Disclosure: This post may contain affiliate links. If you click on a link I may make a small commission at no extra cost to you. You can read the full disclosure here.

Last Updated on October 23, 2022 by Chris Panteli

What Is The Purpose Of A Budget

How many times have you sat down and just stressed out over money? They say that money isn’t the root of all evil, but the fact of the matter is money is a necessity for life. And when you’re trying to save money and find ways to increase your bank balance, you just might be asking yourself exactly “what is the purpose of a budget”?

Truth be told, there are many benefits of budgeting your money each and every month. And even if you don’t want to admit it, the entire purpose of budgeting is to help you figure out a way to save money fast. It’s imperative that we all start to realize that setting financial goals now is what we need to slow down spending and potentially get out of credit card debt or other forms of financial strain.

With a little bit of planning, you can create a spending plan that will teach you how to properly spend money while building up your emergency fund as well. You have total control over your financial planning and money management so it’s time to make it work best for you.

Purpose Of A Budget

The purpose of budget preparation is simple. When you think of the budgeting process as a way to take charge of your personal finances, you just might find that you spend money in a very careless fashion. Creating a budget helps you learn about what you truly need versus what you want and allows you the time to make the changes in your overall spending habits.

What Is A Budget

Think of a budget in the sense that it’s a barrier to your spending. Literally, everyone in the world has a budget, although that budget amount is going to vary greatly from person to person. Even millionaires are on a budget as hard as that might be to believe.

A budget is a set monetary amount that keeps you within the limits of what you earn versus what you can spend. Your budget needs to factor in all the mandatory monthly bills that you’re required to pay along with any expenses that might “pop up” during the month.

Your budget is something that you can generally stick to monthly once set but there might be circumstances such as a job loss, pay increase, etc. that might require your budget to change. If this happens, you can absolutely re-evaluate your budget to see what suits your current situation.

Personal Budget vs Business Budget

If you happen to run your own business, you’re going to need to have a budget set up for your business that is separate from your personal budget. This is because budgeting for a business will require you to factor in a lot of other expenses that you can then typically write off in your taxes at the end of the year (always talk to an accountant before writing off anything that you’re unsure of).

Your personal budget is a budget that really just involves you and your family while a business budget is solely for the costs associated with running a business; paying your employees, utilities, stock, etc.

There’s a very high probability that your business budget will be higher than your personal budget because of the high-cost nature associated with most businesses. After all, the purpose of a business is to make a profit, and in order to do that, there will be a cost involved.

You must spend money to make money.

You must ensure to keep your business and personal budgets separate. If you run a lifestyle business (as I do) it can be difficult to clearly see the distinction between the two, as the finances are often very much entangled. But having clear lines of separation between the two distinct budgets will greatly improve efficiency, accuracy, and accountability.

Benefits of Using A Budget

If you’re wondering about the purpose of limiting your spending and setting up a budget, here are some of the benefits of finally implementing a budget and sticking to it.

Financial Organization

When you have a budget, you’ll notice that your life is probably going to be a little less stressful. This is because you’ve created a boundary where you can be financially organized. This means that you won’t have any weird or unknown transactions showing up on your bank statement because you have no idea where you actually spent your money…it’s quite the opposite experience, actually.

90 percent of Americans say that money has an impact on their stress level

A budget will help you track and get comfortable with your finances in a way that will give you confidence about your future and your spending.

Reduction In Wasteful Spending

Have you ever truly looked at where your money goes each and every month? Most people who have financial issues don’t even take the time to track their spending patterns.

Even if you don’t balance your checkbook or bank statement, you still need to visually look at it and understand what you’re spending your money on. It might be a big eye-opener about ways that you truly are wasteful with your money.

There are even credit cards out there that itemize your spending monthly for you. When you get your credit card statement online, they’ll show you the percentage monthly that you’re spending on food, entertainment, and more.

This can be a huge awakening in showing you all the places that you need to trim your wasteful spending. And when you accept that and open your eyes to creating a budget, the outcome is that you’re not going to be falling for those spending traps any longer.

Increase Your Wealth

Are you wanting to work forever to stay afloat? No, of course not. This sounds horrible for so many reasons, right? But if you don’t watch your spending and track what you do, that nightmare of never being able to retire could actually become your reality.

Starting a simple budget now is a great way to increase your wealth so that you can have many years of putting your feet up and retiring without having financial worries.

