Disclosure: This post may contain affiliate links. If you click on a link I may make a small commission at no extra cost to you. You can read the full disclosure here.

Last Updated on October 23, 2022 by Chris Panteli

Frugal Living Tips With A Big Impact

Would you like to have more money? Perhaps you want to be able to afford your dream car or holiday? Or be debt-free? Or maybe you just like the idea of having savings!

One great way to have more money is to save money by living frugally.

In this guide, you can learn about 19 frugal living tips with a big impact, how to maintain a frugal mindset and the benefits of frugality. Read on if you are ready to begin your journey to saving money and having more financial freedom.

- Frugal Living Tips With A Big Impact

- What Is Frugal Living?

- The Benefits Of Frugality

- 19 Best Frugal Living Tips With A Big Impact

- 1. Budget For Every Dollar

- 2. Save Every Cent

- 3. Use The 30-Day Money Saving Rule

- 4. Install Honey On Your Web Browser

- 5. Always Get Cashback

- 6. Buy Discounts

- 7. Automate Your Monthly Bill Negotiation

- 8. Cancel Unused Subscriptions

- 9. Shop For Bargains

- 10. Food Shop The Smart Way

- 11. Don’t Pay For Starbucks

- 12. Go To The Gym Online

- 13. Get Paid To Walk

- 14. Control The Heat In Your Home

- 15. Don’t Buy Special Occasion Clothes

- 16. Don’t Pay For Cable TV

- 17. Use Fiverr For Small Gig Jobs

- 18. Learn How To DIY

- 19. Get A Side Hustle

- How To Maintain The Frugal Mindset For A Big Impact

- FAQs

- Final Thoughts

- Frugal Living Tips With A Big Impact

What Is Frugal Living?

What do you think of when you hear the term frugal living? You probably associate the word cheap with being frugal. But is this correct? Well, not really.

To be frugal doesn’t mean to be cheap. Frugal living is really about prioritizing your spending. This means spending less on some things so you can spend more on others that are of more importance to you.

If you can reduce the amount you spend by $20 a day you will be $7300 a year better off

Some examples of this include buying a cheaper home as this allows you to afford more vacations. You may choose to shop at smaller grocery stores as this allows you to save more for your retirement. You may put more into your retirement fund when you are young so you can retire at a younger age.

People that live frugally often meet at least one of the following criteria:

Later you can read about 19 of the best frugal living tips with a big impact. Before that find out the benefits of frugality:

Recommended: 11+ Incredible Cheapest Ways To Live

The Benefits Of Frugality

Frugal living can enrich your life in a variety of ways. Frugality can help you have more money and more freedom!

Frugality is defined as the quality of being economical with money or food; thriftiness

During your journey to become frugal, you can connect with others that are living similarly for support, and for some, you may develop a better sense of yourself as you spend less and concentrate on what matters most to you.

Whatever your goals in life are, here are 9 of the key benefits of living frugally:

Keep reading to find out how to maintain a frugal mindset but first here 19 of the best frugal living tips with a big impact.

19 Best Frugal Living Tips With A Big Impact

Frugal living isn’t about living cheaply, it’s about learning how to prioritize your spending. Making better choices with your hard-earned money.

A frugal lifestyle can help you achieve some amazing life dreams such as being debt-free, traveling, or retiring earlier. Here are 19 tips on living frugally.

1. Budget For Every Dollar

One of the first things you must do that is essential to being frugal, is to create a budget. The budget must consider every expenditure. Armed with this information you can prioritize how to distribute your income against bills, debt, and savings.

