Disclosure: This post may contain affiliate links. If you click on a link I may make a small commission at no extra cost to you. You can read the full disclosure here.

Last Updated on December 24, 2022 by Chris Panteli

Personal Finance Statistics

The January 2021 nonfarm payroll report has clearly shown that the U.S. is not moving towards maximum employment – and has only seen 49,000 jobs added – with a total of 227,000 jobs lost so far.

This means a staggering 10 million people are unemployed, with 4 million no longer part of the labor market and 2 million Americans wanting full-time work but currently having to settle for part-time.

This is clearly going to impact the average American’s personal finances and the way in which they manage their household budgets, savings, and spending habits. And it may also open up the possibility of more people looking for creative ways to generate additional income and offset lower or lost wages.

As a result, a new survey by LifeUpswing unearths how Americans are coping with the ever-changing economic landscape – and with 64 percent of respondents rating their own personal finances as above average, the broader picture sheds some light on how the population manages their money.

Key Findings

The research survey produced some exciting results with regard to individuals’ personal finances, the strategies they employ, and the concerns and issues they have. Below is a roundup of the main findings from the study:

64% Of Americans – Rate their personal finances above average

56% Of Americans – Have an emergency fund

59% Of Americans – Have less than $1000 available to cover an emergency

74% Of Americans – Actively maintain a household budget

43% Of Americans – Would benefit most from a reduction in utility and food bills

85% Of Americans – Actively try to reduce monthly expenses

66% Of Americans – Would pay for a service to reduce monthly bills

65% Of Americans – Have a side hustle that earns money

50% Of Americans – Would consider starting a side hustle to make money

54% Of Americans – Do not have one form of traditional passive income

43% Of Americans – Have more than $1000 worth of credit card debt

87% Of Americans – Make debt repayments a priority

58% Of Americans – Actively save money into a 401(k) or IRA

47% Of Americans – Use a personal finance app

48% Of Americans – Use cashback providers

Personal Finance Survey Results

The 15 questions posed in the survey aim to provide a holistic overview of Americans’ personal finances and covers topics including budgets, retirement, debt, and work.

1. How Do You Rate Your Personal Finances?

Above average

One could argue that we ourselves are not the best judge of our own personal finances. But it is interesting to get a perspective on how we rate our own abilities when it comes to money.

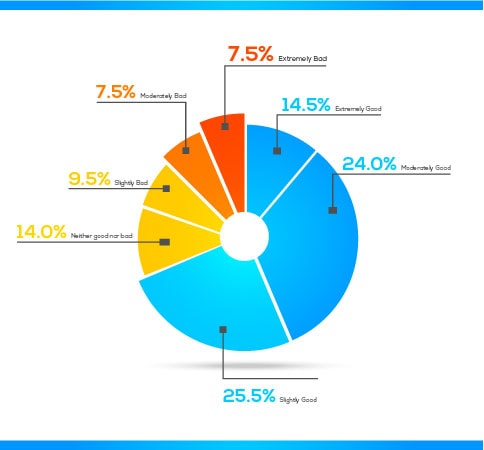

The data from our study indicate that the majority of people rate their personal finances relatively well – with 14.5% saying extremely good, 24% moderately good, 25.5% slightly good, and 14% indifferent. That leaves a collective 17% of Americans rating their personal finances as bad.

The study, therefore, indicates that when making an overall assessment of our own financial planning, literacy, and capability – 64 percent believe to have a grasp on personal finance.

The question remains, however, can one accurately make a worthwhile self-assessment? We shall see how the rest of the study bears out, and if there are any glaringly obvious mismatches with the data obtained by the LifeUpswing survey results.

2. Do you have an emergency fund?

An emergency fund is often considered to be the backbone of a good personal finance strategy – and is designed to get you out of unforeseen financial events with as little impact on your day-to-day life as possible.

