save 7-8% of your monthly income is a lot more manageable than thinking

‘I need to save $500 a month’

And the best ways to make those percentages equate to a higher monthly dollar figure are:

- Increase your monthly take-home pay by making more money

- Reduce your monthly expenditure by saving more money

- Budget and stick to your plan over the long term

It really is all about getting organized and knowing how to squeeze every single nickel. Just because you’re on a tight budget, doesn’t mean you can’t cut down your expenses and have more money in your pocket at the end of each and every month.

How Can I Save Money?

It’s probably best to first define what we mean by a ‘tight budget’.

For many people, there is an extremely thin margin between the total household income and the total household expenditure. Typically, once all your monthly financial obligations are met, the remainder can be set aside for a savings pot. However, if there is only a small difference between these two key figures, one can describe that as being a ‘tight budget’.

Living on a tight budget is experienced by millions of Americans, and not just from low-income households. In fact, 78% of U.S. workers are living paycheck to paycheck and surprisingly, almost 1 in 10 workers making $100,000+ also live paycheck to paycheck.

It is therefore of paramount importance to fundamentally change the narrative.

In order to save more money, there must be an increased margin between total income and total expenditure. Once this is achieved, there will be a larger amount of residual income that can be carried over from month to month. And this income can be set aside and saved.

So how do you increase the margin between total income and total expenditure?

If we are to assume for argument’s sake that your income is fixed, at least in the short term, then logically the only way to achieve this is by reducing expenditure.

We must save money in order to be able to save more money!

So get the chainsaw ready and fired up, because we are about to chop down those expenses and leave no prisoners!

Budget Planner Printable For Tight Budget

There are some incredible free budgeting apps you can use to keep on top of your finances, including Mint, PocketGuard, and EveryDollar, but for some people (me included) nothing quite beats good old pen and paper!

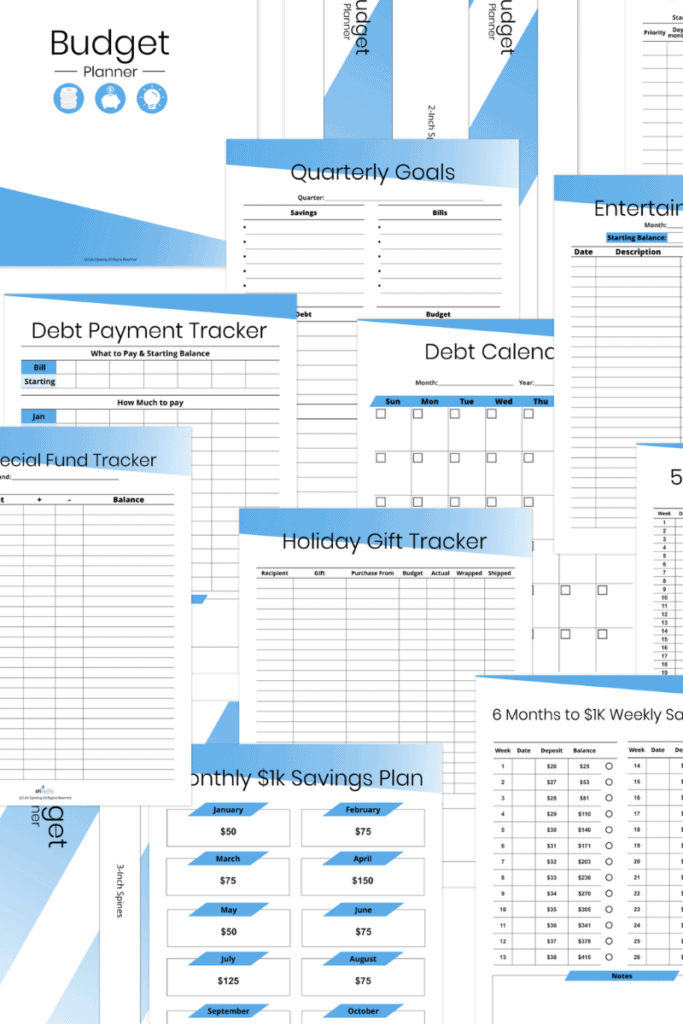

And you get my incredible 165-page budget planner, which includes:

- Goal setting pages

- Expense and subscription trackers

- Debt tracker and calendar

- Savings planners

- Monthly budget and expense worksheets

Beautiful 165 Page Budget Planner Printable

Do you feel overwhelmed when it comes to organizing your finances? With this incredible 165 Page Budget Planner Printable you can take back control of your money, keep on top of your budget and totally rock your finances; stress-free!

