Disclosure: This post may contain affiliate links. If you click on a link I may make a small commission at no extra cost to you. You can read the full disclosure here.

Last Updated on October 23, 2022 by Chris Panteli

Emergency Fund Examples You Need To Know

What are you going to do if you have an emergency expense? Ideally, you already have an emergency fund ready to cover any emergencies. However, there is a high chance you don’t as only 39% of Americans are prepared for an emergency expense of up to $1000.

You may have been putting off starting an emergency fund. Perhaps you’ve needed the money for other priorities. I understand that – times are tough and saving for something that may never happen can seem pointless.

Here is the problem with that – unexpected emergencies happen all the time! You need to be prepared and the first step towards preparedness is building an emergency fund.

To help you understand why it’s so important to have an emergency fund I’ve put together this guide covering 11 different emergency fund examples. By the end, you should be motivated (hopefully not scared!) into starting your fund. As a bonus, I have included some awesome pointers on how to quickly start an emergency fund – make sure to read to the end for that!

Emergency Fund Examples

First, what is an emergency fund? Simply put an emergency fund is an amount of money set aside to cover an unexpected expense. Car repairs, job loss, or emergency medical bills are just some examples of expenses that can arise unexpectedly.

Having an emergency fund is widely considered to be an essential part of staying financially healthy. It can also provide an excellent boost to your mental health.

Think about it – not having to deal with the added stress of finding extra money on top of whatever emergency you are dealing with makes things much easier.

To put things into perspective these figures from our recent study make it more understandable. Astonishingly, 59% of Americans can’t cover an unexpected bill of less than $1000. In the same study, it’s confirmed that the perfect scenario is having an emergency fund that will cover 6 months’ worth of expense – that’s an average of $5,102 a month! In total, your fund would need to be $30,612 to cover 6 months of bills for the average American.

Think about your situation right now. Do you have anything in a savings account? What could you afford in an emergency situation?

To be ready for a financial emergency it’s vital to prepare in advance. Don’t fall into the trap of thinking you’ll start tomorrow. Get started today once you’ve finished this guide!

Why Have Multiple Emergency Funds

Ok – you’ve started one emergency fund and now I’m talking about multiple funds. The thought of this may be overwhelming but let me explain why multiple emergency funds can be a good idea.

The first emergency fund should get you to the point that you’ve got 6 months’ worth of expenses saved up. That is fantastic to have and should you suffer a job loss you know you will be OK.

Acorns Later Retirement

An easy, automated way to save for retirement. You can put your extra cash to work for as little as $5 at a time – straight into an IRA and portfolio that’s right for you

What if you lose your job, your car breaks down, and you need emergency dental treatment within 3-6 months of losing your job?

I wouldn’t wish for emergencies to happen to anyone. Especially not all at once! However, things often happen together which means having multiple funds can be a lifesaver.

Once you’ve built your first fully-funded emergency fund covering 6 months’ worth of bills, then it’s time to build out multiple and diversified funds.

Having these extra safety nets means that should you lose your job and suffer simultaneous emergencies you can cover them all!

Difference Between Emergency Fund And Savings

When talking about money there are some terms that may sound like they are the same thing. Emergency fund, savings, rainy day fund, and sinking fund all sound pretty similar, don’t they?

Each term involves saving money, but for different uses. Let’s have a quick look at each one.

An emergency fund fundamentally exists to cover any and all emergencies. This means, by its very nature, that it’s unexpected – hence the name emergency fund. Savings are for things that are planned for – buying a home, college, or a planned vacation are all examples of savings that are have been predetermined and accounted for.

What about a rainy day and sinking funds?

A rainy day fund is similar to an emergency fund. It’s usually a pot of money put aside to cover small emergencies. For example, a one-off emergency expense like a small repair job would constitute using the rainy day fund.

Sinking funds are much more like savings. You are saving money to cover specific needs in the future that you know you need to pay for. You can have as many sinking funds as you like and add money to each of them. Having a sinking fund for birthdays, Christmas, holidays, and other costs throughout the year are great ways of successfully budgeting for these expected events.

11 Emergency Fund Examples

I’ve put together these 11 emergency fund examples to help you understand what could happen and why emergency savings are essential. I promise I’m not trying to frighten you! However, there is no point in pretending these situations don’t arise every day – and being prepared is just a sensible approach to personal finance.