Your budget can allow for a monthly savings amount to go directly to your 401K, IRA, or any other account so that you can easily increase your wealth.

Acorns Later Retirement

An easy, automated way to save for retirement. You can put your extra cash to work for as little as $5 at a time – straight into an IRA and portfolio that’s right for you

To six figures and beyond!

Get Out And Stay Out Of Debt

Raise your hand if you’re ready to be debt-free! While I can’t see most of you, I have a feeling that you’re all raising at least one, if not both of your hands high up in the air and waving them around.

Being in debt stinks. It really, really does. And there are always different reasons that people go into debt and it sucks.

Whichever way you look at it!

Some people have debt because of horrible spending habits while others end up in debt for health reasons or sudden loss of employment. All these reasons are horrible, but they typically have a debt accruing fast, too.

A budget will put you on the track to eliminate this debt, and more importantly, keep it that way. Unless you have a holistic view of your overall finances, you’ll never be able to get on top of the fine detail. And that is often the reason why so many people fail to break free of the debt chains. But you’re old friend ‘the budget’ is a secret weapon to fight the debt disease!

So use it!

Goal Setting

When you take the time to budget, you’re also going to be taking the time to set goals as well. And let me tell you one thing, goal setting is really, really addictive. Because you get such a natural high and adrenaline rush when you hit your budgeting goal and that means that you’re going to want to set another goal, and another goal, and so on down the list.

So when asking yourself the question what is the purpose of a budget? think about how it can benefit you and your long term plans.

Budget goals really aren’t hard to do but it does require you to stay diligent in making sure that you’re staying on course and tracking your spending habits. And also make certain that you’re setting goals that are reasonable but motivating at the same time.

And these goals can be as a result of what your budget is able to achieve. For example, it may be a large purchase you’ve always wanted to make. So you could set a savings goal of $2000, and when you hit that, you allow yourself the indulgence of that purchase. Incentivize your goals and the results will be much greater.

The goal isn’t more money. The goal is living life on your terms

Chris Brogan

It just works!

Planning For The Future

When you’re on a budget, it allows your mind to wander to the future because you’re saving money to be able to spend later on down the road.

Do you want to retire and travel the world in an RV?

Start managing your money now and make it happen.

A well-crafted budget facilitates the ability to save successfully and regularly. This means you can allow yourself to not only dream about future possibilities but also make it a reality.

if you’re looking forward to retirement then start budgeting now to ensure you achieve your goals.

The purpose of a budget is really all about planning for the future and the unexpected. It gives you a framework in which to manage your finances and get out of unforeseen difficulties. A budget can’t predict the future (unfortunately) but it can help you to navigate it.

Emergency Fund For The Unknown

Life happens.

Look at the entire year of 2020. No one expected this year to be the way it is, yet here we are living it every single day. And for this reason, the people that have an emergency fund right now are probably feeling pretty grateful that they budgeted and managed their money in an organized and logical manner.

You should always plan on having an emergency fund for at least 3-6 months in savings just in case life strikes and turns into a big chaotic mess.