11 Ways To Save Money On A Tight Budget

So now you’ve got your pen and paper to the ready (or you’ve purchased the incredible LifeUpswing Budget Planner) it’s time to start saving some serious cash!

Remember, the best way to maximize the effects of this money-saving operation is to combine efforts and use multiple tactics in conjunction with each other.

When I was a “poor” student living in a rat-infested hall of residence, I was basically skint all of the time. However, I still needed to be able to save some cash for family birthday presents, minor expenses, and upcoming events. The only way I was able to do this was by working a late-night job, side hustling, and utilizing a number of the strategies outlined below.

I learned some amazing life lessons during my student days, and have carried the ethos of financial frugality and savviness into my later life and business.

So master the tactics now.

And when money is tight and income is low these tips and tricks will keep you in good stead for years to come.

Here are 11 Incredible Ways To Save Money On A Tight Budget:

1. Budget Properly

It may seem obvious to start out by stating how important a budget actually is when it comes to saving money. But it really is the foundational blueprint to good personal finance. And surprisingly, many Americans don’t have much money saved.

58% of Americans have less than $1,000 saved

And perhaps somewhat unsurprisingly, many Americans do not actively maintain a household budget.

Only 32% of US families maintain a household budget

You need to have a budget to be able to track all of your income and expenditure. It is going to be next to impossible to really save money if you don’t know where all your money is going. Running a household, with all of its moving parts, is very much like running a business. And to successfully manage the day-to-day operations of family life there needs to be some form of concrete organization and record keeping.

If you need to save money on a tight budget, then first of all make sure you actually have a budget!

Ok, ill be the first to admit that budgeting is not the most exciting activity one can engage in. In fact, the process itself can be difficult to begin due to fear of what it may reveal.

When I needed to clear my student credit card debt, I knew that the situation was bad. I also knew that in order to actually deal with the problem at hand I would have to face it head-on.

It’s like ripping off a band-aid.

Just pull the trigger, collate your finances, and start a budget. You will then have a clear view of your current financial situation, with all the income and expenses. And from there you can prioritize your debt repayment, monthly bills, and last but by no means least, your savings!

A budget does not need to be overly complicated or time-consuming. You just have to spend an afternoon gathering the information and sort through it. Either use my budget planner, a decent notepad, or a free app.

Tap twice to load then open Video...

Once your budget is organized, you can take a big sigh of relief and move on to the good stuff.

Making fundamental changes that will result in you having more money.

2. Negotiate Your Bills Automatically

The most consistent and necessary expense you will encounter is almost certainly your monthly bills. They are a necessary evil and must be paid to keep your house running smoothly.

If you’ve ever forgotten to pay a bill before, you’ll know how disrupting it can be.

But the thing about bills is you can often pay much less than you currently are. If you’ve locked in a deal price then this will often expire after the contract period and revert to a higher monthly amount. That is why it’s so important to stay on top of your bills, how much you are paying, and how much of a discount you could get.

This process of monitoring your bills is a lot easier when you have a budget, but still requires the regular task of negotiating prices down as and when the situation calls for it.

And this often puts people off.

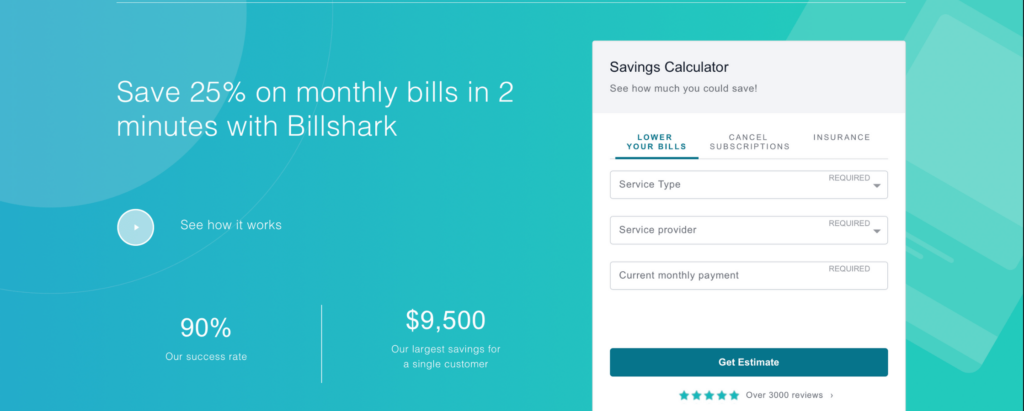

That’s why a service like Bill Shark is so useful. They will monitor your bill payments and subscriptions and automatically negotiate better prices for you. You simply pay 40% of what they manage to save, and if they don’t save you money, you don’t pay a cent!