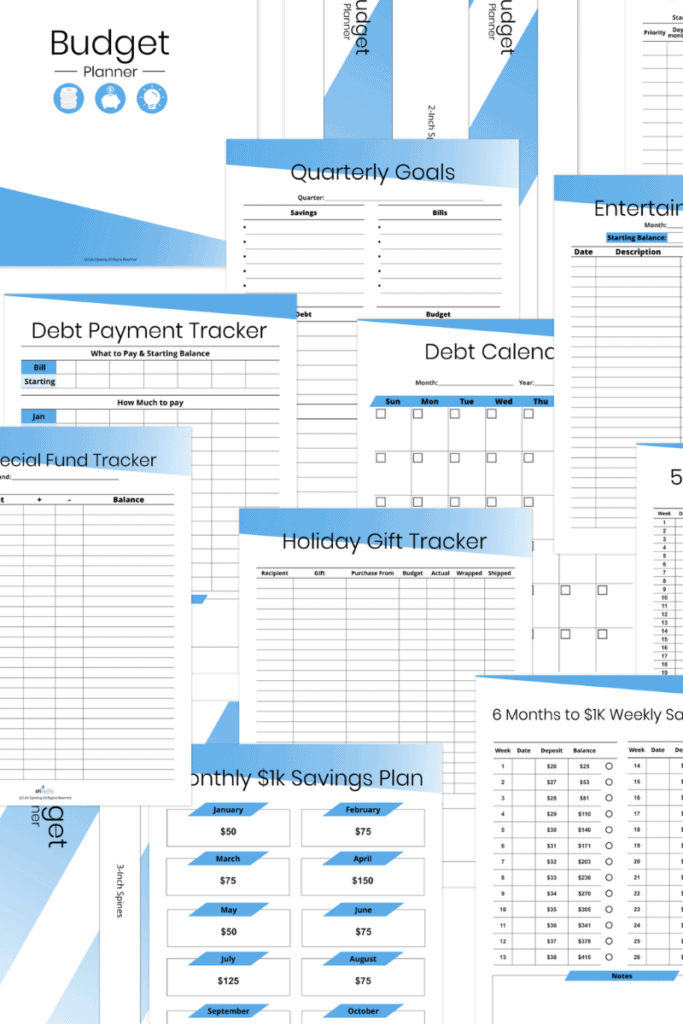

Beautiful 165 Page Budget Planner Printable

Do you feel overwhelmed when it comes to organizing your finances? With this incredible 165 Page Budget Planner Printable you can take back control of your money, keep on top of your budget and totally rock your finances; stress-free!

Knowing exactly where your money is going is a great way to save money. This is because you can identify things you are spending too much on or no longer need. By cutting wasteful spending you will have more money available to save, invest, or pay off debt.

A budget planner is a great tool for living frugally as you can track expenses, watch debts go down, and savings increase.

Here are some helpful tips when creating a budget:

Related: What Is The Purpose Of A Budget

2. Save Every Cent

As you begin your journey to frugal living a good habit to get into is to save every spare cent. You may think it’s not worth the trouble but there are two great benefits to saving as much as you can no matter how small the amount.

Acorns Later Retirement

An easy, automated way to save for retirement. You can put your extra cash to work for as little as $5 at a time – straight into an IRA and portfolio that’s right for you

A great place to start saving is through Acorns. With plans starting from just $1 a month there is a savings style to suit all financial circumstances. Use the Acorns website or the convenient Acorns app found on the Play Store and the App Store.