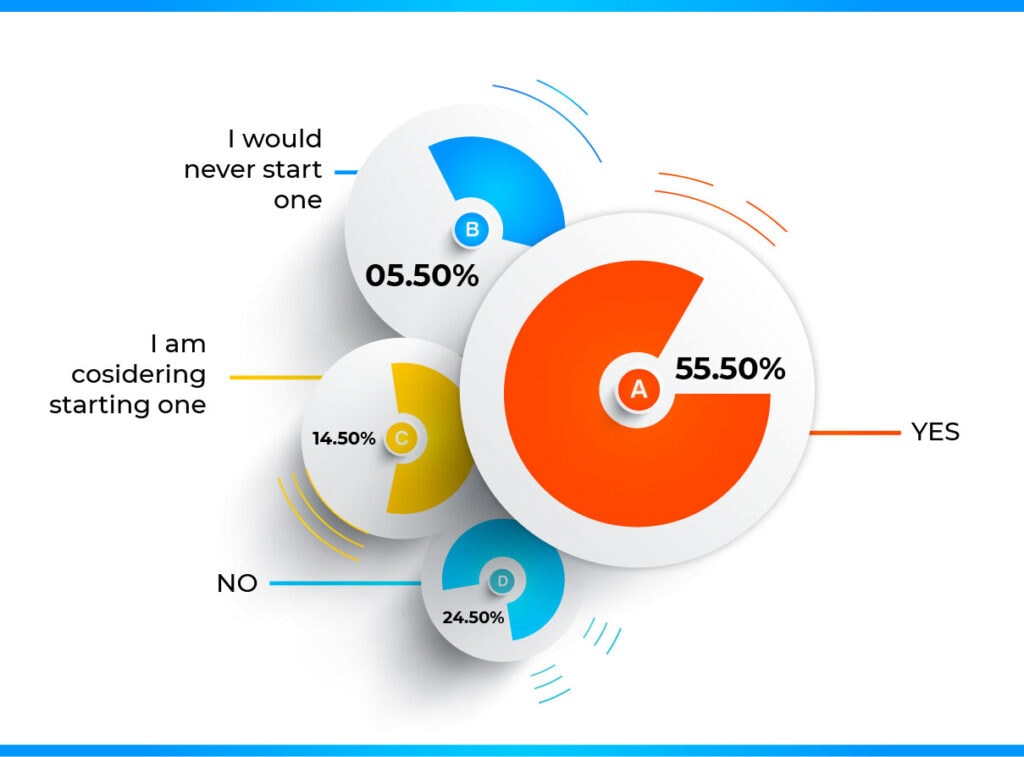

The study shows that 56 percent of respondents do in fact have an emergency fund – and this is indicative of those practicing good personal finance.

And while 24.5 percent of people don’t yet have an emergency fund – 14.5 percent would consider starting one.

Often, getting an emergency fund started is the hardest part – but once you have allocated a set monthly amount into a separate account, the fund will actually grow surprisingly quickly.

Have an emergency fund

Interestingly, just over 5 percent of Americans would never consider starting an emergency fund. And while the survey doesn’t delve into this topic further – one could assume a multitude of reasons for this being the case.

3. How much cash do you have available to cover an emergency?

Less than $1000

This question took a small amount of liberty when it was worded. When considering having money available to cover an emergency, one could assume that would be drawn upon from an emergency fund. And while this was the focus of the question, I decided to not directly assume this to be the case. Therefore, I worded the question as such to not outright specify the location of funds – but it serves the same purpose.

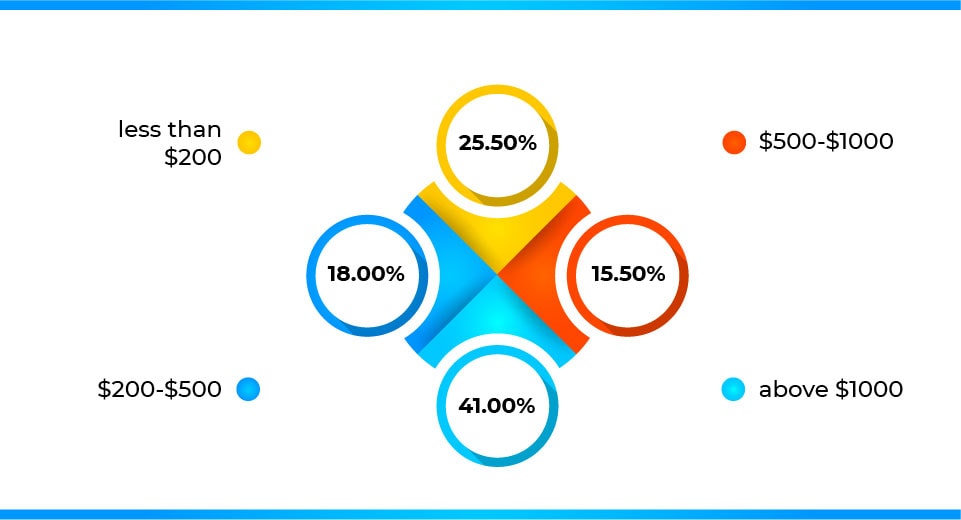

And the results were very much in line with wider studies, with 59 percent of Americans having less than $1000 available to cover an emergency.