Bill Shark can save you 25% on monthly bills in 2 minutes, and:

- They have a 90% success rate in saving money on bills

- Protect your data using 256-bit encryption (bank-level security)

- Largest saving of $9500 for a single customer

Try Bill Shark now and save 25% on your monthly bills. Even if you’re on a tight budget, that’s a significant amount of money to keep in your wallet.

According to a study from the Bureau of Labor Statistics, in 2018 the average household income was $78,635, with the average expenditure being $61,224. Incredibly, that means most Americans are spending nearly 80% of their total income.

So to avoid being just another financial statistic, cut down those expenses and let Bill Shark save you money on monthly bills.

3. Cut Cable TV

I’ve got some news for you TV-loving folk out there, you could be spending way more money than you need to be. Long gone are the days where you need to pay for an expensive cable TV package.

In fact, you’re probably missing out on loads of incredible content by not switching over to a streaming service. And you could save a bucket load of cash in the process!

According to the Leichtman Research Group, 78% of US households subscribe to a pay-TV service. On average they pay $107 per month.

Instead of showing loyalty to your cable or satellite TV, why not consider a streaming service instead. There are plenty to choose from, and a wealth of shows and movies that will keep you entertained for years!

Amazon Prime members can get access to Prime Video as part of their yearly (or monthly) Prime subscription. This is insanely good value, considering all the other perks that come with Amazon Prime (free two-day delivery, Prime Music, and more).

Try Amazon Prime for FREE for 30 days, and see how good Prime Video really is!

For either just $10.99 per month or the discounted yearly fee of $119, you can do away with your expensive ($100+/month) Cable TV and have unlimited access to Prime Video, as well as everything else they offer.

Seriously, when thinking about easy ways to save money on a tight budget, this one is a no-brainer.

4. Use a Programmable Thermostat

Don’t you just love it when there is a simple way to save money?

Switching over to a programmable thermostat is one of those such ways. I made the switch a few years ago and my heating bill has never been lower!

I must confess, I was initially put off by the idea of messing around with the thermostat, and though it sounded far too complicated and that something would inevitably go wrong. But it’s way easier than I thought, thanks to our good old friend YouTube:

Tap twice to load then open Video...

This is one of those situations where you need to spend a small amount of money in order to save money. But it’s totally worth it. I recommend Google Nest because it’s a super sleek design, hooks up to your Google Home app (also works with Alexa), and functions perfectly.

So how does a programable thermostat allow you to save money on a tight budget?

With ever-increasing energy costs, not being efficient with your energy usage is just plain madness when you’re on a budget. My mum was forever shouting at me when I was a kid for constantly leaving the back door open during the winter – and letting ‘all the damn heat out’.

And while the Google Nest won’t magically keep heat in the house even with the doors open, it will significantly improve your usage efficiency – and save you boatloads of cash!

A programmable thermostat will also:

- Help maintain a consistent temperature throughout your home

- Allow you to manage temperature remotely via the app if schedule changes

So if you want a quick, fast and simple way to save up to 10-12% on your heating bills, get the Google Nest Programmable thermostat now.

5. Ditch The Car

According to Statista’s Global Consumer Survey, 86 percent of Americans use their own car to commute between home and work.

And only 5 percent use a bicycle.

In contrast, 25% of trips to work in the Netherlands are made by bike.

That means a staggering 20% more Dutch people are using the good old fashioned bicycle over the motor vehicle, and consequently, saving a ton of money.

So if you can, why not consider doing what my brother has done for over a year now, and ditch the car for 2 wheels instead. This has to be the easiest way to not only save money on fuel and maintenance but also make money on the sale of your vehicle as well.

And I appreciate that this is not possible for everyone (me included), but if it is, think of the additional benefits you can also enjoy:

- Good for your weight and overall health

- Reduce your carbon footprint

- No traffic jams hogging your time

Live too far away to cycle to work? Then why not consider crowdsourcing your commute?

If you need a vehicle to get to work then sharing your journey with others will definitely save you some money. You could try these apps to help burden the financial cost of driving into work:

Or the simplest way is to check with neighbors and organize your own community carpool. I have a friend who does this and literally cut his commuting costs in half!