1. Loss Of Income Fund

The biggest event in life that can cause financial hardship is suffering a loss of income. If your income stops, you still must find money to pay the bills. Rent or mortgage, utilities, insurance, groceries, and everything else must be paid for.

Earlier we mentioned building up a cash reserve covering 6 months’ worth of expenses. That means if you lose your job you can pay for everything for those 6 months at least. At a stressful time, you will at least have some breathing space.

You should know your monthly expenses, but if you don’t make sure to create a budget now listing every one of your expenses. Once you know the total amount you need for 1 month – make sure to save 6 months’ worth.

2. Medical Requirements Fund

Medical emergencies can be expensive even if you have health insurance. Your insurance may cover part of the cost, but you may still need to pay towards it via a deductible, plus other costs depending on what your insurance policy covers.

An average trip to the ER costs $1,389, that’s not pocket change! Most of us may not think about medical emergencies. Especially if you are relatively healthy.

However, accidents or illness can strike at any time. Make sure you are prepared for the unexpected by setting aside enough to cover at least basic medical emergencies.

3. Home Repair Fund

If you are anything like me no doubt your home is your pride and joy. After all, it’s your biggest expense – plus home is the place where you spend most of your time. Especially if you are working from home these days!

The downside to owning your own home is that you are 100% responsible for all repairs. You probably have insurance to cover some emergencies – especially a big one like a natural disaster or a fire.

However, claiming on insurance isn’t free as you still have deductibles to pay. You may also want to avoid claiming for smaller things as claims could increase your insurance premiums in the future.

What you need to do is make sure you have an emergency fund to cover home repairs. At the very least make sure you always have enough to pay your insurance deductible should you ever need to make an insurance claim.

Ideally, you will also have enough to pay for repairs yourself when a smaller amount is required. An appliance breakdown, roof damage following a storm, or a leak are all examples of small damages you may want to pony up for.

After all, you don’t want to live in a property that’s falling down around you!

4. Loss Of Transport Fund

Depending on where you live, having access to your own transport may be essential. Commuting to work, shopping, helping elderly relatives, and getting the kids to school on time could all be impacted by a loss of transport.

If you suddenly lose access to your vehicle, what are you going to do?

You could rent a car, use public transport, or use a service like Uber to still get around. However, all these things cost money!

To cover an emergency situation like this building a fully-funded emergency fund is essential.

5. Automobile Maintenance Fund

Maintaining your car is something you should already plan for. Perhaps you’ve got a sinking fund for car maintenance as you know during the year some work will be needed.

However, we are talking about emergencies. What will you do if your automobile needs emergency maintenance? Maybe you’ve broken down whilst on a long trip.

You may not be worried as you’ve got a credit card for exactly this type of emergency situation.

The only problem with that is that depending on where you are your credit card may not be accepted! Many small mechanics don’t take them.

If you have cash saved up in your emergency fund, then this won’t be a problem! You can just pay using the money you’ve got in your emergency savings fund. Problem solved! Plus, you avoid interest charges on your credit card. A win all around!

6. Technology Replacement Fund

Could you live for a day or two without your computer? You possibly could if you don’t need it for work or school. For anyone that works from home though you likely couldn’t live without a computer for long. Otherwise, you would be losing money!

Technology can suddenly fail at any moment. If you’ve got kids, then you know they can also break things without even trying.

Computers, tablets, TVs, game consoles, and more could all need replacing at a moment’s notice.

Decluttr Your Tech And Make Money

Decluttr is the smart way to sell old cell phones, tech, CDs, DVDs, games, and books. You can get an instant valuation, ship for FREE, and get paid! What are you waiting for?

To make sure you don’t lose out on work or the kids don’t miss school, make sure you’ve got enough in your emergency fund to replace any items that get broken or simply stop working.

7. Child Emergency Expenses Fund

Children are incredibly expensive. Did you know it’s estimated a child born in 2015 will cost $233,610 to raise to the age of 17! That’s not even including the cost of college!

Apart from all the stuff they break kids can have any number of emergency costs. The most likely emergency expense is for a medical emergency. Falling out of trees, hitting their head while playing, or an illness could happen at any time.