So, even though most Americans either have an emergency fund or at the very least, would consider starting one – most people actually have relatively low funds available.

Martin Lewis, the founder of MoneySavingExpert.com, recommends having an emergency fund of at least six months worth of bills. And with the average American’s monthly expenses set at $5,102 – that would equate to an emergency fund of $30,612.

However, 41 percent of respondents do have more than $1000 to cover an emergency, but how close to the recommended consensus amount is not known.

The reason why so many personal finance experts recommend a multiple figure amount for emergency fund sizes (which can become very large depending on your expenses) is because of the ‘uncertainty factor’. The nature and impact of any emergency are impossible to account for, and so having 6 months worth of funds available is the best way to mitigate against the ‘worst-case scenario’.

Yes, $30,612 might seem like overkill for a one-off vet bill, but perfectly adequate for a medical emergency that puts you out of work.

4. Do you actively maintain a household budget?

Maintaining a household budget is another cornerstone of good personal finances – and is really the bedrock of any well-managed household. If you think of the day-to-day running of a home and family as a business, then it’s perhaps no surprise that nearly 3 in 4 Americans have a household budget.

The reason why a budget is so useful is that it gives a holistic viewpoint on everything coming in and out. If your budget is correctly subdivided into categories then you can quickly identify problematic spending patterns and areas which need improvement.

Have a household budget

The fact that 73.5 percent of Americans budget their finances provides an insight into how the population is actively managing their spending habits – and the way in which they identify expenses that require attention.