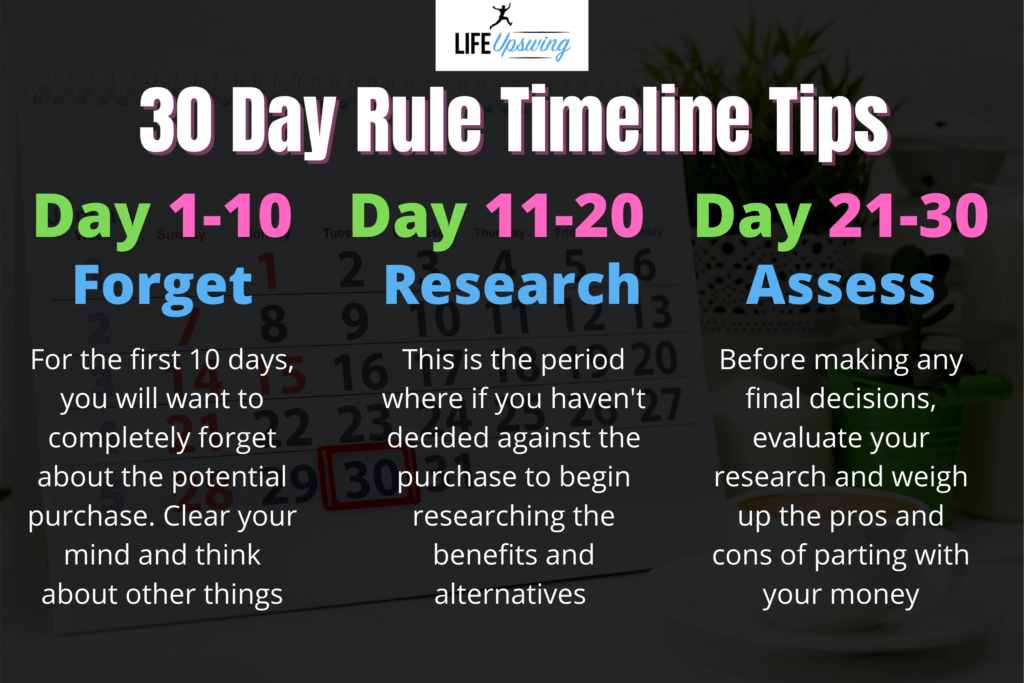

3. Use The 30-Day Money Saving Rule

The 30-day money-saving rule means putting the money you were going to spend impulsively into a savings account for 30 days.

At the end of the 30 days if you still want the item, then go ahead and buy it. If not, leave the money in your savings account or use it for a better purpose such as paying off debt.

How does following this rule help?

At first, it will be hard, especially if you previously spent freely. However, following this rule will help adjust your thinking towards spending. No longer getting the instant gratification from buying new things will help you learn to be content with what you already have. One day you won’t even have to follow the rule as your priorities have shifted and impulse buying is a distant memory!

To start with try setting yourself little challenges. This might be to follow the rule for 30 days for all purchases or starting with high limits and gradually reducing. Maybe purchases over $500 follow the rule, then the next month reduce that to $250.

Building good habits takes time so be realistic and patient with yourself. Before you know it the desire to buy impulsively will be gone.

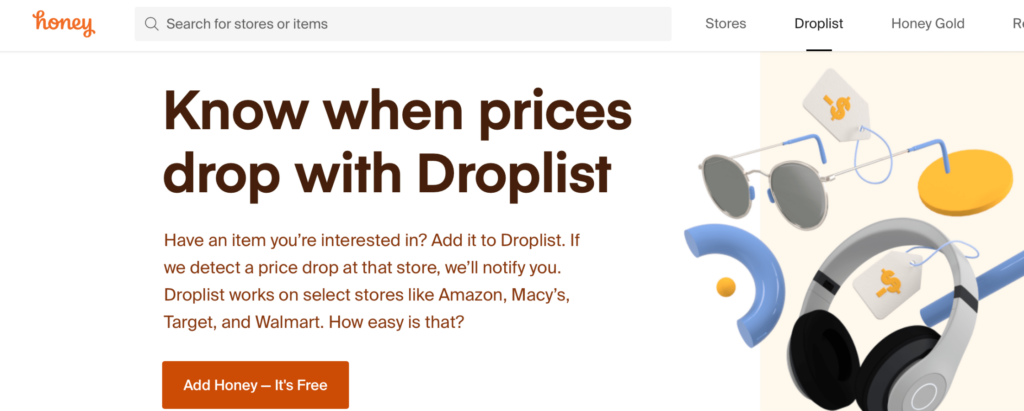

4. Install Honey On Your Web Browser

Honey is an application that you can add to your web browser. It benefits you as it automatically finds coupons for any purchases you are considering. You don’t have to spend time searching for these coupon codes, the Honey app does all the work for you!

Not only does Honey save you money but it also saves your time, time that you can use elsewhere.

Other benefits of Honey include cashback, notifications when prices drop, and you can track the price history of items you are considering. One final point to mention that makes Honey compatible with the frugal lifestyle, Honey is FREE to use!

5. Always Get Cashback

Whenever cashback is available you should always claim it. Many bank accounts offer cashback when making purchases, many purchases offer cashback if certain criteria are met, and sometimes there are one-off cashback offers for a one-time purchase.

If you can claim cashback, then you should always make sure to do so. Amounts may sometimes be small but over a year can add up to a large amount.