6. Ditch The Credit Cards

In the final quarter of 2019 credit card debt hit a record high of $930 billion for Americans. Debt is fast becoming a normal part of everyday life, and that little piece of plastic makes spending money you don’t have very easy!

So when thinking about easy ways to save money on a tight budget, ditching the credit card has to be one of the best. In fact, one of the biggest problems with credit cards (and debt of that nature in general), is the misperception it creates.

Some debts are fun when you are acquiring them, but none are fun when you set about retiring them

Ogden Nash

Just because you’ve not realized the cost at the point of service, doesn’t invalidate the fact a cost has been incurred. All that’s happened is a delay in the repayment of the borrowed amount, and perhaps more importantly, with interest. So unless you’re using an ‘interest-free’ credit card as a mere stop-gap between paychecks, it really is costing you money.

And not only are you spending outside of your budget, but you are also adding to your total debt. So why not ditch the very thing that facilitates this ‘bad money habit entirely?

Maybe try the ‘cash only’ challenge, which you can read more about soon. And stop that tight budget from getting any tighter!

7. Declutter

Saving money is difficult when you are on a tight budget. And although the reasons for your tight budget situation will vary, the fundamental cause is always the same; not enough money! And while there are a great many ways to increase your income, many involve devoting time and resources.

From side hustles to weekend jobs, all involve at least some commitment of resources and this is something many people are reluctant to do.

However, a full-proof quick win strategy to save money on a tight budget is to sell items for a quick buck. This way, you get a nice cash injection into the budget equation and give yourself a little breathing room.

Are you a hoarder? There are between 5 and 14 million people in the U.S. who are compulsive hoarders—which is at least twice the number of people diagnosed with OCD.

And so many Americans have unused items just lying around the house and gathering dust. If this resonates with you then you could be sitting on a small windfall. You can sell almost anything on:

And there is no better way to monetize your unused (higher priced) tech items than selling on Declutrr. From DVDs, CDs, Blu-rays, Cell Phones, Tablets, Laptops, Game Consoles, and more!

If you have managed to amass a collection of these sorts of goods, get them valued for free on Declutrr and get a quick influx of cash to boost your budget!

8. Trim The Food Bill Fat

Did you know that Americans are global leaders in food waste?

Every year, nearly 40 million tons of food are discarded, which equates to more than $161 billion. This is primarily down to poor planning, over-purchasing, and a misunderstanding of food expiration labels.

I’m sure you’ve been in a situation where you buy way more than you need to (Christmas time springs to mind) and there simply isn’t enough time to eat all the wonderful food you’ve purchased.

Well, this is a recipe for disaster when you’re trying to save money on a tight budget.

There are plenty of savvy food purchasing decisions you can make to ‘trim the fat’ from your monthly food bill, but chief among them is making sure you only buy what you need.

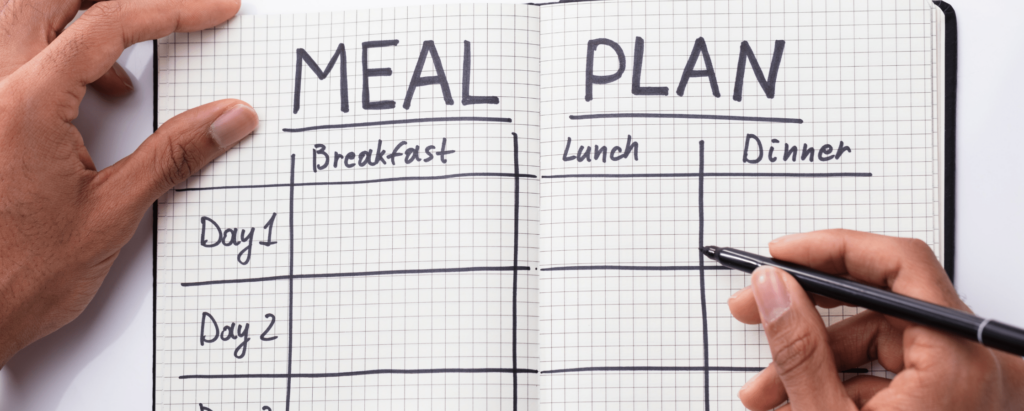

And that’s where the $5 Meal Plan can save you time and more importantly, money!

$5 Meal Plan

Let the team at $5 Meal Plan save you money and time by planning your food for the week!