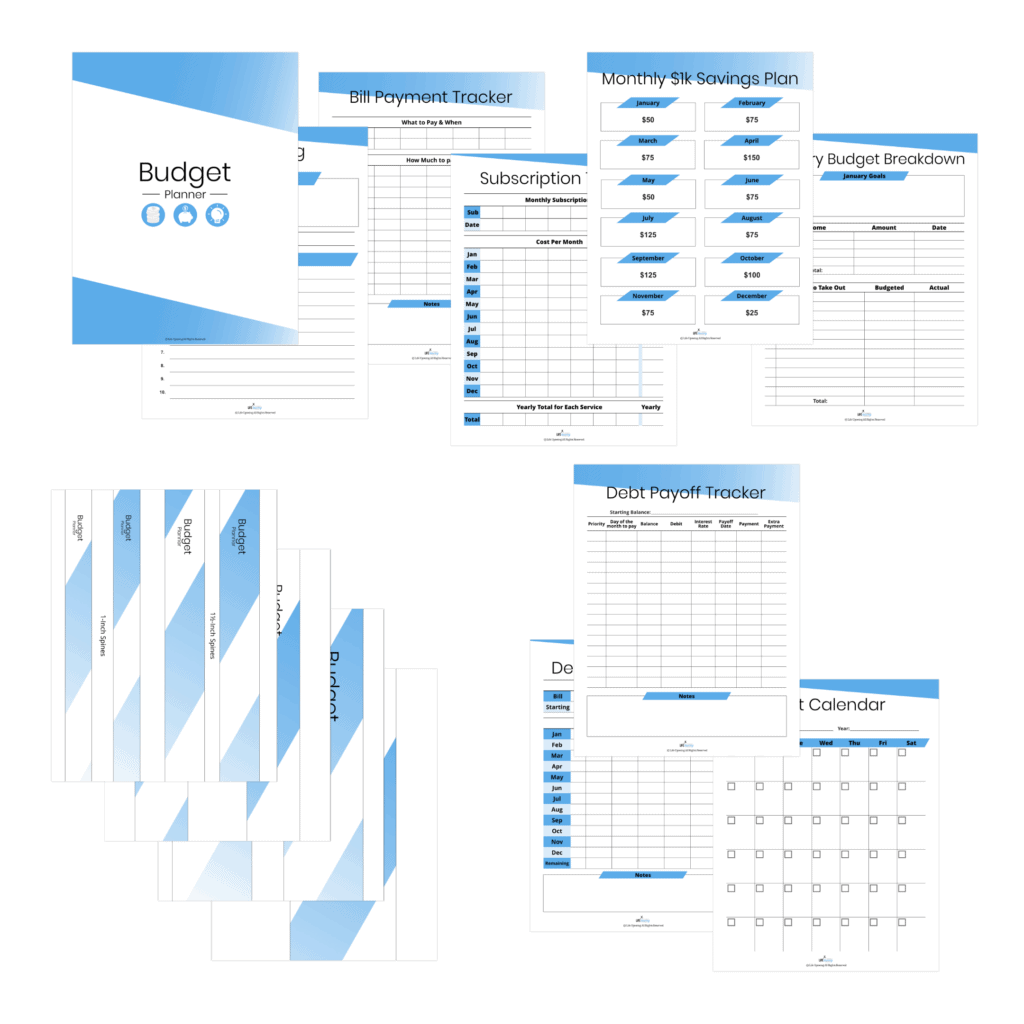

165 Page Budget Planner Printable

If you are part of the 26% of Americans who have yet to start a budget – then get the LifeUpswing 165 Page Budget Planner Printable with 50% off using the discount code upswing50

5. What area of your household budget would benefit most from a reduction in spending.

Utility bills and food

The Indian speaker U.G. Krishnamurti said, “Food, clothing, and shelter – these are the basic needs”. And this is clearly evidenced by where most Americans are spending heavily – and would benefit most from a reduction in cost.

Monthly expenses are an inescapable part of life! Unless of course you are able to live off the fat of the land like in Steinbeck’s classic novel Of Mice and Men – but who can really do that?

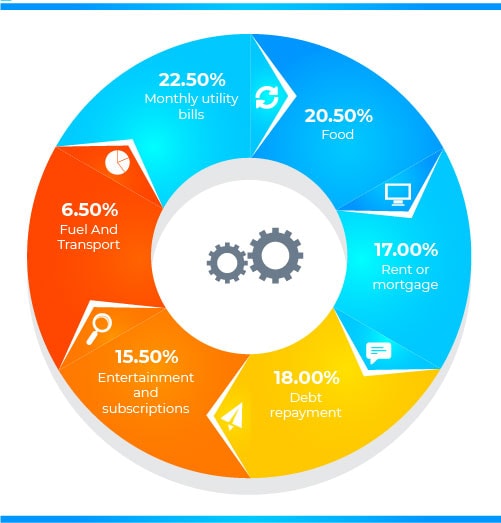

Most of us are beholden to regularly sending money on the things we need to stay alive and live comfortably. And the respondents to our survey clearly identified monthly utility bills (22.5%) and food (20.5%) as being the biggest burden on their budget.

Debt repayment (18%), rent or mortgage (17%) and entertainment/subscriptions (15.5%) are the next biggest areas of Americans’ household budgets that would benefit most from reductions.

Surprisingly, fuel and transport costs (6.5%) had the smallest amount of impact on finances – and would benefit the household budget least if reductions could be found.

Even though our household budget may appear pretty rigid, there are actually many ways to seriously reduce your expenses. Actively engaging in price comparison shopping, energy efficiency behaviors, waste reduction, and expense cutting are all proven methods to improve one’s budget.

6. Do you actively look for ways to cut your monthly expenses?

Identifying areas of your budget that have the most significant effect on your personal finances is the first step to budget improvement. Next, you need to actively engage in monthly expense reduction within the identified problem areas.