Get $5 For FREE Right Now

Signup to the greatest rewards platform on the internet and earn a $5 welcome bonus…

Earn more with cashback on all your purchases, watching videos, playing games, and taking surveys. Some users can make an extra $200+ per month!!

The other way to get cashback on a regular basis is through dedicated cashback apps or sites. There are many cashback sites available but two of the best to start with are Ibotta and Swagbucks.

Recommended:

- 11 Awesome Ways To Liquidate Visa And Mastercard Gift Cards

- Ibotta Cheat List | Ultimate Guide

- Is Ibotta Legit? | Definitive Review

6. Buy Discounts

One great way to save money is through discounts. You may not know this, but you can buy discount codes from online marketplaces.

Buying discount codes can add up to a large amount of money saved over the year plus there are codes available for nearly every purchase you could think of including travel, electronics, and beauty products.

Tap twice to load then open Video...

A great site to get started is Raise that can be accessed on their website via the app on Play Store or App Store. As well as buying discount codes on Raise you can also get special offers for further discounts or extras such as free shipping.

7. Automate Your Monthly Bill Negotiation

Modern life is hectic and as part of that, you need to manage bills, subscriptions, and paying any other expenses. Many people overlook this as they are just too busy. This can result in paying thousands of dollars more a year than necessary!

Imagine if someone else could do the work for you and you save money in the process.

Great news! You no longer need to imagine this. There are services that exist to help negotiate your bills and save you money.

The average Truebill user saves $512 per year

One company that offers this life-changing service is Truebill. Once you have completed the signup process and securely linked your accounts you can then allow Truebill to start managing your finances including bill negotiation. Bill negotiation may include getting a lower rate or a one-time credit to your account.

Either way, you are saving money without having to do the hard work!

8. Cancel Unused Subscriptions

Subscriptions are often a low amount between 5-10 dollars per month. For this reason, it is easy to forget about them. However, if you have ten subscriptions that could be $100 a month you are spending!

It is unlikely that you need all these subscriptions. This is where services like Billshark come in. Billshark offers help for those with subscriptions that need to be canceled. Simply sign up, securely provide all the necessary details, and they will do the hard work for you.

In one year, that could be a saving of $1200!

As you can see those subscriptions soon add up. Make sure to act now to stop any wasteful spending.

9. Shop For Bargains

Shopping for bargains is a must to successfully live frugally.

One great source of bargains is at Dollar Tree. You can save money on a huge range of products by shopping at Dollar Tree online. One more excellent benefit is the option to have your order delivered free of charge to your nearest dollar tree store for collection. Not only do you save money on your purchases but also could save shipping costs too!

Keep in mind that cheap isn’t always best. Many items from Dollar Tree are excellent and worth paying less for. Things such as electronics may not be as reliable when paying less for them.

As always being frugal isn’t about being cheap. It’s about making your money work for you and maximizing every financial decision. Sometimes you must pay more for a product that will last longer. In the long run, that saves you money!

There are many great things to buy at Dollar Tree though that are worth it including:

They even sometimes sell steaks at selected stores with freezers!

Now that’s living frugally, hey!

10. Food Shop The Smart Way

Food can be expensive, especially if you eat out a lot or order takeaways. Meal planning is an excellent way to start saving money. Planning and shopping for your meals in advance means you are prepared and hastily spending money on fast food.

If you are interested in meal planning, then a great way to get started is with the $5 meal plan. This plan provides a month’s worth of meal plans including grocery lists for just $5 a month. Following this plan can save you time and money as you don’t have the hassle of trying to work out a meal plan yourself.

$5 Meal Plan

Let the team at $5 Meal Plan save you money and time by planning your food for the week!

You can take advantage of their 14-day FREE trial and if you don’t think it’s for you simply cancel at any time.

Other ways to save money on food include:

11. Don’t Pay For Starbucks

Buying a Starbucks every day can add up to quite a lot over the year. To be frugal you may think that you have to stop buying Starbucks altogether. You could do that and make your own coffee at home OR you could get a Starbucks for free!

Getting your coffee for free is an excellent frugal move.