You may have great health insurance, but you still need to pay a deductible plus other costs that aren’t covered. Have you got enough in your emergency fund to cover these costs?

Other emergency expenses your child may incur include needing dental treatment, replacing lost school equipment, or paying for the damage they’ve caused when playing.

All this is on top of the normal stuff you’ve got to pay for like food, housing, and entertainment! Kids hey, who’d have them?!

8. Pet Emergency Costs Fund

If you have a pet, then you know it’s part of the family. That means when your pet is sick or injured you will take them to the vet for treatment just like you or I would go to a doctor when we’re sick.

However, visits to the vet that are not routine can cost thousands of dollars. Hopefully, you have good pet insurance to cover some of the cost. You could still have to pay thousands of dollars depending on the treatment.

To cover these costs, it’s important to have an emergency fund. That way you know your beloved family pet will always get the best care possible.

9. Unexpected Tax Fund

Predicting exactly how much tax you will need to pay isn’t always possible. If you are self-employed, then this can be an even bigger problem.

Over the year you’ve (hopefully) put a portion of your earnings aside to cover the eventual tax bill. However, there is a big risk that the bill will be higher than you thought.

Almost 3 in 10 tax-filing Americans claim to have received an unusually large tax bill in the last 3 years.

In some cases, the additional tax owed can run to tens of thousands of dollars!

Don’t let an unexpected tax bill ruin you financially. Make sure you have an emergency fund prepared to cover this type of situation.

10. Unplanned Travel Fund

Sadly, the illness or death of a family member or friend can happen at any time. This means you may need to quickly travel to be there. Booking flights at the last minute, accommodation, and other travel expenses can be costly.

A credit card may be a solution in an emergency like this, but the downside of using a credit card is you will incur interest and possibly other charges.

Your emergency fund can come to the rescue here. You can avoid incurring interest fees as you won’t have had to use the dreaded plastic. The other benefit is less stress as you’re not having to worry about finding the money to travel. Instead, you can concentrate on your family or friend safe with the knowledge you’ve got enough in your savings account to cover the unplanned trip.

11. Death Arrangements Fund

The death of a loved one can be hugely devasting. As well as dealing with your grief you also must handle the cost of the funeral. Your loved one may have life insurance that will help with the costs but often this can take a while to payout.

In the meantime, you may need to spend thousands of dollars upfront to pay for the funeral. In 2019 the average funeral cost in America was $7,640. That’s not small change! Make sure you can cover this by building an adequate emergency fund.

Quick Guide To Starting An Emergency Fund

As promised at the start I’ve put together this quick guide for successfully starting an emergency fund.

First, you need to add up your total monthly expenses. Once you’ve done that you can now calculate how big your emergency fund needs to be. Remember, the ideal scenario is having approximately 6 months’ worth of expenses covered by your emergency funds.

Don’t panic if you can’t save that much – if you can at least save 3 months’ worth of expenses that should give you a good enough cushion to survive worst-case scenarios like losing your job.

Once you know the amount you need to save for expenses, think about other possible emergencies and decide what to save for them as well. If you have a total amount in mind, then you can figure out a savings plan as part of your budget to build up those emergency funds.