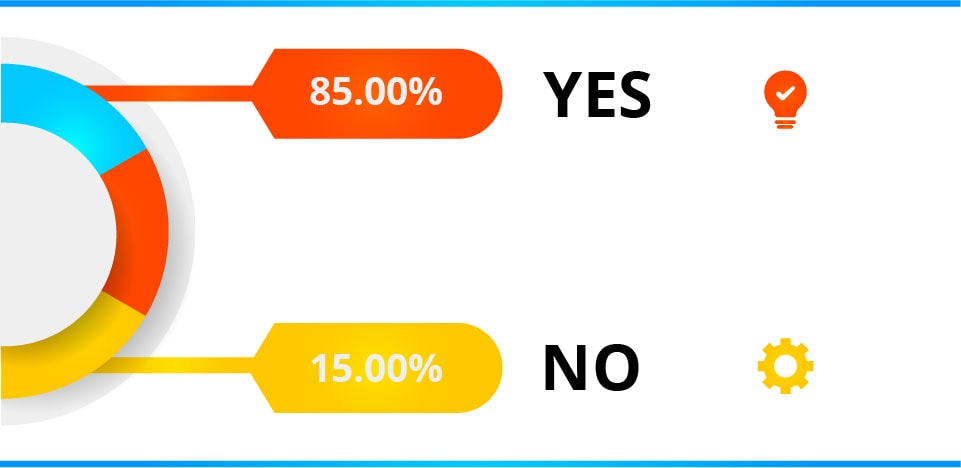

Looking for ways to cut monthly expenses is an activity that an overwhelming 85 percent of Americans do.

Actively try to reduce monthly expenses

Although the survey does not reveal the reason why 15 percent of respondents do not try to reduce their expenses – one could assume at a certain net worth these ongoing costs are fairly inconsequential.

7. Would you consider paying for a service that could reduce your monthly bills?

Would pay for a service to reduce monthly bills

It may seem counterintuitive to pay out money in order to save money. But these services do exist, and they operate a pricing model that benefits both the company and its customers.

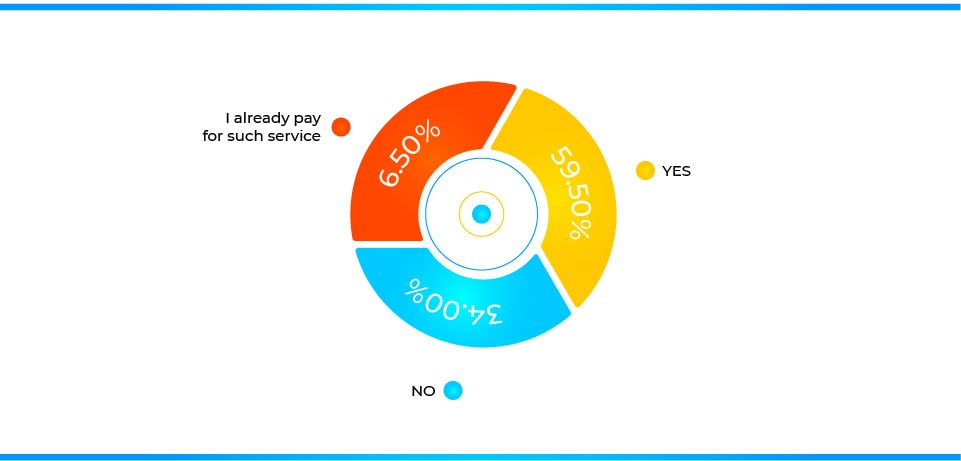

Our survey reveals that 6.5% of Americans already use bill reduction services and 59.5% of people would consider using one if they don’t already.

The way these companies work is by charging you a portion of the savings they are able to gain – and therefore it sort of operates like a no-win-no-fee pricing model. It can be a hands-off way to make a significant impact on your monthly outgoings.

There are a number of tools and tactics you can employ in order to reduce your monthly expenses – and in doing so give breathing room for your household budget.

Services like TrueBill and BillShark will autonomously check for better rates, negotiate existing rates and cancel unused subscriptions for a small percentage fee of the savings made.

8. Do you have a side hustle (actively earning money outside of your main source of income)

The phrase side hustle may very well be the buzzword of the past decade – but it really does only mean one thing. And that is earning money outside of your main source of income. In fact, people have been doing this for a very long time – even a second job is technically a side hustle.