To get you started here are 3 easy ways to get a free Starbucks:

Related: 13 Ways To Get Free Drinks At Starbucks

12. Go To The Gym Online

Staying fit can be expensive if you belong to a gym. Also, being a member of a gym doesn’t mean you will go. Many sign up but soon stop going or go infrequently.

63% of memberships go completely unused

A better idea and one that can save money, in the long run, is to go to the gym online.

One great service to start with is Beachbody. You can choose from a huge range of fitness programs to help lose weight, build muscle, or just stay fit. Using technology allows you to enjoy fitness programs that will benefit you from the comfort of your own home.

13. Get Paid To Walk

Walking as much as possible is great exercise and it saves you money on gas. Even better than that is you can get paid to walk!

Healthy adults can take anywhere between 4,000 and 18,000 steps per day

A simple way to start getting paid to walk is by using Sweatcoin. Just download the app on the App Store or Play Store and start earning for walking. The app tracks your steps, and these steps are converted into Sweatcoins. Sweatcoins can be used for purchases against a wide range of retailers as well as cash exchanges via PayPal.

Related: How Much Can I Earn With Sweatcoin?

14. Control The Heat In Your Home

Energy-efficiency can be a great way to save money. One big part of saving money on your energy bills is to monitor heating your home. There is a range of technological options to help you do this.

Nest can save you between 10-12% of your annual heating bill

One of the best on the market is the Nest thermostat. This amazing device learns as you use it so it can use energy at the right times for your home. You can also control it from anywhere using a convenient app which means you never have to worry about forgetting to switch the heating off again!

15. Don’t Buy Special Occasion Clothes

It is always tempting to buy a new outfit for a special occasion such as a wedding or christening. A frugal living tip with a big impact is moving away from buying clothes for every occasion. Instead, you can choose to rent clothes when you need them.

Renting clothes means you are saving money on a purchase that would probably only be used once. It also helps the environment as fewer clothes are sent to landfill or left sitting in the closet.

A great place to start renting clothes is Rent The Runway. On this site, you can do one-off rentals or regular rentals if needed. Enjoy designer clothes when you need them but not at designer prices.

16. Don’t Pay For Cable TV

Cable TV is expensive and these days probably unnecessary. You can use one of the many streaming services to enjoy all your favorite content. Many people signup for one or two to enjoy plenty of variety and still save a good amount of money compared to cable.

One other tip is to share accounts. Make sure to follow the rules of the service but many allow the subscription to be watched on multiple screens. This could work if you sign up for Amazon Prime and a family member signed up for Disney+. You can share accounts but only pay for one each.

Watch your favorite shows now with Amazon Prime Video for 30 days for FREE

Amazon Prime also offers much more than TV as you can get music, books, and faster delivery on most items. Check out the Amazon Prime offer here and take advantage of their 30-day free trial.

Recommended: 27 Definitive Ways To Get Free Steam Codes

17. Use Fiverr For Small Gig Jobs

Living frugally doesn’t just apply to your personal life. Many frugal living tips can be used in other aspects of life including your business.

If you are trying to be frugal in your business as well and looking to make a big impact, Fiverr is a great place to get good quality at a fraction of the cost. Just find highly rated users with lots of feedback.

Fiverr can be used to find low-cost high-quality work for things including:

18. Learn How To DIY

DIY isn’t something that everyone is naturally great at. If you haven’t tried before then you may feel overwhelmed at the thought of attempting any DIY.

However, frugal living tips with a big impact include DIY.

DIY can save you thousands of dollars over a year. Paying for parts, labor, and callout fees in the event of an emergency can get awfully expensive. Learning how to fix things yourself can save you so much money. On top of knowing how to repair things, learning the best way to maintain everything can be a great way to help save money.

You can apply DIY to your property, vehicles, and even people. Learn how to fix a leak, change tires on a car, or cut hair for a family member. Doing all these things and more will help to save money and be frugal.

A great way to start learning the skills that you need is to use the internet. One excellent site to start on is Udemy, which offers a massive selection of courses covering all kinds of topics.

If you’re already a dab hand at DIY then you could also put your skills to work and make some extra cash. TaskRabbit is the leading online and mobile marketplace that matches freelance labor with local consumers to find immediate help with everyday tasks.

Get started today and in no time at all, you can be saving money normally given to repairmen.