For just $5 a month you can have your weekly meals planned and exact shopping lists curated for you. And the best part is, every delicious meal on the plan will cost around $2 per person, and in most instances, much less.

You can either opt-in for the Pre-made Weekly Meal Plan or for more fussy eaters they have a Meal Plan Builder option, where you can customize your own weekly meal plan according to taste and preferences.

So if you want to know how to save money on a low income, definitely think about how much you could be wasting on food!

9. Cash-Only Challenge

There are many ways to save money on a tight budget. But to really see an impact you must reduce the amount you actually spend. It’s all well and good crawling back $40 a month on your utility bills, but if you’re a big spender then your bank balance will never grow.

And did you know you are much more likely to spend more money with plastic as opposed to cash?

The psychology of credit card usage would suggest a simple way to save money on a tight budget is to ditch the plastic. It might be a good idea to attempt a cash-only challenge for a week, or even a month to see how much you could really save!

I actually did this for the entire period of time I was saving for my house. Aside from the inescapable card transactions, I was able to limit my spending to cash-only transactions and the results were magnificent.

➡️A study by Dun & Bradstreet found that people spend 12%-18% more when using credit cards instead of cash.

➡️The average cash transaction is $22, whereas the average non-cash transaction is $112

You really are fully confronted with every purchase you make when you’re handing over physical cash. And this greatly reduced the number of purchases I made and significantly improved the rate at which I could save.

And if you are planning on having some extra cash on hand, I would definitely recommend investing in a safe.

Yuanshikj Electronic Deluxe Digital Security Safe Box

- Secure digital locking box

- Equipped with an easy to program digital keypad

- Two sets of emergency keys included

- Reinforced solid steel wall construction

They are great for not only cash but also jewelry, valuables, and important documents as well. So give the cash-only challenge a try, and see how much money you can save. This has to be one of the best things to try if you’re on a tight budget!

10. Buy Second Hand

If you’re on a tight budget then buying second-hand is a simple tactic you should definitely be implementing.

Don’t get me wrong, sometimes it’s great to buy brand new, and if you’ve worked hard then treating yourself to something special is a must.

And some items are just not appropriate for the second-hand market (no one wants a used pair of underwear). But there are some things that make total sense to at least explore second-hand options before committing yourself to a purchase.

Clothes, especially fashion brands, are massively expensive. So when you’re on a tight budget you should consider alternatives to the high street fashion outlets. eBay is a great place to start looking for quality outfits at reasonable prices. And you can also try:

Cars are another huge no-brainer to buy second-hand.

A new car depreciates in value by 15-35% in the first year and up to 50% or more over three years.

Who doesn’t want a brand new Maserati? And I guess if you’re reading this post, then buying a brand new expensive car wasn’t something you considered anyway! But don’t be fooled by finance deals on new vehicles either. It makes much more financial sense to buy a reliable second-hand car that does the job.

Finally, you should consider buying any item that does not benefit from a manufacturer’s warranty second-hand. This will save you a boatload of cash in the short term, and give you more financial flexibility to increase your savings.

11. Use Cashback Now

Cashback is my secret weapon of choice when it comes to saving money. And if you’re on a tight budget, then every cent helps.