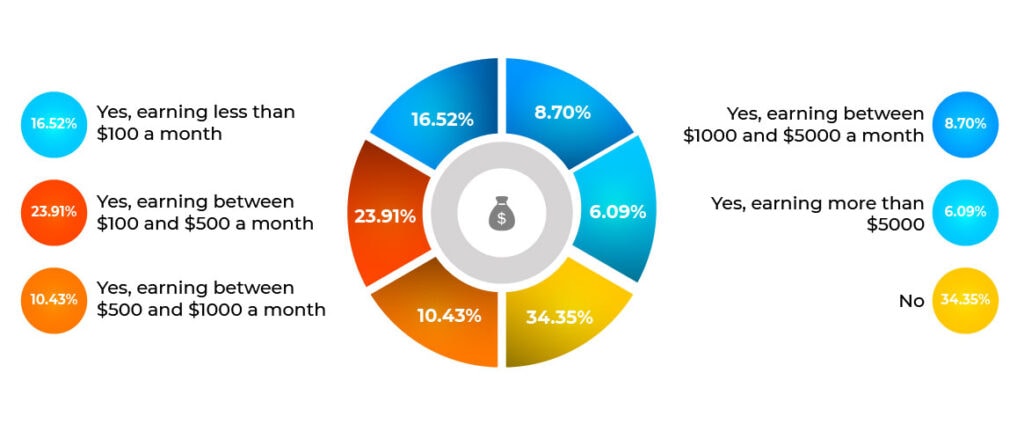

So it’s probably no surprise that a massive 65 percent of Americans actively partake in a side gig that generates additional income. What is interesting though is the discrepancy between earning levels that this extra-curricular activity produces.

Just over 15 percent of the survey respondents have a side gig that earns them less than $100 a month.

The next bracket of earnings ($100-$500 a month) is the largest subgroup of earners at 24 percent, with only 10 percent of Americans making $500 – $1000 per month.

Of Americans have a side hustle that earns money

The highest earners are fewer still, with 9 percent making $1000-$5000 a month and only 6 percent making more than $5000 a month from a side hustle.

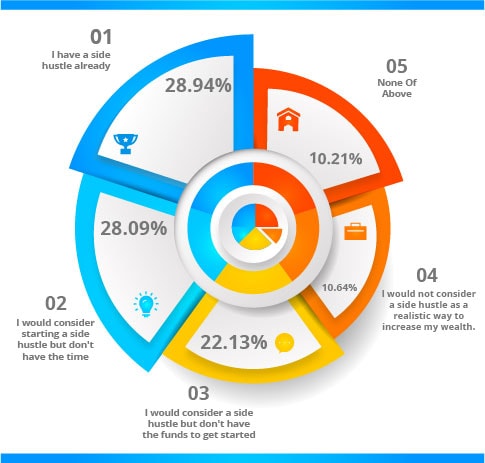

9. If you don’t have a side hustle, would you consider starting one?

Of Americans would consider starting a side hustle to make money

A study by Vistaprint found a similar result to the study we conducted – with 55% of workers confirming aspirations to turn a hobby into a side hustle.

And whilst our survey did not specify the reasons for wanting to start a side gig – it did provide some insight into the reasons against it.

Firstly, 28 percent of respondents said they would start a side hustle but simply do not have the time – with nearly 60 percent of this group being over the age of 25.

Secondly, 22 percent of respondents said they would start a side hustle but do not have the funds – with 63 percent of this group being under the age of 25.

Finally, 11 percent of Americans dismiss side hustles as a realistic way to increase personal wealth.

One could draw a relatively simplistic conclusion from this data – Of those wishing to start a side hustle to improve personal finances, the younger generation can not afford it, and the older generation does not have the time.

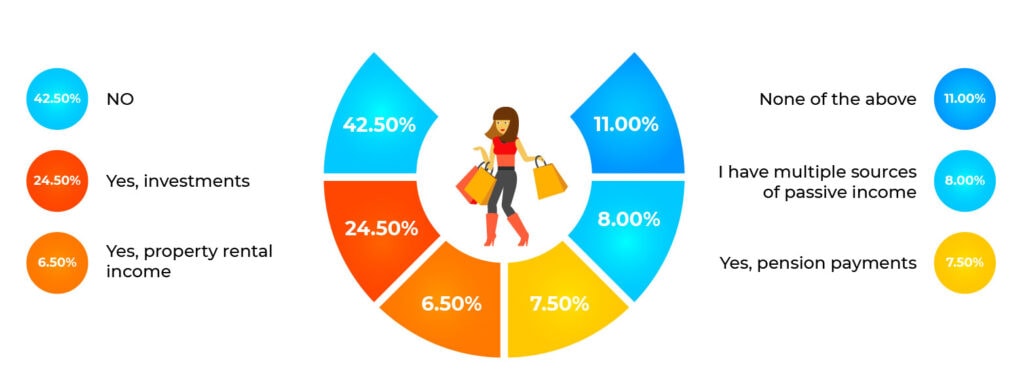

10. Do you have any sources of passive income?

Passive income really is the dream! It’s a way of earning money, repeatedly, with seemingly minimal effort. And while it may not entirely be as easy as that, it’s definitely a revenue stream worth having in your arsenal.