19. Get A Side Hustle

A side hustle is a great help for people wanting to enjoy a frugal life. Advancements in technology mean it is easier than ever to earn money from just about anywhere. Millions of people have side hustles that are earning a decent extra income. This could be doing all kinds of activities including freelancing, selling homemade items, or any number of other ideas made possible by technology.

The good news is that most side hustles are extremely easy to get started. All you have to do is choose what you want to do, sign up for the appropriate service, and start earning! For example, Fiverr that as mentioned earlier is as easy as creating a profile, then once you have completed a job you get paid. It can be that easy.

Working full-time and having a side hustle can be challenging sometimes. However, if you choose the best side hustle for you and plan your time effectively, then it can be rewarding. Not just financially, but also for your mental health as the ability to build a frugal lifestyle helps you achieve your goals in life.

Here are some great tips to help have a successful side hustle:

Having a thoughtfully planned side hustle can be a great benefit to someone wanting to live a frugal lifestyle. The extra money can help you achieve your financial goals quicker such as paying off debt, building savings, or traveling. A successful side hustle also means you have a safety net should your full- time job be made redundant.

For some people, a side-hustle can turn into a full-time job which means not just financial freedom, but freedom to live a lifestyle free from the 9-5 grind.

How To Maintain The Frugal Mindset For A Big Impact

Living frugally can be challenging at first but with persistence, you can see significant improvements to your lifestyle. How can you maintain a frugal mindset for a big impact?

First, consider why you want to be frugal. What are your goals? Goals could include the ability to travel, being debt-free, retiring earlier, homeownership, or simply having savings in the bank. Maybe you want all of this!

Living frugally means want to save as much of your money as possible. Why? To live out all the dreams you have for your life. A great way to keep a frugal mindset is to always remember what your goals are and why you wanted to be frugal in the first place.

Another helpful idea is to not be too hard on yourself. You won’t do everything on this list and that’s OK. Do what is right for you and what is realistic for your lifestyle.

By following as many frugal living tips as you can, you will see great results and have the financial freedom to do whatever you want to do.

FAQs

Can being frugal make you rich?

Being frugal won’t make you rich but it can certainly help towards it! By following the tips for frugal living, you can be wealthier. If you have a high-paying job as well, then in time you may also be rich if that is your goal.

How can a large family be frugal?

A large family can be frugal in a variety of ways. First, everything on this list could be applied to every family member. If the whole family is being frugal, then the entire household benefits. Large families may find some frugal tips easier as they can share clothes, subscriptions, and help with DIY around the house.

How do you lead a frugal lifestyle?

To lead a frugal lifestyle start following the advice in this guide. Budget, pay off debt, follow the 30-day rule, save, invest, and spend as little as possible. Doing this will help you be frugal and build up your wealth to be used on whatever you desire.

Is it worth being frugal?

Frugal living is worthwhile for you personally and for the environment. Being frugal allows you to have more financial freedom to pursue other goals as your money isn’t wasted on unnecessary spending. As you spend less, you also use much less. This can have a positive effect on the environment.

Is a frugal lifestyle enjoyable?

Absolutely, yes! A frugal lifestyle doesn’t have to be boring, embarrassing, or something you should keep a secret from friends or family.

Living frugally means you are managing your money to a high degree with the goal of being debt-free and having financial freedom. It doesn’t mean you have to deny yourself from enjoying life. Following the 30- day rule means you can still buy items you really want. Thanks to financial freedom you can travel, retire earlier, or take part in any other activity you desire.

As you build a frugal lifestyle you will also realize there are many enjoyable activities that are free! Examples include:

Spending time with family

Using the local library

Going to a beach or park

Join a club either locally or online

These are just some ideas that fit well with a frugal lifestyle but still allow you to make friends and enjoy life. Remember, frugality isn’t about being cheap, it’s about building a lifestyle that allows you to enjoy financial freedom.

Final Thoughts

Please don’t think that being frugal means being boring and not enjoying life. Rather it is the opposite, you can enjoy what you really want and cut out the things that don’t really bring you joy.

These frugal living tips with a big impact can be implemented by anyone. Get started today and in no time at all, you can start enjoying the benefits of living frugally.