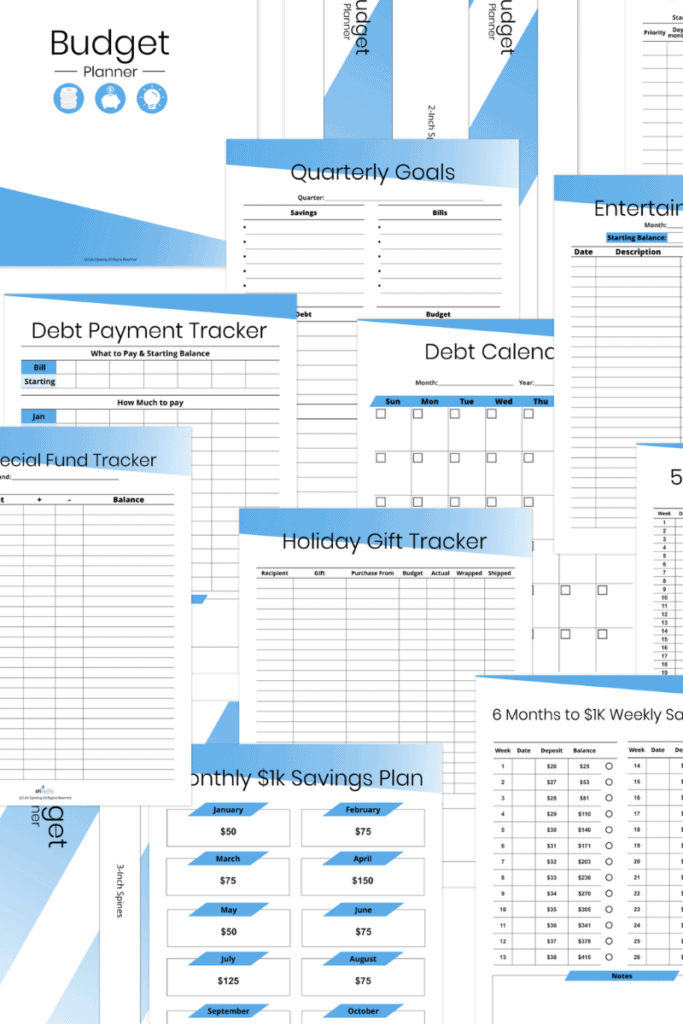

Beautiful 165 Page Budget Planner Printable

Do you feel overwhelmed when it comes to organizing your finances? With this incredible 165 Page Budget Planner Printable you can take back control of your money, keep on top of your budget and totally rock your finances; stress-free!

Now that you’ve got some solid figures worked out the next step is to decide where to keep the money.

Keep in mind this money is for emergencies – this means you need quick access to it should the worst happen. The first $1000 you save is best off in a high-yield savings account. Using this type of account means you are still earning some interest but can access the money quickly if needed.

Making sure you can access your money instantly is an essential part of meticulously planning an emergency fund. Things that need paying straight away like a car repair can be handled easily.

However, for longer-term emergencies like unemployment, you may not need all the money instantly. The great news about that is that once you’ve saved at least $1000 you could start putting some of the money into funds that will give bigger returns.

There is an element of risk when investing, but with the right approach, you can minimize the risk and enjoy watching your emergency fund grow.

Read my full guide on How To Start An Emergency Fund for more advice and tips.

4 quick steps for starting an emergency fund –

- Add up total monthly expenses

- Decide how big your emergency fund needs to be

- Choose where to keep your fund

- Consider strategies to grow your fund

FAQs

What are the benefits of having an emergency fund?

Having emergency money means you can save money in the long run. This is because you are not having to use high-interest credit cards or drain your retirement fund. It also means your monthly budget won’t be ruined as you have the money to pay for the emergency and can still pay all your bills as usual!

How much should I save in my emergency fund?

There is no set amount you need to save. Aim to save $1000 quickly, to begin with – just $84 a month gives you $1000 in 12 months! If you can afford more, then you can save up even quicker! Remember – the goal is to be able to cover at least 6 months’ worth of expenses.

I can’t afford to save, what should I do?

First of all – don’t panic! Lots of people live paycheck to paycheck and it’s a struggle. When you don’t have much money, saving might feel impossible. However, with the right planning, it’s possible to save something.

Start by making a detailed budget accounting for every cent you spend. Make cuts, where you can, to free up money in the budget. If you’ve got debts, then make a plan to start paying them off. Even adding just a few dollars a month into your savings is better than nothing.

When you don’t have much money spare, any emergency expense could cripple you. Having some savings ready for an emergency gives you a little financial freedom to absorb any financial shocks.

You could also consider increasing your income by starting a side hustle such as blogging, earn cash for completing surveys, or finding additional part-time work in your local area.

I know it’s hard to save when you don’t have much spare – if you follow these tips though you can save something. Some savings are better than none when an emergency strikes. Trust me you can do it!

Should I have emergency cash?

This is an interesting question. Most payments can be made online or using a card when in-person. Having said that you never know when there might be a world-ending emergency! Think earthquake, nuclear war, or perhaps a zombie uprising! OK, maybe not that last one!

In the event that online payments can’t be made and electronic payment systems are offline, cash will be king! I wouldn’t recommend keeping much cash on hand – perhaps $100-$250 would be enough for a few days. Simply make sure to keep it secure in a safe or lockbox.

Recommended: 22 Awesome Things To Buy With 1000 Dollars