Unfortunately, by its very nature, passive income often requires expensive assets (property, businesses, intellectual property) or years of building wealth that generate consistent returns. That’s probably why 54% of Americans do not have any form of traditional passive income.

Of those that do enjoy this form of earnings, 1 in 4 surveyed receive payouts from investments. The next largest group (8%) get passive income from pension payouts and then only 7% of respondents receive a regular rental income.

Interestingly, 8% of Americans actually enjoy more than one source of passive income – which means they have managed to diversify their risk allocation across multiple streams.

Of Americans do not have one form of traditional passive income

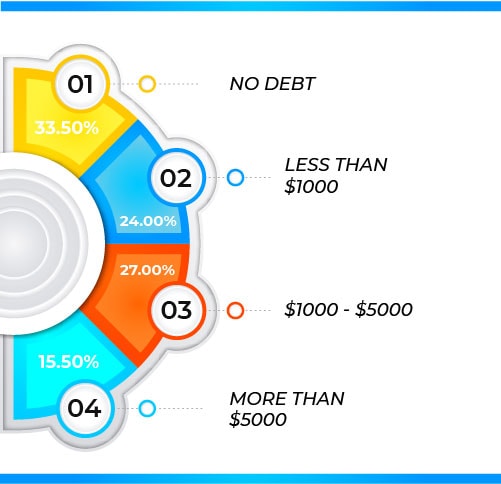

11. How much credit card debt do you currently have?

Of Americans have more than $1000 worth of credit card debt

Maintaining credit card debt isn’t necessarily the be-all and end-all of personal finance – and the statistics do not always paint the fullest of pictures. The problems arise when the debt becomes expensive – and cannot be paid off.

If the carried debt can be managed within the individual’s financial circumstances – then credit is an instrument that can facilitate responsible borrowing. These statistics do not reveal the circumstances behind the credit, nor the individuals borrowing habits. But rather, they highlight the sorts of debt levels proportioned throughout the population.

Just over 1 in 3 Americans carry no credit card debt whatsoever – and interestingly this was evenly split across the age groups.

Slightly less than 1 in 4 carry less than $1000 in average credit card debt and the largest group (27%) had between $1000-$5000.

Finally, 16 percent of Americans have more than $5000 worth of credit card debt.

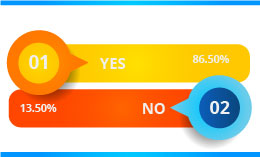

12. Do you make your debt repayments a priority?

Debt comes in many forms – from credit card debt, student loans, household debt, and mortgage debt – and getting it paid down is key to healthy personal finances.

And while our study showed that 43 percent of Americans have credit card debt – the average American has a total debt of $90,460 – which includes personal loans, mortgages, and student debt.

It is good to see that 87 percent of respondents make debt repayments a priority – and with so many of us now carrying such large sums of debt, it’s no surprise clearing the balance is something many strive for.

Of Americans make debt repayments a priority

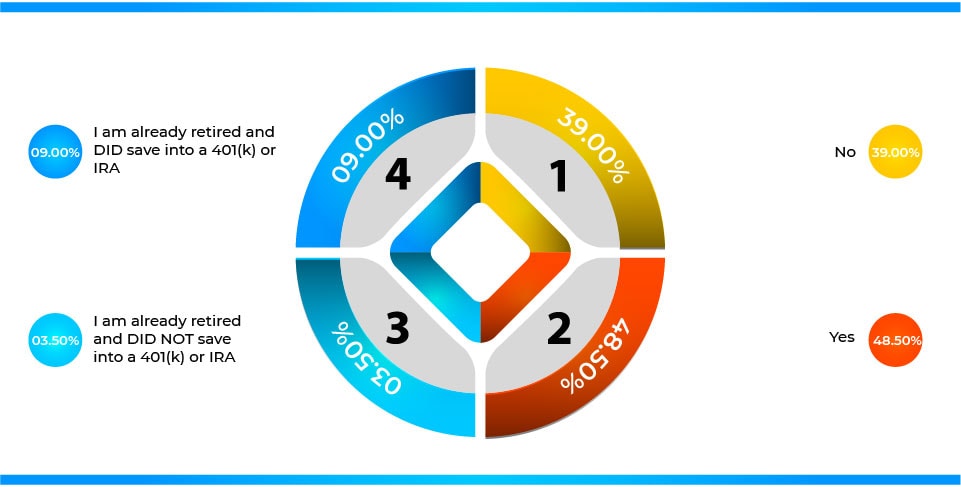

13. Do you actively save money into a retirement account, 401(k) or IRA?

Only 58% of Americans actively save money into a 401(k) or IRA

Having little to no retirement savings is a dangerous game to play when considering your financial future.

