Disclosure: This post may contain affiliate links. If you click on a link I may make a small commission at no extra cost to you. You can read the full disclosure here.

Last Updated on October 23, 2022 by Chris Panteli

My Husband Says His Money Is His

You are probably well aware that cheating is a leading cause of divorce. Another type of cheating is just as serious and that’s financial infidelity.

Studies show almost a quarter of divorces cite money problems as the primary reason. That’s not to mention how many other divorces will have money as a contributing factor.

What about your husband?

‘My husband says his money is his’ – is this something affecting your marriage?

Does your husband routinely exclude you from financial decisions? Perhaps he isn’t upfront about how much money he truly has? He may even be suggesting to own separate property.

For a marriage to last, you and your spouse must be able to agree on financial matters. Knowing how to communicate with each other effectively on topics like money will in the long run mean a stronger union.

Marriage and Money

Getting married should be a fun, joyous, and memorable occasion. Once the wedding is over the hard work begins as married life takes work from both sides. A key part of a successful marriage is each spouse agreeing on how the money will be handled.

Every married couple is unique and what works for one couple may not work for another. There are two common ways of managing money that married couples fit into.

Sharing Finances

When sharing finances, a joint account is created that all earnings are paid into. From this joint account, all bills are paid, savings are built, and discretionary spending is allocated.

You may both maintain your own accounts as well, but you both have full access to all funds in the joint account.

Joint Finances

The other common way of managing finances is to keep everything separate. You both keep your individual accounts and split bills. For example, he pays the mortgage, insurances, and utilities. You pay for groceries, cable, and other expenses.

It’s this second way of handling money that may be problematic for some. Not all occasions of keeping money separate translate to financial abuse. If it works for you, then carry on!

However, for many couples, the husband’s desire to keep money separate could be an indicator of abuse. If one party wants to control all the money, this is a bad sign if the other doesn’t agree!

Abuse is not a word to take lightly and it could be the husband is immature or hasn’t communicated any concerns properly. Discussing money openly, honestly, and calmly is key to establishing a foundation for your marriage that will work for both of you.

Financial independence is still important and achievable when sharing finances, but you must communicate!

My Husband Says His Money Is His

A separate bank account for each spouse can block effective communication if it’s not discussed beforehand. Your husband may feel like he can spend his money however he likes without consideration for the household.

He may refuse to share his finances, but still expects you to share yours or even give him extra money when he’s short with no explanation offered!

Please note – no one is saying either partner has to ask permission to spend their own money. What is being said is that you both need to agree beforehand on how the money will be shared. That way you should both have a fair amount of discretionary spending money every month.

Married couples that are on the same page can prosper. Think about yourself and your husband. Is one of you a spender and the other a saver?

Keep this in mind when talking about money.

For example, your husband may be a spender and may feel guilty about this. Therefore, he gets defensive when talking about money as he knows he’s in the wrong. Try to frame the conversation as benefiting both parties so that he knows he can still have spending money within the family budget.

Separate accounts may lead to more disagreements. Who is in charge of savings? If you have children, how are expenses related to the kids shared? How is retirement planning handled?

Often when a husband says his money is his it means he expects you to cover all these expenses and won’t contribute to savings, retirement funds, or any other household expense.

These arguments can not only damage a marriage but your mental health as well.

A joint account makes managing finances much easier. Bills, savings, and other expenses can all get paid directly from the joint funds. You can both get a fair share of the money that’s leftover for spending.

Now you just need some tips on talking about money!

How To Talk About Money

Many people struggle to talk about money as it makes them uncomfortable. Bringing up the topic in a neutral moment is a good start. Remaining calm, firm, and non-accusatory are also essential to having a conversation about money.

Remember – you are not picking a fight! Instead, you are hopefully going to resolve money issues in the marriage with your spouse and build a stronger future together.

If your husband flat-out refuses or gets defensive every time, then you may have bigger problems to address.

Hopefully, your husband will discuss these issues with you reasonably. Here are some tips on what to talk about.

Budgeting Together

Financial guru and best-selling author Dave Ramsey had this to say about money and marriage:

Marriage is a partnership, and couples can’t win with money unless they budget as a team

Dave Ramsey

Budgeting is vital for financial success. Married couples can plan their futures together by building a budget that works for both. Buying a home, having children, and retirement are a few situations that married couples can plan ahead for by budgeting.

Make sure the budget includes all income that is hopefully going into a joint account that you both have access to.

All expenses including bills, debts, and savings should be considered. If you have debts, then make a plan together to get them paid off.

Once all expenses have been accounted for, then you can agree on how to share the remaining money. Both of you should have some spending money. If your husband is a spender, then making sure he has money to spend each month will prevent resentment from building up. Equally, you also deserve spending money too!