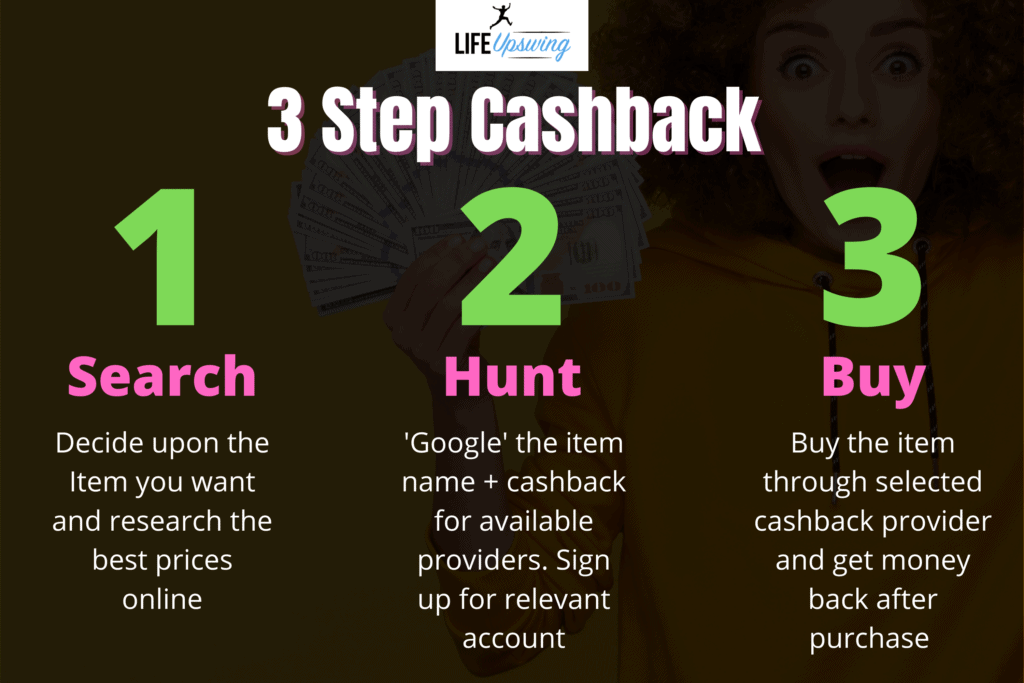

If you are unfamiliar with the concept of cashback then you’re about to learn an incredibly versatile technique to save money on nearly all your purchases. I recommend you start with Ibotta, Swagbucks, and TopCashback, which are all excellent.

Essentially, cashback is a process whereby the buyer of an item or service receives a portion of the sale price back. This is because the cashback provider has referred you to the merchant and themselves earned an affiliate commission. A portion of the commission is then shared with you in the form of a cashback payment.

The size of the global cashback industry is estimated to be around $84 billion. Fancy a piece of that pie?

You can think of it as a discount every time you shop. And while not every item or service is eligible for cashback, and not every cashback provider covers the same merchants, it is still definitely a game worth playing. Here is my simple 3 step process to locate and lock in cashback savings:

When you’re on a restricted income and looking to save money on a tight budget, cashback is a powerful way to stack the odds of success in your favor!

Recommended:

The Best Way To Save Money

It is important to think about saving money in two ways. Firstly, you need to reduce your spending and save money on your everyday purchases, bills, and outgoings. This form of saving money is actively making changes in order to achieve higher retention of income.

Secondly, this active approach to reducing your outgoings will result in a higher level of available income, and this in turn can be passively saved. Whether you decide to contribute to your emergency fund, invest via the Acorns platform, or simply put it into a higher-yielding savings account.

Fighting the ‘savings battle‘ on both fronts will allow you to grow your savings, even if you’re on a tight budget or restricted income.

Living On A Tight Budget Tips

Living on a tight budget is not easy, but many of us have been through it time and time again. I spent the first 5 years or so after graduating from University living on beans and rice! And although saving money is often the last thing on your list of priorities, it should still play a part in your financial plans.

My 3 best tips for saving money on a tight budget are:

- Record and track your spending on a regular basis via your budget! You will never be able to save money if you don’t know where your money is going.

- Shop smarter with cashback, discounts, and rewards. If you are paying full price for goods and services then you’re leaving money on the table!

- Save little and often. If you’re on a tight budget then saving $500 a month is unrealistic. But saving a little bit on a frequent basis will add up and get the ball rolling.

Still Struggling To Save Money

If you’re still struggling to save money then the best thing you can do is try and increase your income. I know it sounds obvious, but having an increased influx of cash will really make a difference to your long-term financial goals.

The first step is to get paid more for the work you are currently doing. There is an excellent article on Forbes which discusses tips on how to get a raise, even when they’re not handing them out. It is well worth a read and definitely worth a try.

Failing that, you may need to take a more direct approach to earn more money. There is a whole section on my site dedicated to this very subject, so I urge you to explore some ideas there.

Saving money on a tight budget is more than possible, you just need to get organized, and actively manage your expectations as you implement strategies to achieve your goals.

FAQs

How do you save on a tight budget?

You need to start with a budget. Once you have a clear holistic view of your income and expenses you can then begin to tackle the problems preventing you from saving money.

How can I save money when struggling?

When you are struggling to save money it is imperative that you reduce your expenditure significantly and try to increase your income. A combination of these 2 tactics will significantly increase your ability to save.

How can I save money daily?

Saving money on a daily basis is a great idea. And if you’re on a tight budget, then this ‘little but often’ approach to saving can be very powerful indeed. The trick is to save what you can without impacting your budgeted expense commitments.

How much should you save monthly?

The amount you should save per month will vary greatly depending on your individual circumstances. It is best to calculate this in terms of percentages. That way, you will be giving yourself a realistic chance to stick with a savings plan over the long term.