And with only 58 percent of Americans actively saving into a 401(k) or IRA, it begs the question what are they doing instead with regards to financial investments?

In fact, 40 million private-sector employees don’t have access to a retirement plan via their employer, according to a 2018 study by the U.S. Bureau of Labor Statistics.

And an even more frightening statistic is that if you want to be able to retire at 65 with half your annual final salary – you need to save 40% of your income over the next 30 years (if investment returns are less than 3%).

Acorns Later Retirement

An easy, automated way to save for retirement. You can put your extra cash to work for as little as $5 at a time – straight into an IRA and portfolio that’s right for you

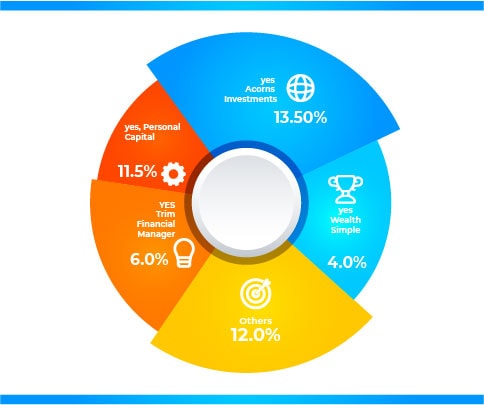

14. Do you use personal finance apps?

Thanks to the technological age in which we live, it’s never been easier to manage your wealth with financial aid to help with saving money.

On your journey towards financial independence, the market is now awash with apps, online platforms, and bespoke services to expertly assist you with the ever increasingly complicated financial decisions you need to make.

It’s no wonder then that 47 percent of Americans use a personal finance app – with Acorns and Personal Capital being the distinct leaders amongst our survey responses.

The Trim Financial Manager app is another popular choice with those on a budgeting drive – and helps to reduce consumer spending, save money and achieve your financial goal.

Of Americans use a personal finance app

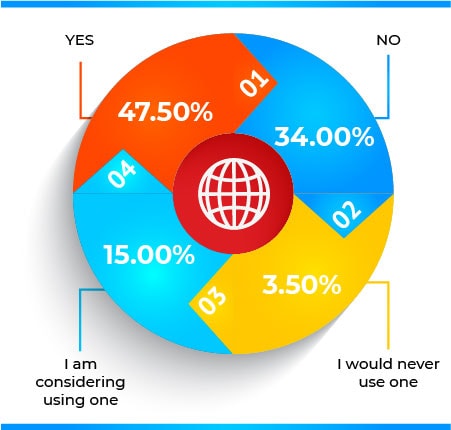

15. Do you use cashback providers such as Ibotta or Swagbucks to save money?

Of Americans use cashback providers

If you really know your onions when it comes to personal finance – then using cashback providers will be second nature to you. And while this is an increasingly used form of consumer saving, our survey reveals rather less than full adoption.

In fact, just under half of the American consumers use cashback providers as a means to save money when making purchases.

Cashback providers such as Swagbucks and Ibotta incentivize purchases through their platforms by offering some of their affiliate commissions back to you. It’s really a win-win situation for all parties involved.

And our survey does reveal that although just over 50 percent of American consumers don’t currently use cashback – 15 percent would consider it to be a possibility in the future.

Gaining more financial knowledge and exposure to better personal finance tactics is on the rise. And although currently, not everyone is fully adopting the cashback model, the willingness to engage with the new-age world of consumer spending seems to be promising.

Key Takeaways

With many facing a reduction in household income, personal finance education is shining light on the American population’s resilience to economic downturns. The sheer fact that 65 percent of people have a side hustle to generate additional income is a testament to their hard work and ingenuity.

And while striving for high net worth, elimination of student loan debt, a good credit score and low levels of consumer debt are admirable pursuits – the holistic approach many Americans are taking toward better financial literacy is an all-around solid approach to good personal finances.

All results from this study came from a poll commissioned by LifeUpswing that was conducted online by polling company Pollfish.

Recommended: 5 Finance Experts Bust The Biggest Savings Myths