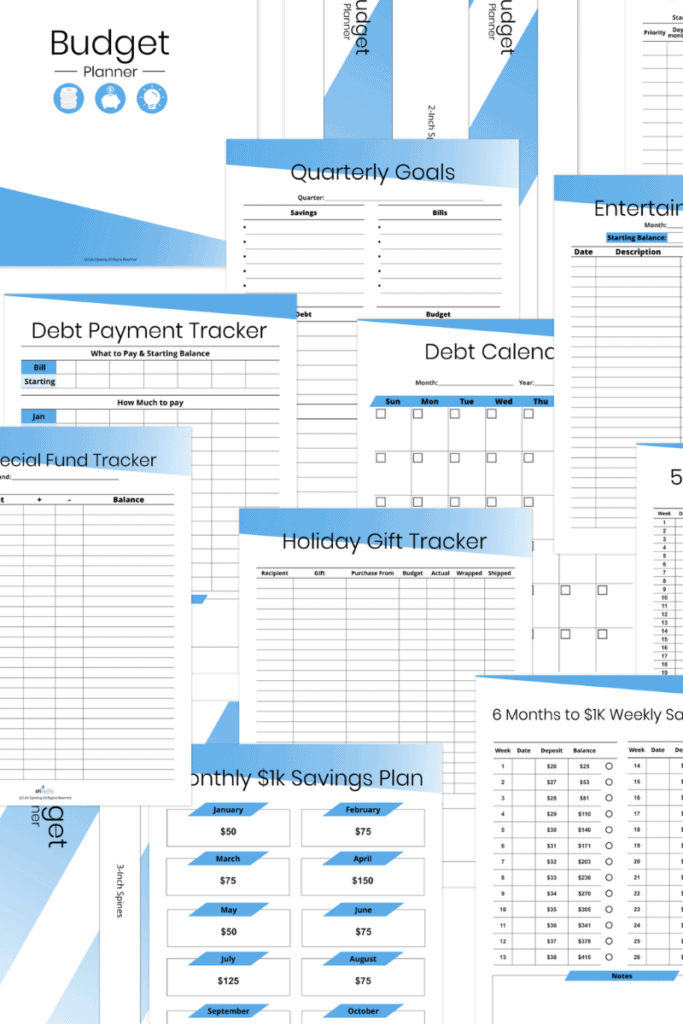

Beautiful 165 Page Budget Planner Printable

Do you feel overwhelmed when it comes to organizing your finances? With this incredible 165 Page Budget Planner Printable you can take back control of your money, keep on top of your budget and totally rock your finances; stress-free!

Knowing that he will still have money to spend should mean your husband is more receptive to building a budget.

Saving or Spending Plans

Future financial goals like buying a home, savings for the kid’s college funds, or building a retirement fund are things that must be discussed together.

Both parties having a say and agreeing on spending plans means you are working together as a team. It also means you can stay on top of the budget!

Savings should be transparent. It can sometimes be financially beneficial to put savings into one person’s name. If your husband has a savings account in his name only (or vice-versa), make sure to keep track of this together. Perhaps create a spreadsheet to track all savings and make sure you are hitting your savings goals. If early retirement is a goal for you or your husband, it makes sense to closely monitor all savings accounts.

Decide Big Purchases Together

Husbands that make big purchases without discussion first are ultimately selfish. That’s because spending large amounts of money means less money in the family budget.

Big purchases might include cars, electronics, or vacations. Your husband (and you) should discuss these plans with the other before going ahead. Unexpected spending could mean not having enough money to pay the bills or buy groceries.

Hobbies can also be expensive if equipment or supplies are regularly needed to maintain the hobby. If this spending comes out of the joint account, it could hurt your ability to save, buy food, or pay for necessary items.

Limits need to be agreed upon when it comes to spending on hobbies and larger items. How much will depend on your financial circumstances! Agreeing that purchases of $100 a more need to be discussed first isn’t unreasonable.

Set these limits and expectations when discussing finances to avoid conflict later.

Equal Discretionary Spending

Talking about money could get some couples heated. To avoid this, stick to the facts. Start by creating a budget of income and expenses. Next, check receipts and credit card statements to work out who is spending what.

You could even track spending for a month to work out exactly where every cent is going.

Once you’ve got these figures you can deduct payments for bills, savings, and other necessary payments like health care. Now you both know exactly what’s leftover you can agree on discretionary spending.

Preferably, you will both have an equal amount of money to spend each month.

Why Talking About Money Is Important

Keeping finances separate is often an indicator of bigger issues. Spouses that won’t share or discuss finances could be hiding something. Keeping finances secret or separate could also be a suggestion you feel the marriage won’t last.

Money is one of the leading causes of divorce, but it doesn’t have to be.

Talking about money openly and calmly means a healthy relationship. You may decide to keep separate accounts. That’s OK if you and your husband have agreed on this together.

Knowing where the money is going and making sure you both have a fair amount to spend each month is one less thing to worry about. Financial security means less stress for both of you which will mean a happier marriage. A happier marriage means a much better chance of staying together!

Another reason talking about money is important is when an unexpected death happens. The surviving spouse will need to know what accounts need handling and what money they will have access to.

Without prior knowledge, it could mean spending hours talking to customer service teams or having to rely on social security for help. This is time the surviving spouse could be spending grieving and making funeral arrangements instead.

What if We Can’t Agree on Money?

If the marriage breaks down due to disputes over money, then all marital property will have to be shared anyway. A wife may be entitled to alimony, custody of any children, and child support.

Husbands that have controlled household finances to the detriment of their wives will not be treated kindly in court. The divorce lawyer acting for the wife will always seek the best settlement for their client, but if a judge can see a husband has acted poorly during a marriage it may strengthen the case.

Joint assets, an investment account solely in the husband’s name, and other bank accounts could be split in favor of the woman to make up for the husband’s lack of financial responsibility during the marriage.

FAQs

When should you seek outside help?

If you are struggling to have a calm discussion about money, then it may be time to seek outside help. A therapist, appropriate family member, or financial advisor can be used to help you both resolve your financial concerns together.

Seeking outside help from professionals is advisable when you’ve got a financial problem.

How can you stop your husband’s selfish behavior?

Talking to your husband is the first step. Your husband may not realize how selfish he is being. It could be that he is immature or struggles to communicate.

Explain how his actions make you feel and that you want to work together as a team. Start by building a budget and discussing future plans. Hopefully, your husband will be receptive and change his ways!

Is my husband abusive?

Financial abuse is a real and serious matter. If your husband is using money to be abusive or is abusive in other ways, please seek urgent help. Discreet advice and help are available if you suffer domestic violence, emotional abuse, or you are in an abusive relationship.

When in immediate danger from domestic abuse call 9-1-1.