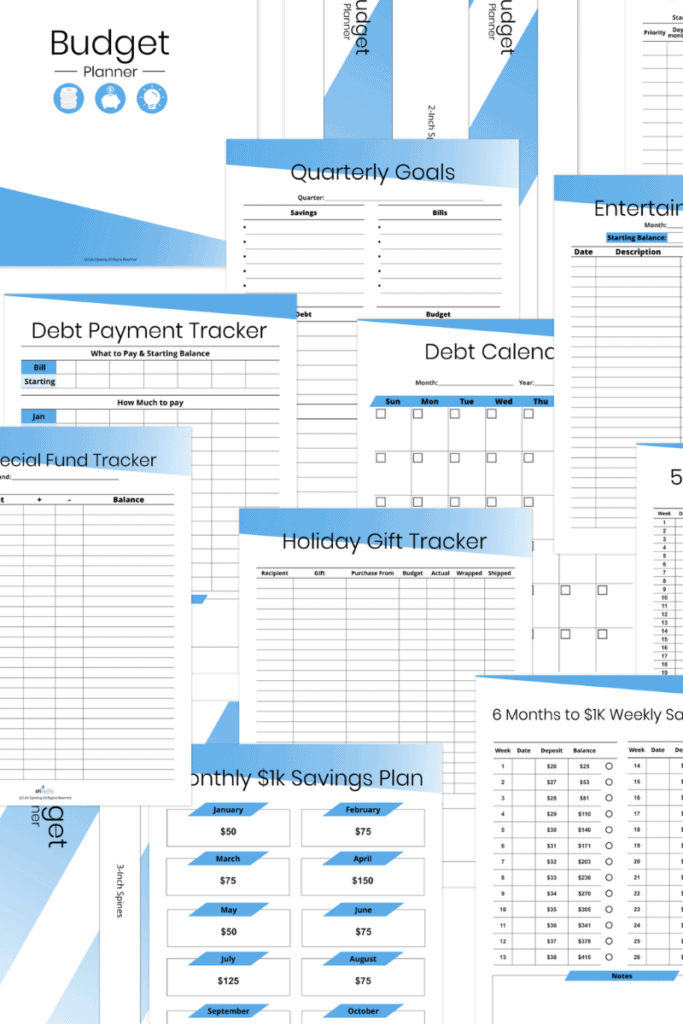

LifeUpswing Budget Planner

Using a budget planner is a great way to stay on budget. With a few simple changes to your daily life, you can easily make adjustments that can increase your wealth fast. If you use this planner in the way it’s intended to be used, you’ll be able to save up to $1,000 with minimal effort at the end of a year. This budget planner also literally tracks every penny you spend to show you how wasteful, or savvy, you are.

Beautiful 165 Page Budget Planner Printable

Do you feel overwhelmed when it comes to organizing your finances? With this incredible 165 Page Budget Planner Printable you can take back control of your money, keep on top of your budget and totally rock your finances; stress-free!

When you take the time to write out your budget and plan for your financial success, you’re telling your brain that it’s important and something to pay attention to. This means that you’re more likely to stick to your savings goals when you use a paper planner because it will hold you accountable in your mind and in your spending activities.

Best Free Budgeting Apps

Since we live in a world of technology, there are quite a few free budgeting apps that you can easily download and have on your phone or laptop to help you keep your spending in check.

- Mint – This app is super simple and can sync right up to your bank account to help you track and figure out your budget.

- Budgt – Currently only for iPhone but is still an awesome app that can add in your income and track your expenses to help you keep a current total of what you’re spending daily.

- Unsplurge – This is actually a fun app in the sense that it helps you budget and save your money for fun things that you want to do. While you might not want to spend all your saved money on entertainment, this app is a good indicator that creating a habit of saving money is something that can stay with you for your entire life.

Different Types Of Budgets

When it comes to budgets, there isn’t a one-size-fits-all answer, either. This is why there are different types of budgets that you can, and should, consider. Budgets can come in all shapes and sizes and this means that the budget guidelines set by each individual person are going to vary and not be the same.

Understanding that before you get started is key because this will save you frustration and confusion later on down the road.

FAQs

What is the main purpose of a budget?

The main purpose of a budget is to help you be better prepared for the future. This means that you’ll need to plan, prepare, organize, and implement your goals to make your budget work.

What is the objective of a budget?

Setting up a budget for your spending is going to help you cut out the “fat” and spend your money on the items and things that you actually need. The overall objective is to stop wasteful spending and focus on the difference between needs versus wants.

What are the 4 steps in preparing a budget?

While there can be many moving parts to a budget, there are 4 steps that you need to really pay attention to.

1.Understand and Set Goals

2.Review your Past Spending

3. Understand Your Monthly Income Versus Your Must-Have Spending

4. Set a Budget Based on your Research

Following these budget guidelines can be a great way to ensure that your budget is going to work well for you right from the start.

What are the two main types of budget?

When it comes to setting up a budget, there are two main types to consider. The first is the basic budget which is a basic guideline of items that everyone needs to have on their list to start to plan on out their budget. This should include mortgage, utilities, groceries, etc., and basically any type of expense that you have to pay every single month.

The second type of budget is the current budget which gets into a little more detail about your personal spending. Listing out all your spending habits and then weeding out what you don’t need is part of trying to figure out what the current budget truly is. A current budget is also a budget that can change depending on your financial circumstances. In other words, this is where you set your budget based on what you’re “currently” earning.

Are you ready to take charge of your budget? The time is now to stop procrastinating and start saving more money. Because the sooner you start, the sooner you’ll have your first deposit into your savings account as well.

And trust me, that is an amazing feeling to know and see that all your hard work and efforts are truly “paying” off!